Highlights:

- Mercurity Fintech wants to raise $800 million to fund its long-term Bitcoin reserve strategy.

- The Fintech firm will acquire considerable BTC holdings, which it will integrate into its digital reserve framework.

- The company’s CEO noted that the initiative will diversify its fund-generating ability and position it ahead of competitors.

New York-based fintech firm Mercurity Fintech Holding Inc. (MFH) has announced a fundraising initiative aimed at generating $800 million to establish a long-term Bitcoin (BTC) reserve. The fintech firm announced the initiative in a press release on June 11, which elicited reactions from investors and other market participants.

According to the publication, Mercurity Fintech hopes to leverage the fundraiser and its experience in blockchain-driven infrastructures to buy and manage Bitcoin assets. “The Company also plans to integrate these holdings into its digital reserve framework through blockchain-native custody, staking integration, and tokenized treasury management services,” Mercurity Fintech stated.

Mercurity Fintech Announces $800 Million Financing Plan for Bitcoin Treasury; Achieves Preliminary Inclusion in the U.S. Russell 2000 Index

MFH today announced its plans to raise $800 million to establish a long-term Bitcoin treasury reserve. Read full PRhttps://t.co/8mC9PFfTAY

— Mercurity Fintech Holding (@MFH_Holding) June 11, 2025

Bitcoin Reserve Position Plans

In addition, the company plans to develop a Bitcoin reserve position integrated into a digital asset framework. The whole setup will involve blockchain-native liquidity protocols, capital efficiency tools with staking options, and institutional-grade custodial infrastructure.

Mercurity Fintech added that the above plan would help diversify its treasury. Per the fintech firm, the treasury will be blockchain-aligned with yield-bearing ability. The company believes this setup would guarantee a longer timeline for asset exposure and a resilient balance sheet amid market instabilities.

Shi Qiu, the company’s Chief Executive Officer (CEO), stated that he and other Mercurity Fintech stakeholders adopted Bitcoin because they believe it would become an essential component of the future financial infrastructure. “We are positioning our company to be a key player in the evolving digital financial ecosystem,” the CEO added.

MFH Visibility Sets to Soar with Russell’s Inclusion

Mercurity Fintech disclosed that it could join the Russell 3000 and Russell 2000 indexes this year. If MFH achieves such huge feats, it would be a significant upgrade from its previous lower position. For context, the Russell 3000 and the Russell 2000 are different levels of stock market indexing. The former tracks the market performance of the top 3,000 US-based publicly traded companies, while the latter focuses on the performance of 2,000 small-cap publicly traded US firms.

Joining any of the indexes would boost Mercurity Fintech’s visibility amid stiff competition from similar companies. In the press release, the fintech firm stated that the anticipated inclusion reflects its impressive market performance and the rising significance of its blockchain infrastructure strategy.

Mercurity Fintech’s CEO stated:

“Moving from the Russell Microcap to the Russell 2000 shows that investors recognize the value we are creating in blockchain finance.”

UK-Based Firm Shows Similar Interest in BTC Investments

In one of its June 10 publications, Crypto2Community reported that Smarter Web Company (SWC), a UK-based web design platform, spent $4.76 million on 45.32 BTC, expanding its portfolio to 168.08 BTC. These Bitcoin holdings are worth $17.73 million at an average cost of $105,779 per token.

Meanwhile, SWC announced today that its shares (Ordinary Shares) have begun trading on the OTCQB Venture Market following approval. Notably, the shares will trade under the market ticker TSWCF. The company noted that the new development makes it easier for US-based investors to boost the company’s stock liquidity.

The Smarter Web Company (#SWC) RNS Announcement: Admission to Trading on OTCQB Market.

Today our Ordinary Shares have been approved to trade on the OTCQB Venture Market in the United States and will commence trading on the stock market at the open today.@asjwebley: "We value… pic.twitter.com/uqS9w3vBQo

— The Smarter Web Company (@smarterwebuk) June 11, 2025

BTC Nears Peak Price Level

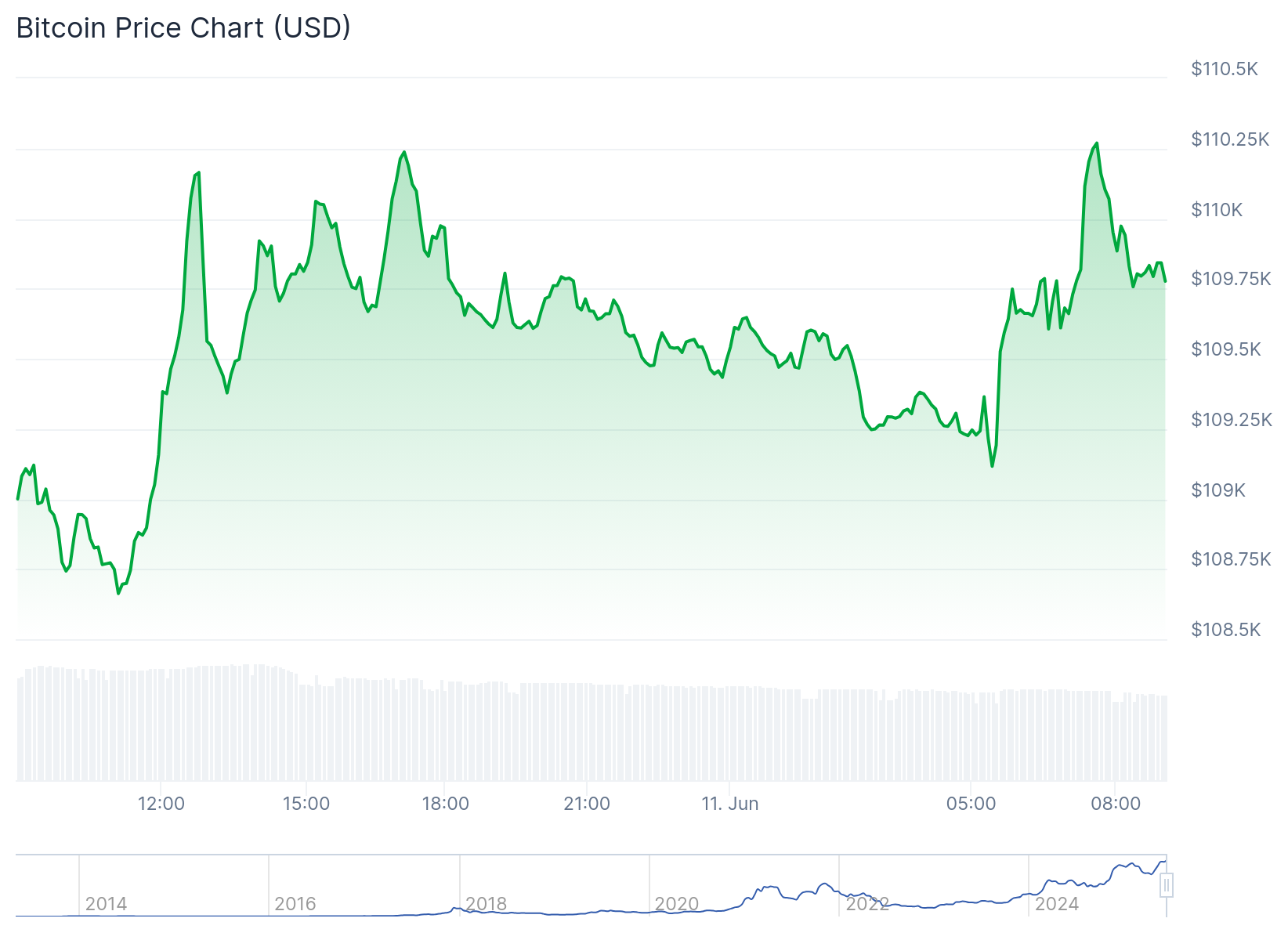

Bitcoin is up 1.1% in the past 24 hours, trading at about $109,900 and fluctuating between $108,644 and $110,269. The flagship crypto is roughly $2,000 below its all-time high (ATH) of about $111,814, attained on May 22, 2025.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.