Highlights:

- Méliuz has upgraded to a Bitcoin treasury firm following shareholders’ approval.

- The company also invested $28.4 million in Bitcoin, increasing its holdings to 320.2 BTC.

- Méliuz started investing in Bitcoin in March after its Board of Directors approved a 10% allocation for BTC investments.

Leading fintech firm Méliuz becomes the first Brazilian Bitcoin treasury firm after betting big on the asset. The company added 274.52 BTC worth $28.4 million to its treasury, according to Israel Salmen, Méliuz’s chairman. The chairman noted that Méliuz paid $ 103,604 per BTC and has achieved a 600% yield. This purchase brought the company’s Bitcoin holdings to 320.2 BTC, valued at an average of $101,703.80 per token.

Salmen also noted that Méliuz was recently approved to become a Bitcoin treasury firm. He stated: “Historic day! Our shareholders have approved, by a wide majority, the transformation of Méliuz into the first Bitcoin Treasury Company listed in Brazil.” The news sparked widespread reactions within the crypto community as market experts debated the new development’s impacts.

Historic day! Our shareholders have approved, by a wide majority, the transformation of Méliuz into the first Bitcoin Treasury Company listed in Brazil.

And today, we took another step forward:

Acquired 274.52 BTC for US$ 28.4M

Average price: US$ 103,604

Achieving a BTC Yield of… pic.twitter.com/y12JlKwW6N— Israel Salmen (@IsraelSalmen) May 15, 2025

Méliuz’s Initial Bitcoin Investment

Méliuz’s Board of Directors approved a 10% allocation of its cash reserves for Bitcoin investments on March 6, 2025, which resulted in its first Bitcoin investments. Méliuz spent about $4.1 million on 45.72 BTC at $90,296.11 per token.

Beyond approving capital for Bitcoin purchases, the Board of Directors also requested feasibility studies from Méliuz’s executive team. The research will cover three important aspects of Bitcoin investments for a company that wants to expand its portfolio.

First, the study will analyse the risks and benefits of adopting Bitcoin as Méliuz’s primary strategic asset. Second, it will look into means of generating incremental Bitcoin for shareholders. Possible options for this exercise were operational cash flow or cash allocation.

Lastly, the research will assess the amendments of corporate documents to accommodate Méliuz’s aspiring status. In addition, it will review the company’s policies, internal procedures, and risk management strategies.

The chairman added:

“The Company will release a new material fact announcement as soon as these decisions are finalised, which is expected to occur within approximately 45 to 60 days.”

We inform the market that the Board of Directors of Méliuz has approved the allocation of 10% of the Company’s total cash reserves in Bitcoin. The Company has made its first Bitcoin purchases, acquiring 45.72 Bitcoin for approximately $4.1 million at an average price of… pic.twitter.com/mGDhxSwVHp

— Israel Salmen (@IsraelSalmen) March 6, 2025

Institutions and Individuals Continue to Buy BTC

On May 12, Strategy and Metaplanet invested big in Bitcoin. In one of its old publications, Crypto2Community reported that Strategy increased its BTC stores by 13,390 with a fresh $13.4 billion investment at $99,856 per BTC. The company currently owns 568,840 BTC, valued at roughly $39.41 billion.

Metaplanet also announced its most recent purchase on the same date as Strategy. The Japanese investment company completed one of its largest purchases this year, worth $126.7 million for 1,241 BTC at $102,119 per token. The purchase expanded the firm’s portfolio to 6,796 BTC.

In one of its most recent tweets, on-chain monitor Lookonchain reported that a whale withdrew 2,218 BTC, valued at approximately $226.75 million. The investor bought 1.18K BTC on Kraken for $120.19 million and 1.038K BTC on Binance for $106.57 million.

A whale withdrew 2,218 $BTC($226.75M) from #Binance and #Kraken in the past 3 hours.https://t.co/8mNHj6acBq pic.twitter.com/pCKcGGP5vI

— Lookonchain (@lookonchain) May 15, 2025

Bitcoin Spikes Slightly

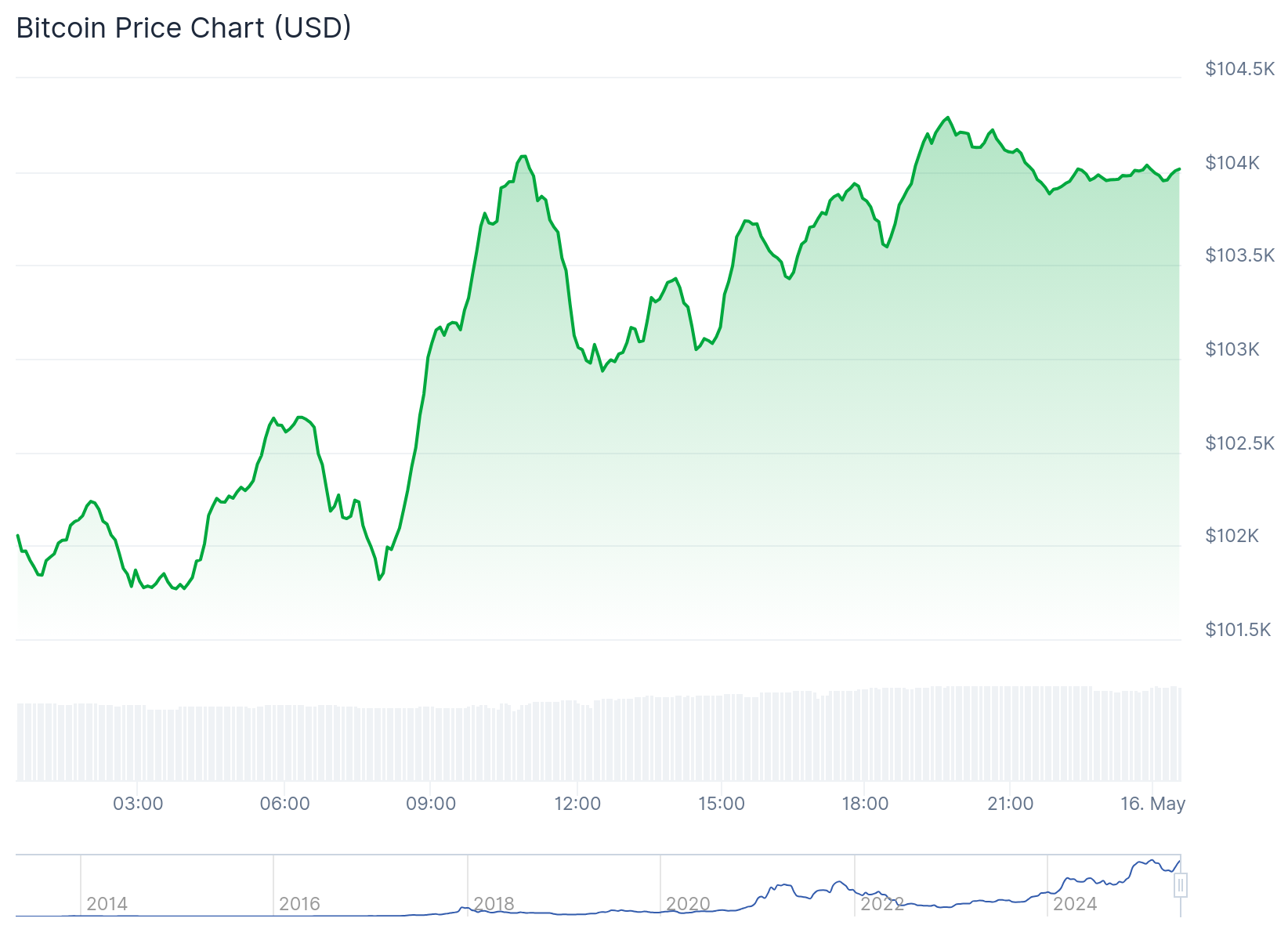

At the time of press, Bitcoin is trading at about $104,000, following a 1.7% upswing in the past 24 hours. Over the past 7 days, Bitcoin soared by only 1%. However, its price fluctuated between $101,749 and $104,778, highlighting a marked recovery from earlier dips. Bitcoin’s market cap has remained above $2 trillion, while its 24-hour trading volume spiked 16% to about $51.66 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.