Highlights:

- Mantra price has shown a bullish reversal, surging 12% to $0.12.

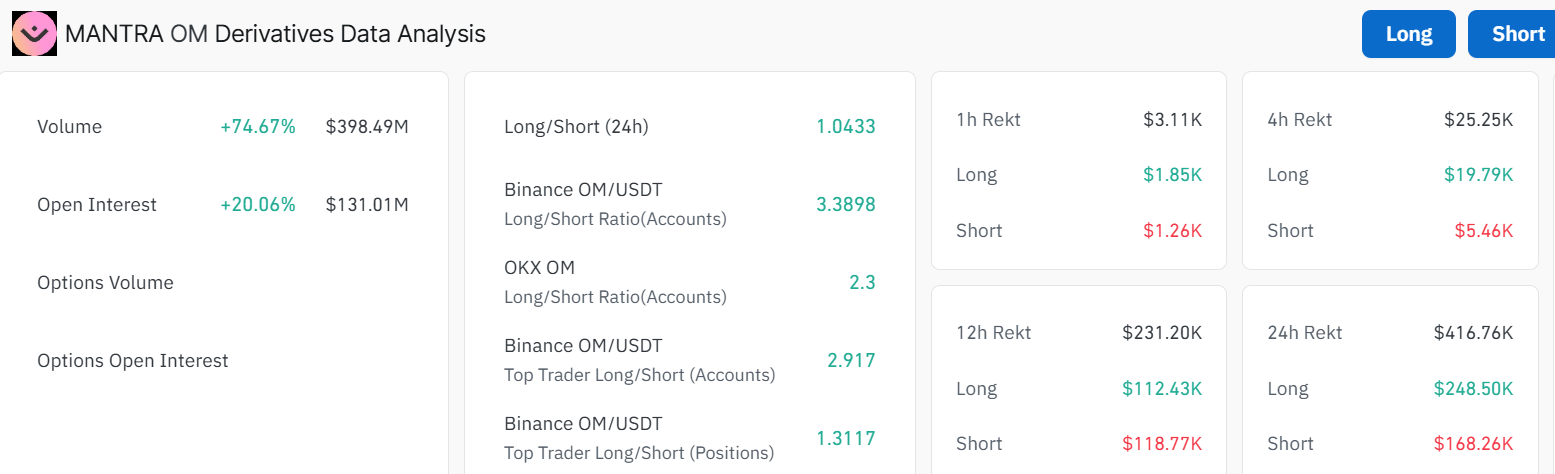

- CoinGlass data reveals a surge in open interest, indicating increasing optimism among traders.

- The technical outlook signals continued recovery as bulls target $0.17-$0.20.

The Mantra price is showing a powerful bullish reversal, soaring 13% to $0.1278, despite the crypto market correction. The daily trading volume has also increased 290%, indicating intense market activity.

Meanwhile, the upcoming Agentic summit, scheduled for October 21st-22nd at the luxurious Four Seasons in Abu Dhabi, will be a key event in the digital assets, tokenization, and market infrastructure sphere. It is a two-day CEO-leader summit organized by Mantra and Invenium, designed to suit the future of markets.

Excited to share the schedule for Agentic. – a two-day institutional summit for leaders driving the next wave of markets, trading, tokenization, and financial innovation.

If you’re active in RWAs, market infrastructure, digital assets, or capital innovation, this is for you.

— MANTRA | Tokenizing RWAs (@MANTRA_Chain) October 14, 2025

The direction of the event will be market-moving technologies that are changing the way trading, digital assets, and capital markets take place. It will be a chance to exchange ideas with other industry leaders, present the latest innovations, and discuss how tokenization transforms the global financial landscape.

Mantra Price Derivatives Market Outlook

Recently, the trading volume and the open interest of the OM (Mantra) derivatives market have demonstrated extraordinary growth. Mantra price volume has soared 250% to $634.38 million, and the open interest has increased by 66.42% to $57.09 million.

This increase indicates a positive feeling in the market and the continued confidence in OM assets. With the increased activity in the derivatives market on the OM front, investors are increasingly considering the risk/reward ratio. The long/short ratio is currently 0.9881, indicating that the market has quite a balanced position.

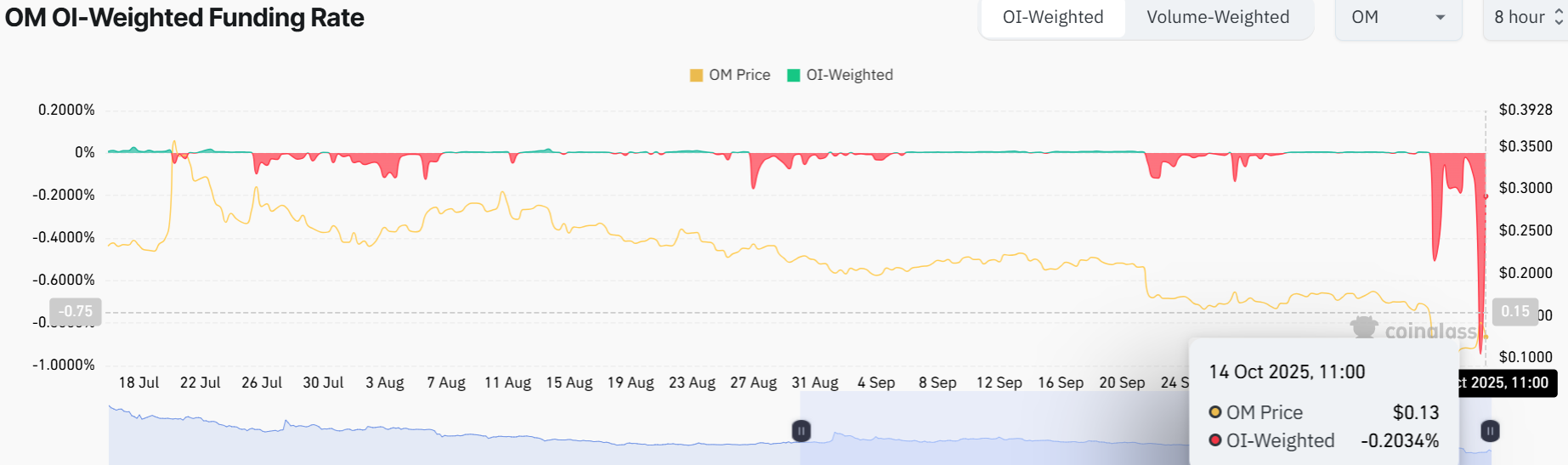

On the other hand, Mantra’s funding rate is at -0.2034%, indicating that short positions are incurring pay to hold. This indicates that the market mood is slightly negative, but the price trend over the last few months suggests the possibility of improvement.

The chart shows OM/USDT on a 1-day timeframe. The token has climbed from a low of around $0.03 to a recent high of $0.13. The 50 SMA ($0.14) and the 200 SMA ($0.0.17) cushion the bulls against further upside. However, the recent 290% pump in volume shows a strong momentum, which may see the bulls overcome the resistance levels.

The Relative Strength Index (RSI) at 53.40 is in neutral territory and not overbought yet, allowing room for more gains if the bullish trend persists. This means that the bulls still have room to run before the Mantra price is considered overbought.

Is It Time to Buy OM Token?

Looking ahead, if the bulls can push past the 50-day SMA resistance and flip it into support, the Mantra price could cruise toward $0.17-$0.20, especially if market sentiment turns positive. Conversely, if the resistance zones prove too strong, traders will want to watch for a drop back to $0.10 support zone.

In the short term, Mantra’s price is looking solid with that 12% daily gain. However, the death cross is a red flag to keep an eye on. Long-term, if the project keeps its fundamentals strong, Mantra price could be in for a moonshot.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.