Highlights:

- Mantle price has spiked 6% to $1.70, rebounding from the recent $1.42 lows.

- Its DEX volume has soared above $700, indicating growing interest.

- CoinGlass data shows a positive funding rate as the OI surges 6%.

The Mantle price has risen 6% to $1.70, eyeing a potential breakout rally. The recovery is underpinned by a rise in bullish positions built up in the Mantle derivatives market and a steady flow of Decentralized Exchange (DEX) trading volume. Technically, the MNT token trades at a crucial crossroads as the selling pressure seems to ease.

Mantle DeFI Data and Derivatives Market Outlook

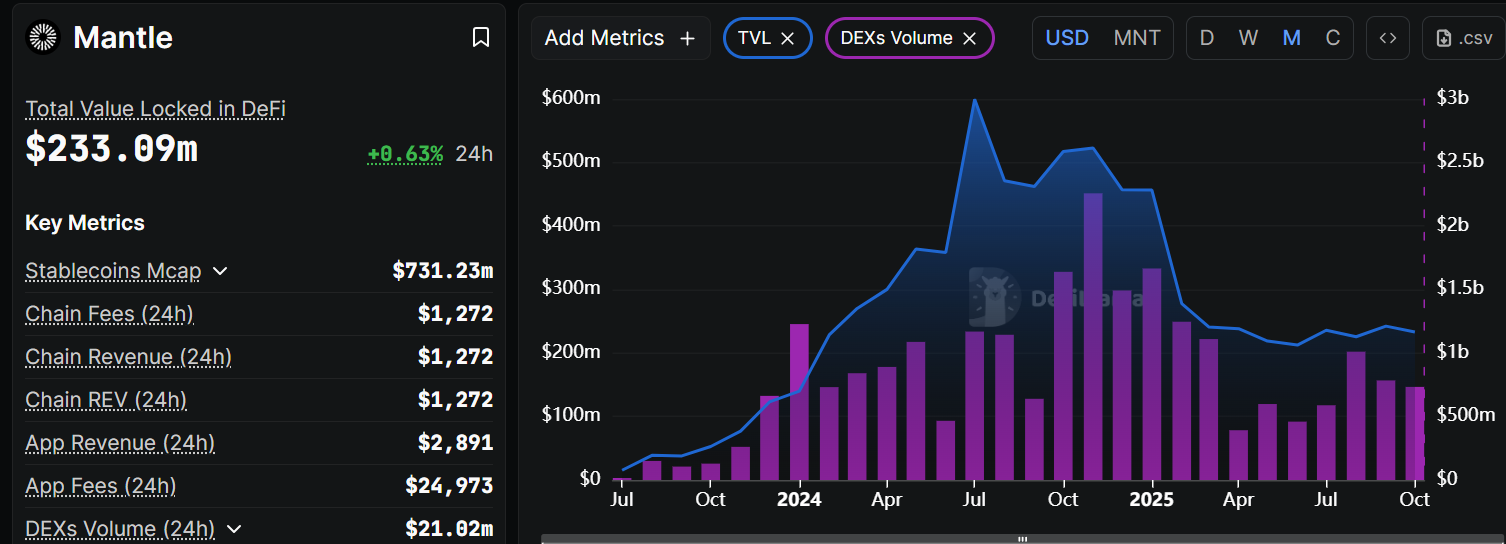

According to DeFiLlama data, the Mantle has already assembled $732.48 million in monthly DEX volume, marking the third consecutive month it has launched over $700 million. In a volatile market, demand remains stable even though the DEX volume reduced to $1 billion in August.

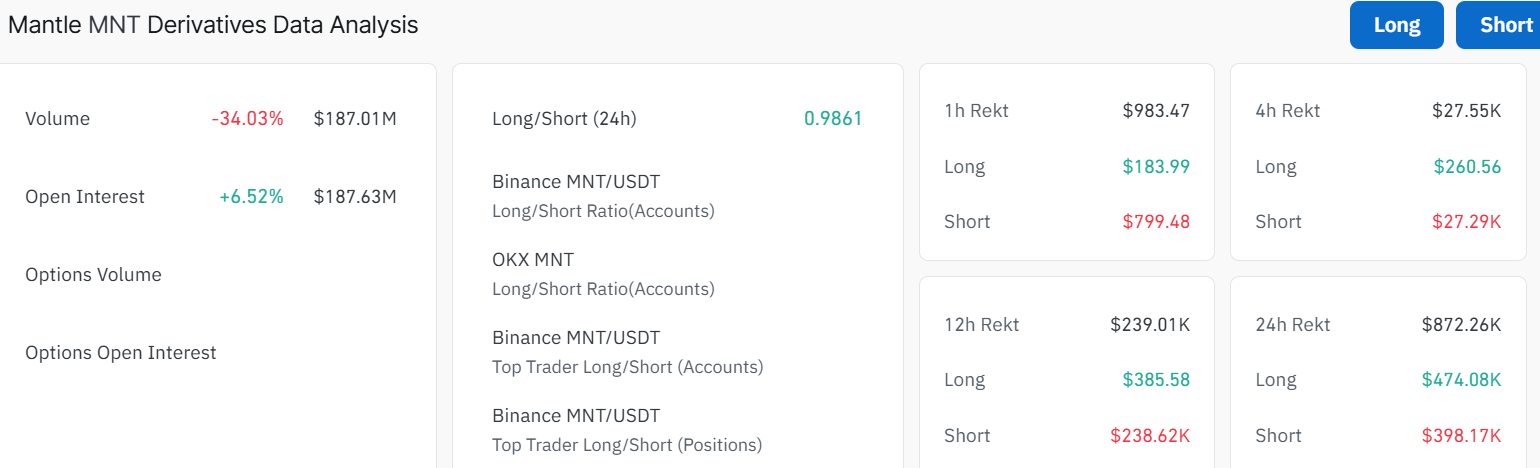

Mantle attracts huge open interest in derivatives, despite the trading volume in the market having generally declined. Coinglass data shows that many traders are trading on future price changes, with the present open interest of $187.63 million, which has increased by 6.52% in the past 24 hours.

Typically, a noticeable increase in futures OI means that the notional value of all open contracts increases. This is because traders become more exposed to risk by buying new long positions or increasing leverage. With the recent market experience of a huge flow of overleveraged positions, new bulls or positions are more likely to emerge.

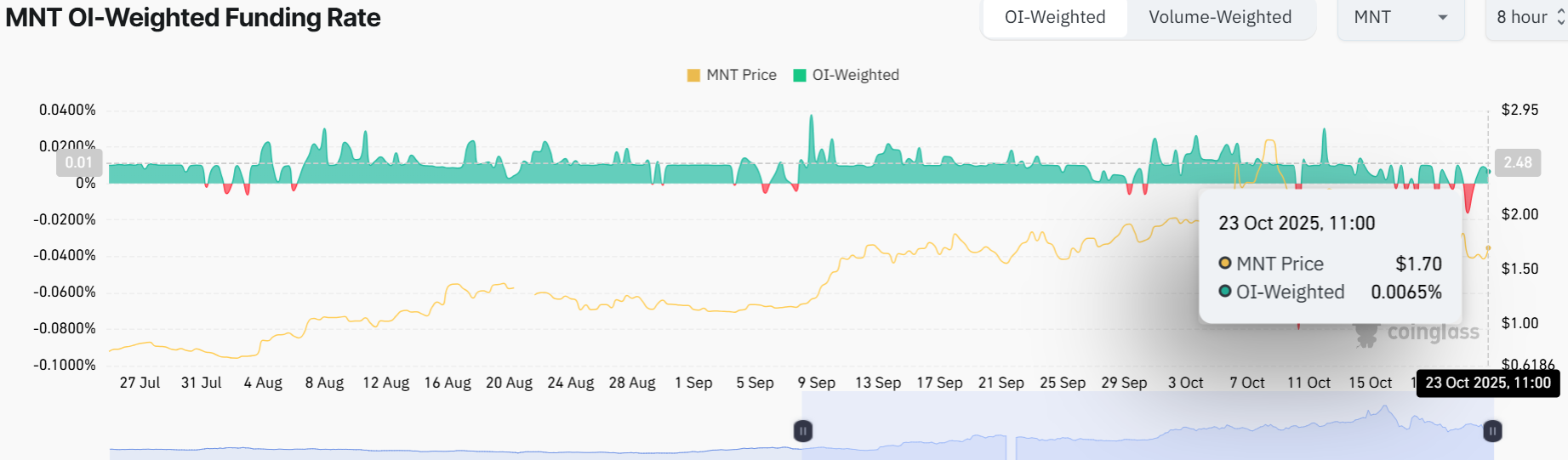

Adding to the bullish sentiment, the OI-weighted rate of funding has turned positive at 0.0065% compared with -0.0187% on Wednesday. This implies that the traders are ready to pay a high price to occupy the call-side jobs. In the meantime, a positive funding rate of 0.010 percent or higher indicates a bull-side dominance.

Mantle Price Gears Up for a Rebound After Bottoming Out

The Mantle price 1-day chart has been suppressed below the green 50-period Simple Moving Average (SMA) at $1.75, as the bulls establish strong support at $1.02. The price is now trading at $1.70, like a boss, after bouncing from the $1.42 low, which is a solid support zone. However, the recent candlestick action suggests that after the 6% surge, the Mantle price may break out of the triangle pattern, towards the $1.75 resistance.

If price breaks above $1.75 and holds, MNT price could bounce to $2.23 or higher in the coming weeks. However, if it gets rejected, traders should expect a dip toward $1.42 or lower.

Zooming in on the technical indicators, the Relative Strength Index (RSI) at 46.89 shows a tug-of-war among the bulls and the bears. Moreover, the MACD indicates a bearish crossover, cautioning traders of a potential selling pressure if the bulls do not gain stamina.

Looking ahead, the 6% pump is a classic bounce from the bottom. However, the downward 50-day SMA is acting like a gatekeeper. If Mantle price smashes through it with volume, it could jump to $2.23-$2.70 next.

But if it fumbles, that support at $1.42 better hold, or MNT cloud slides lower. The chart has a bearish vibe with those lower highs, but the SMA crossover could flip the script if bulls step up. In the meantime, investors should wait for a confirmed break above $1.75 local resistance.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.