Highlights:

- Ethereum’s price drops almost 1% to $ 3,813, as trading volume slips 3%.

- Mantle has officially become part of the Strategic ETH Reserve.

- Crypto analyst say there is plenty of hype in ETH, but a real breakout begins above $4100.

The Ethereum price is down almost 1% to $3813 as its daily trading volume drops 3% to $34.38 billion. Despite the drop, ETH still boasts a 2% rise over the past week and a 54% surge in the past month. Meanwhile, Mantle has officially become a part of the Strategic ETH Reserve. It has contributed a total of 101,867 ETH (approximately $392M) as the largest holder of ETH among all Web3 entities.

Mantle is now listed on the Strategic ETH Reserve (SΞR).

As the largest ETH-backed treasury amongst Web3 entities, this reflects our conviction in Ethereum — not just as infra, but as the monetary layer powering decentralization and on-chain finance.

Slowly, then all at once. https://t.co/9JSU3TNDCs pic.twitter.com/VQ6v5UgbAU

— Mantle (@Mantle_Official) July 29, 2025

Moreover, Ethereumhas exhibited increased whale activity, with more than 220,000 ETH ($840 million) being purchased over the past two days. A significant purchase by relatively large players on the Ethereum network will instill more confidence in the future of cryptocurrency. The buildup of whales coincides with the recent strong performance of Ethereum, which has garnered significant market attention.

Some of the largest whales on the network have bought over 220,000 Ethereum $ETH, worth around $840 million, in the last 48 hours! pic.twitter.com/cGHjbgWarn

— Ali (@ali_charts) July 29, 2025

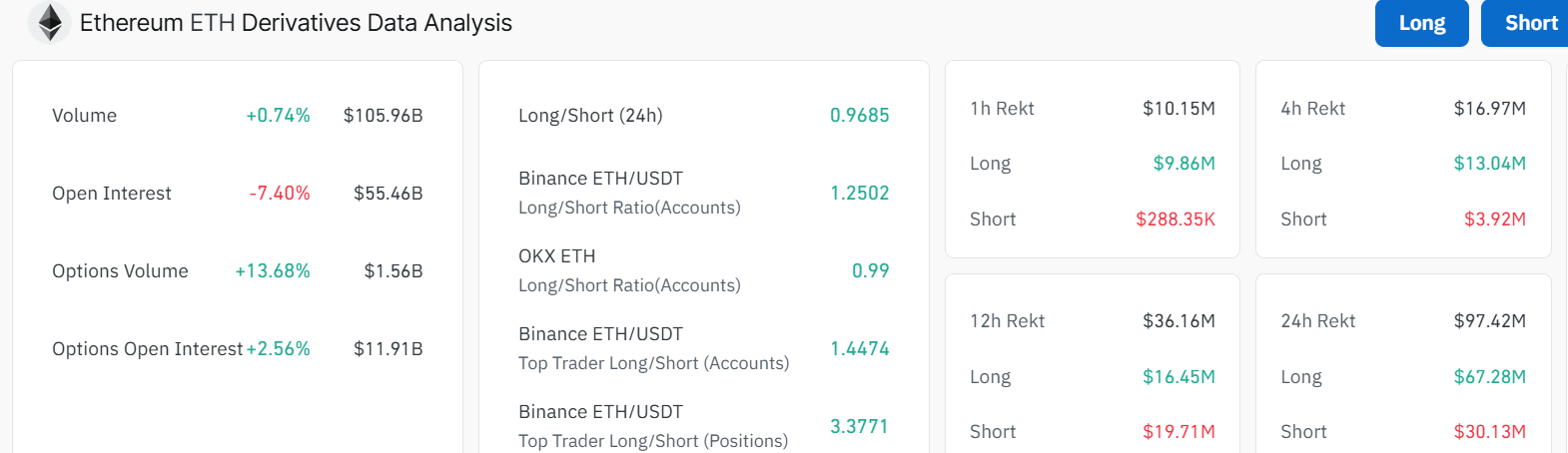

The most recent statistics on the Ethereum derivatives market depict a similar scenario of a bullish trend. ETH has seen its trading volume rise by 0.74% and the open interest has fallen slightly by 7.40%. This suggests some uncertainty among traders in taking long-term positions.

The rise in options volume by 13.68% and the increase in open interest of options by 2.56% indicate that options traders are becoming more active in positioning themselves in preparation for Ethereum’s upcoming moves. Such dynamic change is of immense interest because it suggests that, although Ethereum may experience uncertainties in the short term, its long-term outlook remains positive.

Ethereum Price Poised for a Bullish Breakout

The Etereum price daily chart outlook shows that it has been in a steady uptrend, trading well within the confines of a rising parallel channel. The price action indicates that the ETH price is trading above the 50 Simple Moving Average (SMA) ($ 2,899) and the 200 SMA ($ 2,490), a classic sign of strength.

The Relative Strength Index (RSI) at 74.95 shows intense buying in the ETH market. Moreover, its position above the 70-region caution traders of a possible pullback, hence they should carefully evade the bull trap.

The Moving Average Convergence Divergence (MACD) is indicating bullish momentum, as the MACD line has crossed above the signal line. The histogram is also turning green, a sign of increasing bullish momentum. However, a looming sell signal is present in the ETH market. Nevertheless, traders remain free to buy ETH tokens until then.

Analyst Says a Real Breakout Begins at $4100 in ETH

Looking ahead, if the Ethereum price holds above the $4,000 resistance, we could see it test the $4,200 high, potentially pushing toward $ 4,500 in the next week if the hype train continues. According to Ali Martinez, ‘there is plenty of hype around ETH, but the real breakout begins above $4100.’

There’s plenty of hype around Ethereum $ETH, but the real breakout begins above $4,100. pic.twitter.com/U7xBNY8oqv

— Ali (@ali_charts) July 29, 2025

In the meantime, a drop below $3,710 might signal a breather and could push ETH to $3,623 or even to $3,410. In the long term, Ethereum’s surge in options volume and option interest could drive it past $4,100 by the end of July.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.