Highlights:

- Logan Paul’s motion to blame co-founders for CryptoZoo’s collapse was denied.

- The judge says granting the default judgment risks inconsistent rulings in the CryptoZoo lawsuit.

- The CryptoZoo lawsuit continues as NFT buyers demand accountability from the project’s creators.

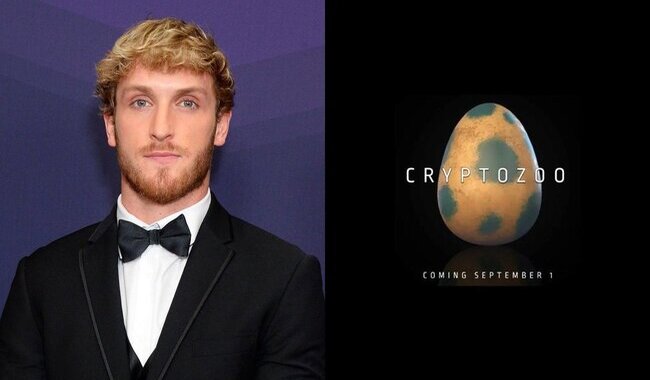

The court in the US has rejected the bid made by Logan Paul in an attempt to shift the blame in the CryptoZoo lawsuit. The lawsuit, presented by dissatisfied NFT buyers, concerns fraud and misinterpretations related to the CryptoZoo NFT project. The project, which was offered as a blockchain-based game, never launched, and this disappointed many investors.

On July 23, Magistrate Judge Ronald Griffin recommended that the court not approve the motion by Paul to demand a default judgment against his co-founders. Paul had brought a counterclaim in January 2024, having promoted CryptoZoo to his substantial following. He blamed Eduardo Ibanez and Jake Greenbaum for deceiving and collapsing the project.

Logan Paul blames partners for 'CryptoZoo' rug pull in lawsuit alleging it was a scam, Bloomberg reports.

New crypto offerings like this always carry a substantial amount of risk.

It's high time retail understands this, while also keeping promoters accountable. pic.twitter.com/6onMxuOBdw

— Brian Rose, Founder & Host of London Real (@LondonRealTV) July 24, 2025

CryptoZoo, launched in 2021, provided a play-to-earn experience with users having the opportunity to buy NFT eggs. The eggs would hatch into hybrid animals, which could then be sold as cryptocurrency. However, the game never became a reality, and people got low-quality stock images rather than original digital animals.

The Court’s Rejection of Paul’s Motion

According to Judge Griffin, the need to accuse Ibanez and Greenbaum, as suggested by Paul, would result in conflicting decisions. This would complicate the suit, as the case involves allegations of joint fraud by all the defendants. The judge reiterated that the case’s focal point is whether all defendants, including Paul, committed fraudulent acts in unison.

According to the judge, treating the co-founders unequally would compromise the cohesive claims by the plaintiffs. He has said that the court must be fair and act in the same manner towards all the defendants and take a common course of action. According to the motion filed by Paul, the co-founders defrauded him and contributed to the failure of the project. The judge added, however, that if the motion is granted, delays and confusion would arise that would ultimately hinder the overall legal proceedings.

The Impact of CryptoZoo’s Collapse

CryptoZoo was marketed as a novel blockchain game, but ended up as a failure to live up to its promises. Investigations showed that major developers were not paid and insiders made money, whereas investors lost. YouTuber Coffeezilla revealed the project as a scam in December 2022 and covered how it had been marketed as a legitimate blockchain game. Moreover, the end of the project was speculated to be the result of mismanagement and probably fraud by its creators, among them Logan Paul.

Paul has since distanced himself from the controversy, alleging that he was misled by his co-founders. However, the plaintiffs in the CryptoZoo lawsuit assert that Paul played a major role in defrauding investors.

What’s Next for the CryptoZoo Lawsuit?

The CryptoZoo lawsuit makes further progress as Judge Griffin’s recommendation clears the way for more legal action. The court will now concentrate on the issue of whether all the defendants were fraudulent, including Paul. The case will proceed provided the district judge does not reverse the decision of the magistrate. In addition to the NFT buyers’ lawsuit, Paul is involved in a separate defamation case against YouTuber Coffeezilla. This case adds further complexity to the legal challenges surrounding CryptoZoo.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.