Highlights:

- Litecoin price surges 9%, defying broader market turbulence.

- The recent rally is fueled by the odds of an LTC ETF approval gaining weight.

- Crypto analysts predict a potential 17% gain to $128 in Litecoin price.

The Litecoin price has defied the broader crypto market turbulence, soaring nearly 9% to $117 amid recent advancements. The token saw renewed market interest fueled by the odds of an LTC ETF approval gaining weight.

Amid these bullish developments, a top crypto market expert, Carl Moon, has highlighted a potential $128 target looming for the token. Analysts say this signals close to 17% gains, as the token has broken above the ascending triangle.

🧨 $LTC is breaking out of this ascending triangle as predicted! The target is $128🎯

Trade #Litecoin on Bitunix – https://t.co/GzXaATj3Ps and get a free $100 after your first $500 deposit! pic.twitter.com/UGD4Qq1aa5

— Carl Moon (@TheMoonCarl) February 10, 2025

LTC Statistical Sata

Based on CoinmarketCap data:

- LTC price now – $117

- Trading volume (24h) – $1.1 billion

- Market cap – $8.82 billion

- Total supply – 84 million

- Circulating supply – 75.51 million

- LTC ranking – #19

The daily chart shows the LTC/USD price aiming to beak above the descending triangle channel. Currently, the Litecoin price is $117, supported by strong bullish momentum. The price has decisively broken above the 50-day and 200-day moving averages, signaling sustained upward pressure and increasing trading volume.

With resistance at $124 as the next significant hurdle, a breakout could drive the price further to $135. Conversely, failure to break above this level could result in a pullback toward the $110 support level, which aligns with the 50-day MA.

Litecoin Price Poised for a Breakout to $140 if $124 Resistance Key is Weakened

The LTC/USD chart illustrates a continuation of the upward momentum above the descending triangle channel. The price has recently surged above the 50-day and 200-day moving averages (MAs), signaling strong bullish pressure.

This breakout is supported by a notable increase in trading volume, suggesting market participants are optimistic about further price gains. The current price level of $117 is approaching the next significant resistance levels at $124, $135, and $140. However, if the bullish momentum persists and the price breaks above $140, the market could target even higher levels, continuing its long-term uptrend.

On the downside, if the resistance at $124 proves too strong, the price might retrace toward the 50-day MA or even the $101, $98, and $87 support levels. A break below this support would signal a bearish reversal and could lead to further declines. For now, the market remains bullish as long as the price stays above the moving averages, with $124 being the key level to watch for the next major move.

Technical Indicators Suggest Potential Upside

A quick look at the RSI at 54.49 suggests neutral-bullish momentum. Its position above the 50-mean level indicates that the buyers are gaining dominance, which may push Litecoin’s price to the upside. Further, the RSI is northbound, so an increased buying appetite might cause the RSI to hit the 70-overbought territory.

The MACD indicator shows a looming buy signal, which will only be executed once the blue MACD line crosses above the orange signal line.

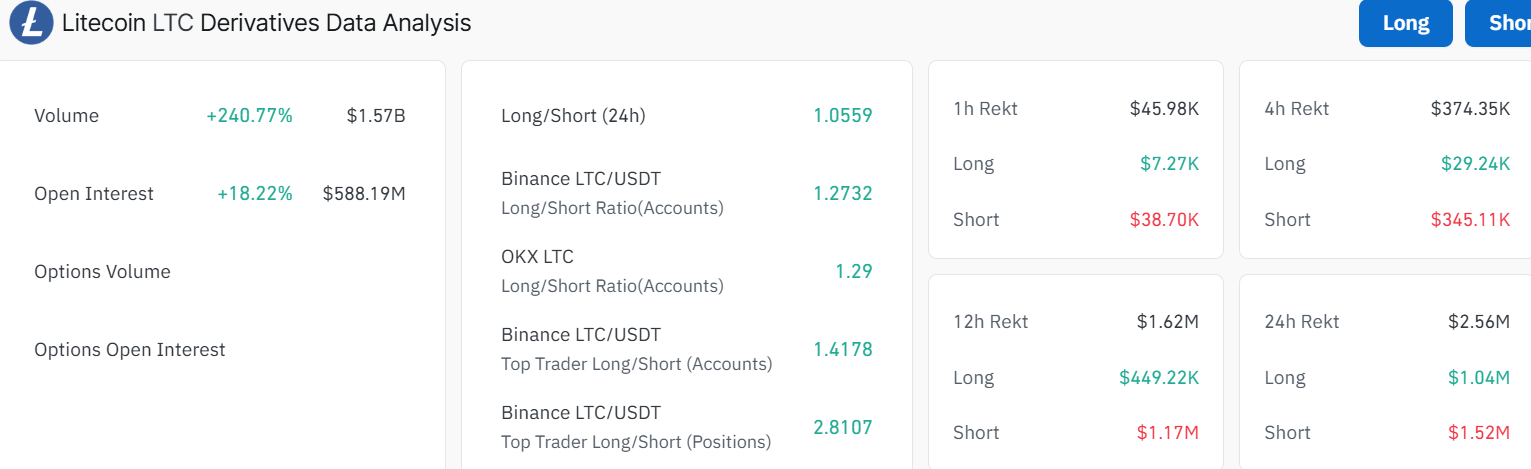

Elsewhere, Coinglass data Open interest has soared 18% to 588.19 M as the volume increased by 240% to $1.57 billion. This suggests heightened market activity and strong interest from traders. In other words, this indicates strong bullish sentiments, which may see the Litecoin price strike an upward trajectory, potentially reaching the $140 mark.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.