Highlights:

- Litecoin price consolidates within a triangle, as a breakout above $115 is likely.

- Recently, LTC has experienced a tremendous increase in its hash rate, as it has tripled in the past 18 months.

- The technical indicators signal a fading bearish outlook, reinforcing a potential rally.

The Litecoin price is currently consolidating within a triangle, despite the 1% drop to $111. Its trading volume has also plunged to the red, down 23% indicating a drop in market captivity. However, Litecoin has recently enjoyed a tremendous increase in its hash rate, as it has more than tripled in the past 18 months. A rise in hash rate indicates that a blockchain network is more secure and stable, as it is directly linked to an increase in processing power used to authenticate transactions.

3x the Litecoin hash rate in just a little over 18 months. 🔥🔥 pic.twitter.com/bUGJdZ0XoN

— Litecoin (@litecoin) September 3, 2025

Increased hash rate is a good indicator to investors that Litecoin is becoming more stable and safe. The network will be more resistant to attack as the hash rate increases and will ensure the integrity of the blockchain. Since the Litecoin price is still receiving increased attention among the mining community, the network will continue to strengthen. This will enable it to have a greater chance of growing in the future.

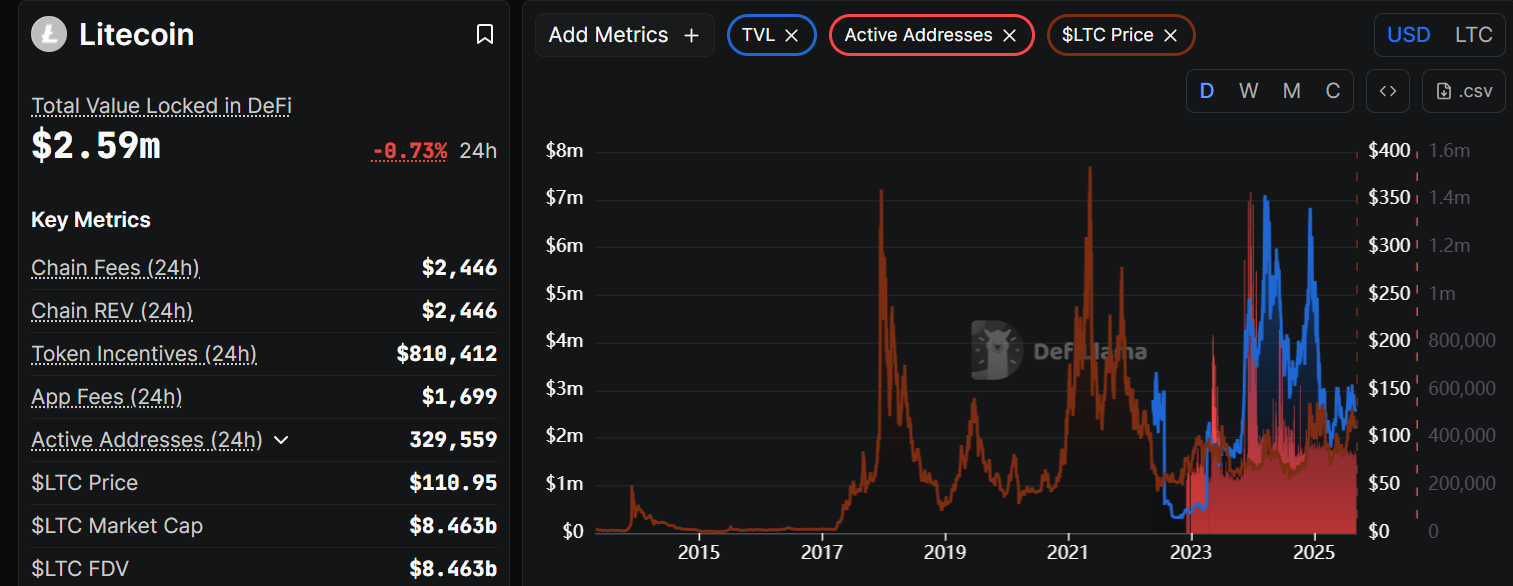

LTC TVL and Derivatives Market Sentiment

When considering the performance of Litecoin in decentralized finance (DeFi), the total value locked (TVL) in DeFi is currently standing at a low but stable level of $2.59 million. This represents a minor decline of 0.73% in the last 24 hours. This slight reduction suggests that minor fluctuations can occur, even as Litecoin remains in the DeFi arena. It also shows that the network is actively managed, as evidenced by the 329,559 addresses received over the past 24 hours, which signify positive user traffic.

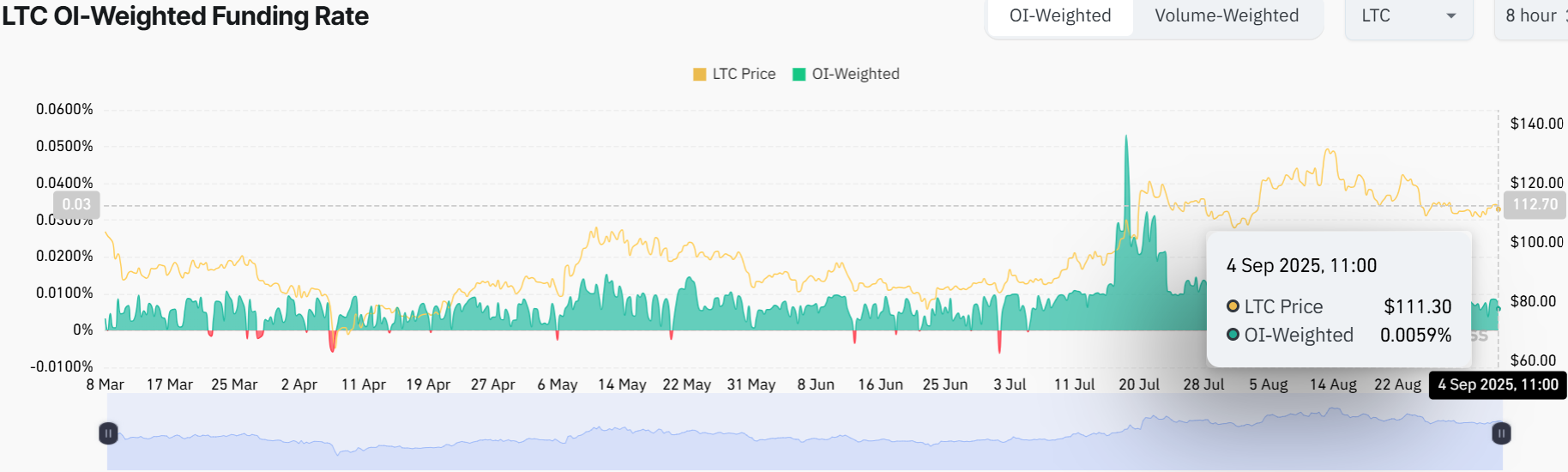

Looking at the funding rate of Litecoin, especially the Open Interest (OI)-weighted funding rate, the current funding rate is 0.0059. It indicates that the derivatives market of Litecoin has medium attention, and traders are cautiously optimistic. The rate of funding is significant as it can be used to determine the mood of leveraged traders. A positive funding rate usually indicates a positive market feeling, whereas a negative rate indicates a negative market feeling.

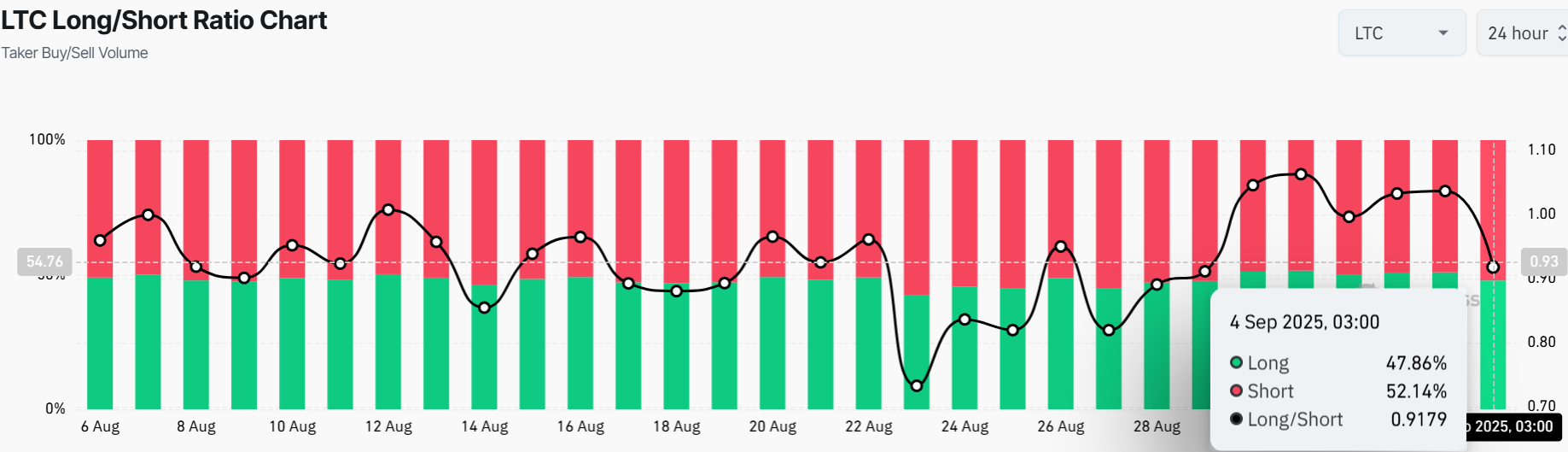

Currently, the long positions are 47.86%, with the short positions taking the bigger share of 52.14%. The ratio of 0.9179 indicates a weak bearish market mood, with a majority of traders slightly betting on the Litecoin price fall. This news may be a sign of the current cooling off of the market.

Litecoin Price Likely to Rally

The Litecoin price is consolidating within a triangle. A breakout above this pattern will favour the bulls as the token currently trades at $111. LTC found support at $97, as the bulls target $115 key zone.

The technical indicators, including the Relative Strength Index (RSI) on the daily chart, read 46.19, nearing 50, indicating a fading of bearish momentum. Meanwhile, until the Litecoin price breaks out clearly from this triangle, either above $115 for a bullish move or below $97 for more downside, traders will likely remain on the sidelines. Volume has dropped as traders wait for the next catalyst. For now, the coin is consolidating, with short-term moves likely to be driven by broader market changes. Otherwise, a retest of $100-$97 support may be possible if selling continues.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.