Highlights:

- Litecoin is making higher lows, a pointer to rising demand

- A rally through the day’s high of $129.11 could push Litecoin to $200

- Rising institutional demand and ETF hype could help sustain momentum

Litecoin is showing strength on a day that most cryptocurrencies are either in the red or showing relatively weak price action. At the time of going to press, Litecoin was trading at $128, up by 14.15% in the day. At the same time, Litecoin trading volumes have shot up intraday, up 228.59% to $1.94 billion. The combination of increasing price and trading volumes is a positive signal for Litecoin. It indicates that FOMO is building up, and Litecoin could be headed to new highs in the short to medium term. A couple of factors support such a rally.

Institutional Demand for Litecoin Rising

One of them is the fact that institutional demand for Litecoin is on the rise. For most of 2025, institutional demand for cryptocurrencies has been on the rise. However, most of this demand has flowed mainly towards Bitcoin and Ethereum. Recently, Litecoin has also been attracting this demand. For instance, throughout July, Litecoin saw a surge in companies buying Litecoin by the hundreds of millions of dollars. For example, MEI Pharma, a listed company on the NASDAQ, announced that it was creating a Litecoin treasury and funding it with $100 million.

Mei Pharma (NASDAQ:MEIP) is doubling their Litecoin strategic treasury! Raising another $100 million through equity in addition to the original $100 million investment already announced last week. $LTC ⚡️ https://t.co/T50UHBLLCw pic.twitter.com/sAB6dCxLeU

— Litecoin Foundation ⚡️ (@LTCFoundation) July 27, 2025

Several other companies have made similar moves, adding to the bullish pressure on Litecoin. At the same time, there is growing optimism that a Litecoin ETF could soon be approved, further adding to Litecoin’s potential to draw institutional money. For context, multiple analysts are now in consensus that there is a 90 – 95% chance for the approval of a Litecoin ETF. As these odds of an ETF remain elevated, the price could increase for two reasons.

Litecoin has a 90% chance of ETF approval — inverse 1.618 extension is my target pic.twitter.com/T5sPgTIe9y

— Tony "The Bull" Severino, CMT (@TonyTheBullCMT) June 11, 2025

Expectations of a Litecoin ETF Could Sustain Momentum

First, retail FOMO could trigger a rally as investors try to front-run the possible ETF. Given Litecoin’s capped supply, this could see Litecoin rally to new highs in the short term. The fact that Litecoin is doing double-digit gains when the broader market is weak indicates that, as the anticipation for an ETF gets stronger, Litecoin could be headed back to its all-time high and potentially breach it.

The potential approval of a Litecoin ETF could also create the perception that it is one of the safer altcoins in an increasingly crowded market. The result is that institutional investors are likely to buy it even more aggressively, potentially pushing the price even higher.

Return of Risk On Sentiment In the Market Could Push Litecoin Higher

Litecoin’s upside momentum will likely be boosted by the rising risk-on sentiment across the market. Despite the recent tariff issues between the US, Canada and India, the markets appear to have priced in the uncertainty and are going up.

US stock indices are up, and since cryptocurrencies tend to trend toward US stock, Litecoin could be headed higher. There is also the growing hope of a rate cut in the US now that the labor market is weak. The anticipation of a rate cut could see a rally across risk-on assets, and with Litecoin already bullish, a parabolic price run could follow.

US equity indices built on modest gains at the open, climbing throughout the day and finishing at the highs, nearly recovering all of Friday's drop. No evidence of systematic EOD selling (in fact seemed the opposite). RUT went from last to first +2.1%. DJIA "lagged" +1.3%. pic.twitter.com/w8suPMbJiI

— Neil Sethi (@neilksethi) August 4, 2025

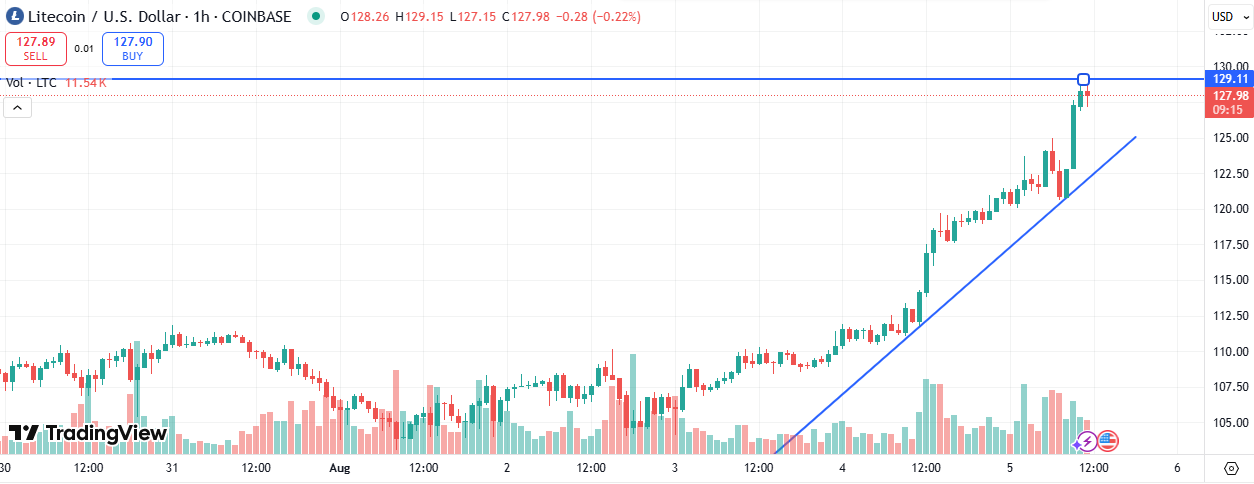

Technical Analysis – Litecoin Making Higher Lows In a Bullish Channel

Litecoin has been trading in a bullish channel since August 2. This means every slight dip in the price of Litecoin has been quickly scooped up. If the current momentum continues, the key level for Litecoin will be the intraday high of $129.11.

If bulls take control and push Litecoin through $129.11, a rally to $200 could follow in the short term. However, if bulls fail at the $129.11 price level, then a consolidation around it could follow in the short term.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.