Highlights:

- The Litecoin price has surged 6% to $85, as its trading volume has spiked 24%.

- LTC derivatives market shows a positive sentiment as Vanguard Group allows crypto ETFs.

- The LTC technical outlook suggests further upside towards $87-$92 in the short term, as bulls gain momentum.

The Litecoin (LTC) price is trading in $84.76 zone, marking a 6% rise in the past 24 hours. According to the derivatives data, there has been an increase in demand, which confirms the recovery in a falling wedge formation, indicating further gains.

Litecoin, a blue-chip cryptocurrency that has an ETF, is on the rise. This follows the Vanguard Group’s decision to allow access to the crypto market through third-party ETFs. The move gives Canary Litecoin ETF (LTCC), which is conservative, additional exposure to its investors and may boost investments in digital assets.

Nice to see the Canary Litecoin ETF spreading its wings! Investment powerhouse @Vanguard_Group now profiles LTCC to its 30 million investors. https://t.co/rsF6KVZtyB pic.twitter.com/N2h122IkKH

— Litecoin Foundation ⚡️ (@LTCFoundation) December 2, 2025

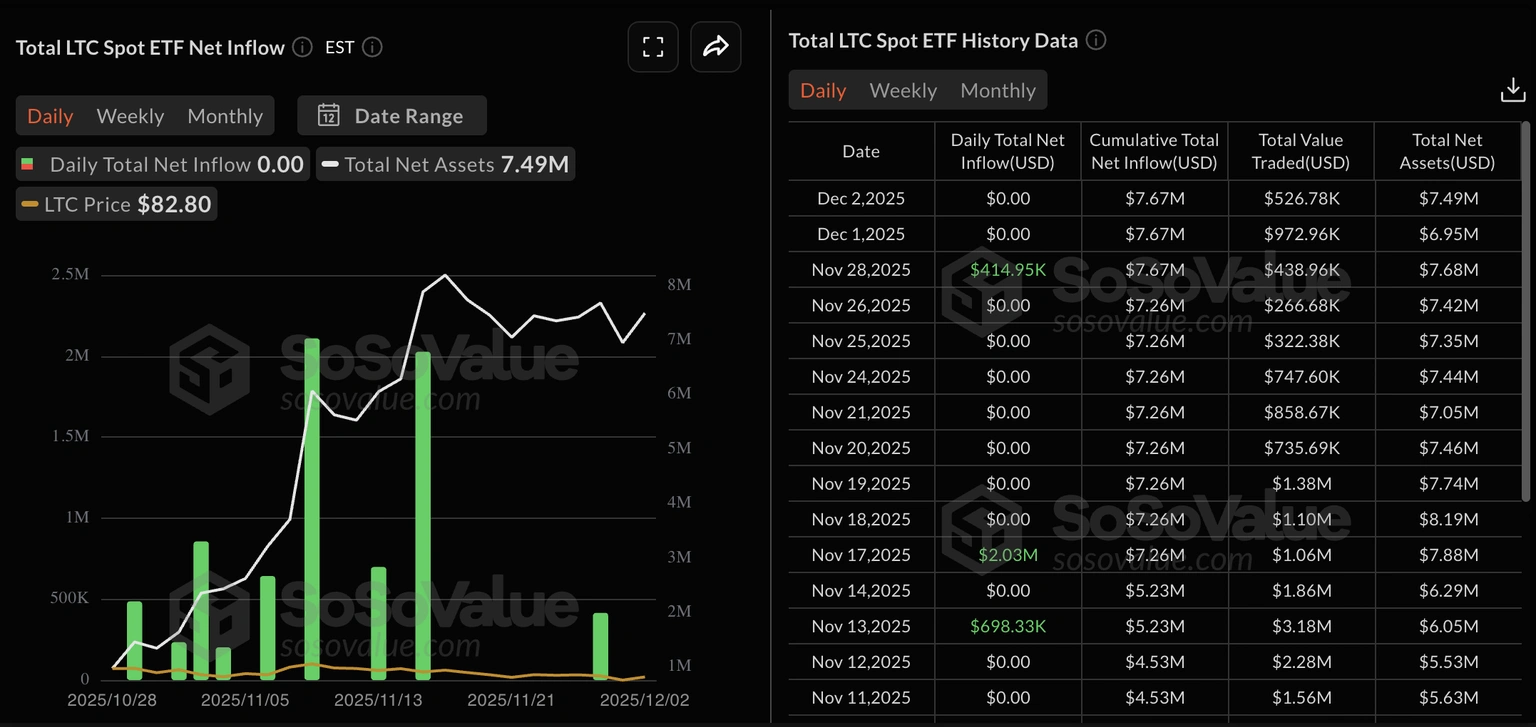

Nevertheless, as per the Sosovalue data, the Litecoin ETF experienced a net-zero flow on Monday and Tuesday. This retained the cumulative net inflow at $7.49 million.

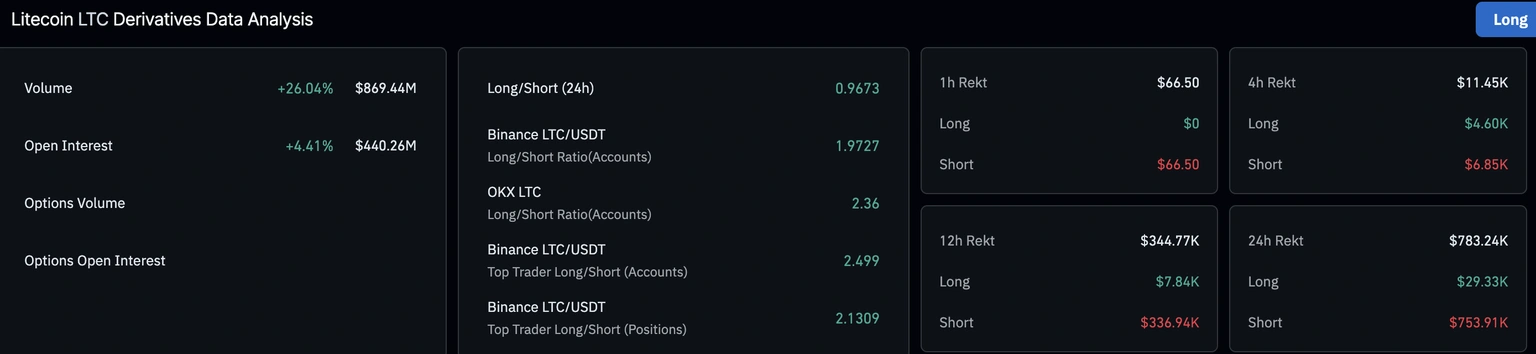

Nevertheless, the Litecoin derivatives market experienced intense demand, with its futures Open Interest (OI) increasing by 4.41% over the past 24 hours to reach $440.26 million. This accumulation in Litecoin futures positions suggests a new wave of risk-on sentiment among investors. Furthermore, the volume has increased by 26.04% to $869.44 million, indicating heightened market activity.

The optimism of investors was also supported by a significant reduction in bearish positions in LTC derivatives. This is reflected in the 24-hour data, where the short liquidations total $753,910, while the long liquidations accumulate $29,330.

Litecoin Price Eyes $87-$92 Resistance

The LTC/USD chart shows the crypto trading at $84.66, up a slight 6% today. The candlestick action shows a recent dip, with a low of around $70, but it is currently bouncing back at $84.

The resistance levels at $92(50-day SMA) and $101(200-day SMA) will test LTC’s gains. However, if the Litecoin price can break past the $87 mark, the price could skyrocket to reclaim the $92 resistance zone, which aligns with the 50-day SMA. Zooming out, the Relative Strength Index (RSI) at 44.65 is hovering near neutral territory and facing upward. This suggests that LTC isn’t overbought yet and has room to run.

Meanwhile, the Moving Average Convergence Divergence (MACD) is bearish as the MACD line is below the signal line (orange). However, recently, the MACD line has attempted to break above the signal line, a sign that the bulls are present, even though their influence is suppressed.

Looking ahead, the traders are piling in, and the Litecoin price could soon test resistance around $87. If it breaks that, the next stop might be $92, which serves as the main target for the bulls in the short term. However, if the resistance zones prove too strong, a pullback towards $81 support zone could be imminent. Nevertheless, volume has been steady, soaring 24%, so this rebound might gain momentum.

In the short term, traders can expect a bounce to $87-$92 within the next week, fueled by dip-buying FOMO. However, if Bitcoin and the market hold steady in the long term, LTC could ride the wave to $101 by the end of December.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.