Highlights:

- The Lido DAO price rebounds to $0.98, marking 5% gains.

- The Lido V3 and Chorus partners are expanding institutional ETH staking.

- LDO funding rate turns positive as bulls target 41.16 resistance.

The Lido DAO price is upholding a bullish outlook, up 5% to $0.98 at press time. The daily trading volume has notably increased by 4% indicating an increase in trading activity. The Ethereum-based liquid staking protocol’s native token fades in the atmosphere of increased volatility in the rest of the cryptocurrency market. It is backed by positive news concerning the activation of the Lido V3 final testnet.

Lido has worked with Chorus One, where Lido V3 and stVaults are used to offer more institutional-focused products as far as ETH staking is concerned. This partnership, as presented in their recent case study, allows Chorus One to provide security, flexibility, and capital efficiency that institutional clients require. Using the infrastructure of Lido, Chorus One has created a system that integrates the liquidity of stETH and the autonomy of vaults and provides a powerful base to stake eth stamps on a large scale.

Case Study: How @ChorusOne uses Lido V3 & stVaults to build institutional ETH staking products.

A look at how Chorus One combines security, flexibility, and capital efficiency for institutional clients through vanilla and looped staking strategies.

— Lido (@LidoFinance) October 14, 2025

This is essential to high-cap investors and institutions aiming to utilize the staking potential of Ethereum. Chorus One makes the sophistication of an institutional-level staking less complex. This is enabled by enabling its clients to stake and manage their assets through a platform called Lido V3. In this process, stVaults also simplifies the process and provides individualized solutions that address the demands of institutional participants within the Ethereum ecosystem.

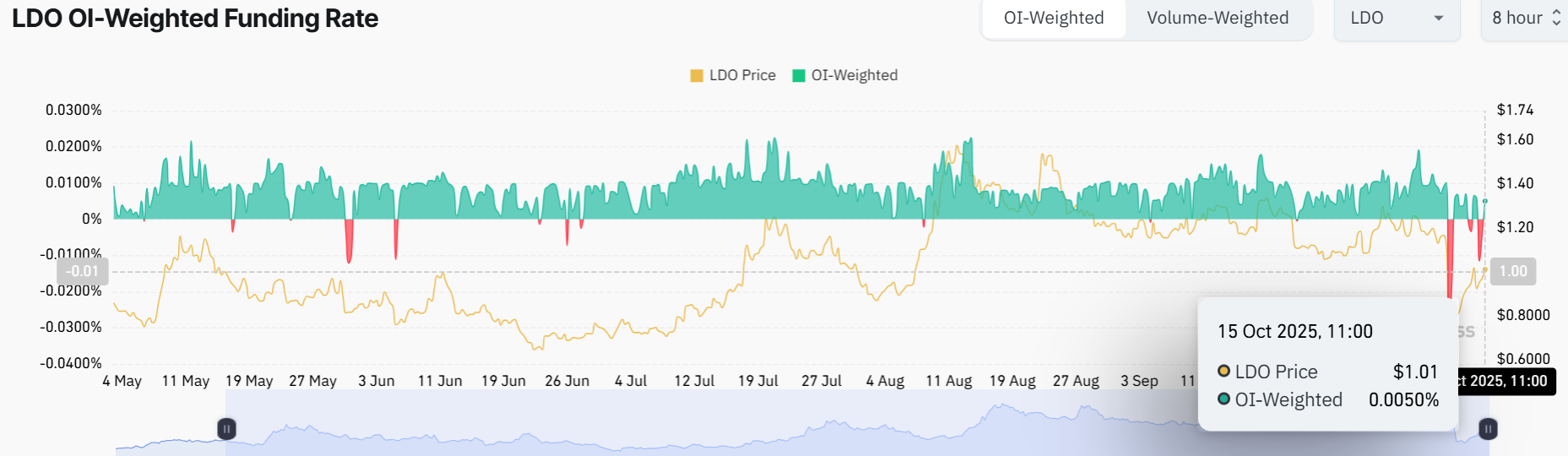

LDO Funding Rate Turns Positive

Meanwhile, there is an increasing hype around LDO after a flash crash last week. It reversed the OI-funding rate to an exceedingly negative level of -0.0307. The flash crash caught traders off guard, resulting in a number of them recording losses due to large-scale liquidation.

The data on the on-chain metrics, CoinGlass, indicates that the LDO OI-weighted funding has regained its position, with an average of 0.0050% at the time of writing. As sentiment turns positive, it implies that traders are piling into long positions, anticipating that the Lido DAO price will rise past $1.16 resistance.

Lido DAO Price Targets a Breakout Above $1.16

The LDO/USD chart shows the token on a daily timeframe. Right now, it is hovering around $0.98, with the immediate resistance at $1.16, aligning with the 50-day SMA. Meanwhile, the 200 SMA is at $0.94, indicating that the Lido DAO price is riding a long-term trend. The chart also shows a descending triangle setup from which the price broke out and hit a low of $0.73.

However, trouble is brewing as the Relative Strength Index (RSI) is 1sitting below the 50-mean level at 43.13. This shows a tug-of-war, as the bears and bulls struggle to take control. Looking at the big picture, if Lido DAO price keeps rising, the next major target is the resistance level around $1.16. This is where the price could face some selling pressure.

If there’s a pullback, strong support levels are likely near $0.94 area, where buyers may step back in. Traders should watch how the price reacts near the $1.61 resistance. If bulls break above it, the rally could continue even further towards $1.65.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.