Highlights:

- John Deaton has debunked a report claiming the SEC defined roles for XRP, SOL, and ADA in the US.

- The XRP lawyer said the document was not from the SEC.

- Deaton’s statement implies that XRP, Solana, and Cardano’s future remains uncertain.

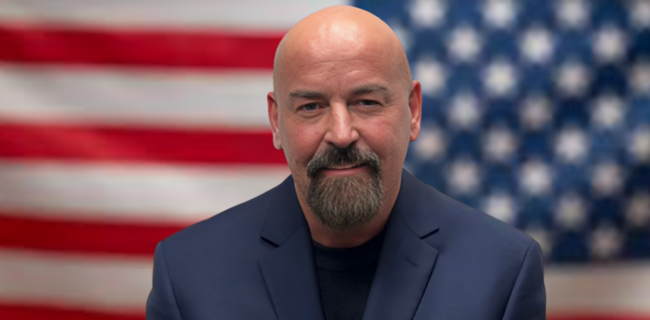

On March 14, posts on X claimed the United States Securities and Exchange Commission (SEC) had specified roles for XRP, Solana (SOL), and Cardano (ADA) under President Trump’s administration, sparking widespread reactions among crypto enthusiasts. XRP lawyer John Deaton, however, quickly debunked the story.

In a recent tweet, Deaton dismissed the report, saying the SEC never issued such a statement. Deaton’s remarks leave the roles of XRP, SOL, and ADA unclear despite their inclusion in the US Crypto Stockpile. Earlier this month, Trump signed an Executive Order establishing a Strategic Bitcoin Reserve and a US Crypto Stockpile.

The order allows expanding the Bitcoin reserve using seized assets and budget-neutral purchases. However, the stockpile will only hold assets seized in civil cases. This arrangement has sparked debate among industry leaders, with many frustrated about the uncertain role of altcoins in the stockpile.

Alleged XRP, SOL, and ADA Role Clarifications

According to the debunked report, XRP will handle state-level financial transactions. It will also enhance government payment systems and interstate liquidity. Solana will be used for rapid blockchain transactions, including real-time government databases, secure voting mechanisms, and digital identity management.

Cardano was deemed best suited for academic credentials. It will also be employed in smart contracts for government services and secure infrastructure management. Overall, Solana and Cardano will be integrated into the US Digital infrastructure to boost efficiency and security for state applications. On its part, XRP will remain the main asset for financial transactions.

EVERYONE:

The @SECGov did not release any such thing. https://t.co/PbRoMZbe6A

— John E Deaton (@JohnEDeaton1) March 14, 2025

Crypto Community Reacts to Deaton’s Clarification

Like the initial tweet about the proposed roles of XRP, SOL, and ADA, Deaton’s follow-up post also attracted significant attention. At the time of press, it has garnered over 148K views, with numerous likes, retweets, and shares. Many X users appreciated the lawyer for clarifying the situation. Others expressed concerns about the surge in unverified news flooding the crypto space.

Fellow XRP lawyer Bill Morgan replied to Deaton’s tweet, saying, “Where does it come from? Endless false information.” Such developments highlight why traders must verify every piece of information on the crypto space to avoid costly investment mistakes.

Where does it come from. Endless false information.

— bill morgan (@Belisarius2020) March 14, 2025

Industry Leaders Remain Divided on XRP, SOL, ADA’s Roles as Stockpile Assets

Since Trump signed the Executive Order establishing the Bitcoin reserve and digital assets stockpile, industry leaders have remained divided on the rationale for selecting XRP, Solana, and Cardano as stockpile assets. Cardano’s founder, Charles Hoskinson, and Ripple’s Chief Executive Officer (CEO) Brad Garlinghouse, have praised the US president’s initiative, calling it a step in the right direction.

However, despite Solana’s inclusion in the planned reserve, its co-founder Anatoly Yakovenko criticized the proposal, warning it could undermine decentralization. He suggested other reserve approaches that would yield better results for the US. Yakovenko argued that state-owned reserves would help prevent economic damage that could result from the federal government’s mistakes. He also called for objective and measurable criteria to determine digital assets’ inclusion in the reserve. He stressed Solana should only be added to the reserve if it meets the objective criteria.

My reserve order of preference

1. No reserve, because if you want decentralization to fail you’d put the government in charge of it.

2. Or states run their own reserve as a hedge against the fed making a mistake

3. Or if there has to be a reserve, it’s based on objectively… https://t.co/LfYXCIeRnG

— toly 🇺🇸 (@aeyakovenko) March 6, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.