Toncoin price has fallen by 1.7% in the past 24 hours, with TON/USD exchanging hands at $5.72 at press time. Despite the plunge, TON is now up 2% in a week but has lost 15% in a month, although the cryptocurrency retains a healthy 129% gain in a year. Moreover, its 24-hour trading volume has plummeted 17% to $256 million, suggesting a recent fall in market activity.

Meanwhile, Bitget and Foresight Ventures have revealed a strategic investment of US$30 million in TON tokens, promoting the entry of more potential dApps into the market.

Bitget and Foresight Ventures jointly announced a strategic investment of US$30 million in TON token, which will be achieved by purchasing discounted TON tokens. They will be deeply involved in the governance and future development planning of the TON ecosystem, and will promote…

— Wu Blockchain (@WuBlockchain) September 18, 2024

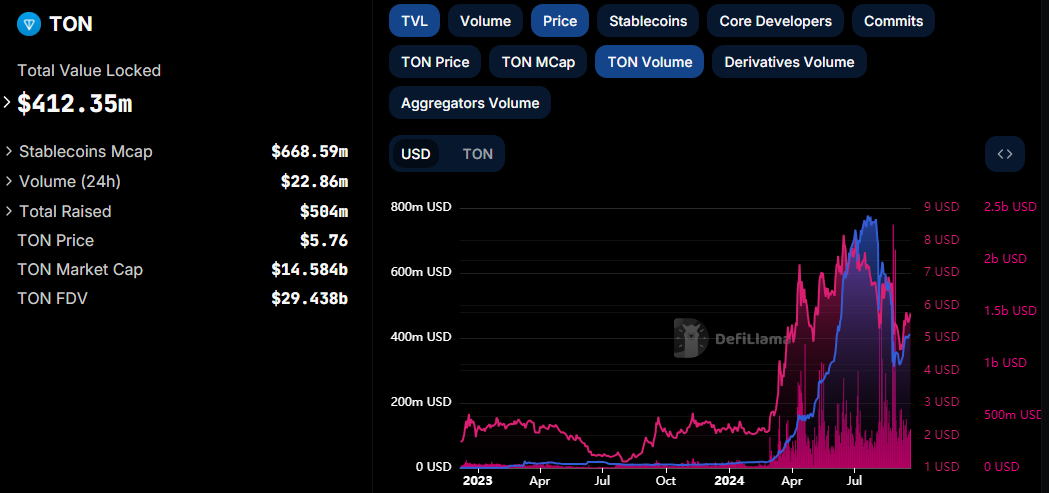

The TON token is valued at $5.76. This represents an 8% gain in the past 24 hours following the Fed’s rate cut, which saw TON’s price climb to $5.76. As per DefiLlama data, investors are showing a growing interest in Toncoin, reflected by the spike in its market’s TVL from $348 million at the end of August to $412 million. An increase in TVL shrinks the potential selling pressure, allowing the TON price to rally in the coming days.

Toncoin Statistical Data

Based on CoinmarketCap data:

- TON price now – $5.72

- Trading volume (24h) – $256 million

- Market cap – $14 billion

- Total supply – 5.11 billion

- Circulating supply – 2.53 billion

- TON ranking – #9

Technical Information Paint a Bullish Picture in TON Market

Toncoin’s technical outlook has turned bullish following the token’s rebound from support at $5.42. Bulls and bears waged a fierce tug-of-war between this support and the resistance at $5.70. However, the bulls seem to be victorious. This has resulted in forming a cup-and-handle technical pattern suggesting a potential uptrend soon.

Nonetheless, after TON reclaimed the 50-day Simple Moving Average (SMA) (green) and the 200-day SMA (blue), turning them into immediate support levels, momentum rallied behind the telegram-based cryptocurrency, propelling the price above the $5.70 hurdle. Moreover, rising above the seller congestion at $5.60 – a confluence level formed by the 50-day SMA may trigger a strong leg up, pushing the TON price to $7.

Key indicators such as the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) also support the bullish outlook. The MACD spots a buy signal, while the RSI shows that the uptrend is stronger.

Currently, the RSI sits at 58, tilting the odds in favor of the buyers. Moreover, if the buyers keep adding to their position, the RSI could rise as there is potential room for the upside before TON is considered overbought.

The Moving Average Convergence Divergence (MACD) indicator upholds the bullish outlook and hints at the uptrend reaching higher than $7. The buy signal is manifested as the blue MACD line flipped above the orange signal line, suggesting that traders can hold long positions in TON. Traders are inclined to continue buying TON unless the trend in the MACD changes.

Toncoin Price Outlook

The Toncoin price in the 4-hour chart above paints a bullish picture, calling for traders to rally behind TON. The TON price holding above bullish key indicators such as the 50-day and 200-day SMA implies that Toncoin has a higher chance of extending the uptrend than retracing to lower support areas. On the upside, increased buying pressure would see TON reach the $7 mark in the short term.

Conversely, the TON price could plunge if the bears step in and the whole crypto market turns negative. In such a case, the $5.40 support level would act as a cushion against further losses.