The Solana price is moving bullishly with the rest of the crypto market, led by Bitcoin and Ethereum. Solana’s price has climbed 2% in the past 24 hours, with the SOL/USD trading at $135. Moreover, the crypto sector has surged by 2%, with BTC and ETH up by 2% and 1% respectively.

Meanwhile, according to data from DefiLlama, SOL’s Total Value Locked (TVL) indicated an upswing of up to $4.77 billion. This surge in TVL suggests that traders and investors are venturing funds into the platform. This might lead to increased liquidity, causing Solana’s price to surge.

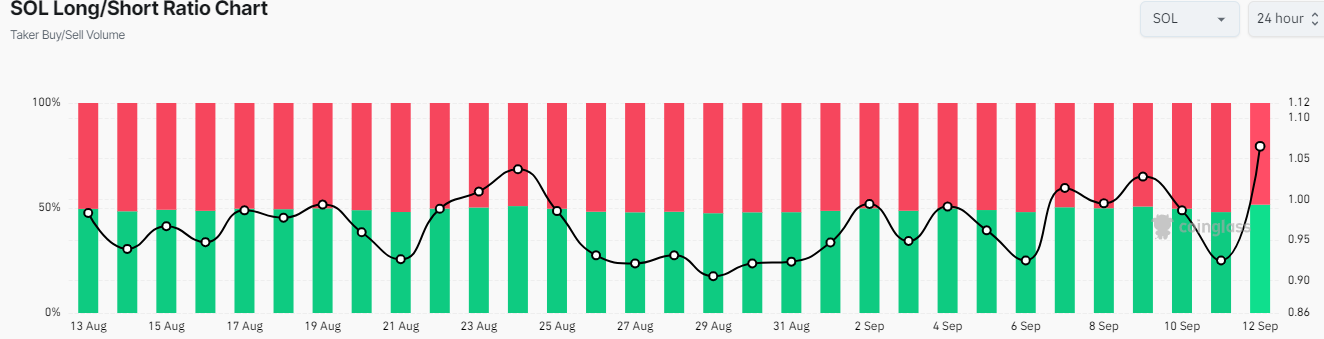

Moreover, Coinglass data suggests that the bulls have gained momentum, as Solana’s price has crossed above the borderline. Solana’s Long/Short Ratio has skyrocketed above 1, currently at 1.06. This ratio is a barometer of investor expectations; in this case, investors are highly bullish. This means that if the reading rises above 1, the average open position is bullish, while a reading below the value suggests a bearish stance.

Solana Statistical Data

Based on CoinmarketCap data:

- SOL price now – $135

- Trading volume – $2.02 billion

- Market cap – $63 billion

- Total supply – 584 million

- Circulating supply – 467 million

- SOL ranking – #5

Solana Price Rises 12% Above Its Range Low of $121: Is $160 Within the Reach?

Over the past few days, Solana’s price has witnessed significant volatility. However, despite that, the Solana price has experienced a rebound, as it is looking for a bullish reversal in the market. Will the bulls sustain the bullish momentum and trigger a strong leg up?

The Solana price is trading with a bullish bias, standing about 12% above its range low of $121.32. The odds continue to favor the upside, supported by multiple technical indicators. To begin with, the bulls have flipped the 50-day Simple Moving Average (SMA) into support at $130. Currently, they are eyeing the next resistance at $141, which, if conquered, might trigger a bullish reversal.

The Relative Strength Index (RSI) is above the mean level of 50, showing rising momentum. Its position at 58 shows there is still more room to the north before SOL can be considered overbought.

The Moving Average Convergence Divergence (MACD) is also in positive territory, still above the signal line. This indicates buyer momentum exceeds the selling pressure. Traders are at liberty to keep their long SOL positions intact, bolstered by the bullish outlook from the MACD indicator. If the bulls flip the $141 resistance into support, bulls could seize the opportunity to push the Solana price to $160 in the short term.

Will the Bulls Sustain the Momentum?

The Solana price upholds a bullish picture, with the odds tilting in favor of the buyers. If the bulls keep adding to their positions at this level, the SOL price could surge. To the upside, if the $130 support holds, the bulls could flip the next resistance at $141 into support. The SOL price could reclaim its $160 mark in such a case.

Conversely, Solana could drop if the $130 support level breaks. This will see the SOL price retest the $126 range, which may be a cushion against the downside. Nevertheless, the bullish sentiment for the SOL price would only be invalidated below the $121.32 support. Such a move would notably signal a change in market structure.