Highlights:

- IMF and El Salvador are on the verge of reaching an agreement under the EFF.

- The IMF stated that several factors have contributed to El Salvador’s economic growth.

- El Salvador is also seeking a $1.14 billion loan under the EFF program.

The International Monetary Fund (IMF) has confirmed that talks with El Salvador have progressed smoothly. In an official statement on December 22, the IMF noted that after months of in-person and virtual meetings with Salvadoran officials, both parties are on the verge of reaching a staff-level agreement under the country’s 40-month Extended Fund Facility (EFF).

According to the IMF, El Salvador’s economy has grown significantly, driven by stronger public trust and steady investment. The IMF also predicted that El Salvador’s Gross Domestic Product (GDP) could reach 4% this year, with continuous expansion expected in 2026.

The IMF and El Salvador continue negotiations on the second review of the EFF program. The 🇸🇻 authorities’ remain committed to addressing imbalances and further discussions are expected with the aim of reaching staff-level agreement on the program. https://t.co/YYUPcmerH0

— IMF (@IMFNews) December 22, 2025

Budget Deficit Cuts and Reform Policies

Aside from economic growth, the IMF noted that the El Salvador government has remained committed to reducing its budget deficit. This has positioned the country to meet its fiscal targets for 2025. The recently approved 2026 budget supports further deficit cuts and has increased spending on social programs. These steps will help reduce local borrowing, aligning with the IMF targets.

The IMF also highlighted steady progress on reform policies. The El Salvador government has released a pension study and a medium-term fiscal plan for long-term budget control. Additionally, new financial regulations have been approved to strengthen banks and safeguard deposits. Meanwhile, updated Basel III rules have been adopted to improve liquidity and funding stability. Lawmakers have also passed a new anti-money laundering law, bringing El Salvador closer to global standards.

El Salvador Continues to Buy BTC Despite Earlier Agreement to Pause Purchase

Bitcoin remains a strong area of interest in discussions between the IMF and El Salvador officials. The IMF said negotiations to sell the government’s e-wallet, Chivo, are at an advanced stage. Meanwhile, El Salvador is seeking to secure about $1.14 billion under the EFF program. The IMF added that it is collaborating closely with the government, including President Nayib Bukele, to push the loan program forward.

El Salvador continues to expand its Bitcoin reserves despite ongoing IMF talks highlighting transparency and security concerns. The government plans to sell the troubled Chivo wallet while maintaining aggressive BTC purchases, signaling a bold but contentious crypto strategy amid… pic.twitter.com/WG5laIj7ej

— Fama Crypto (@Famacrypt) December 23, 2025

Earlier this year, El Salvador paused its official Bitcoin buying plan as part of its agreement with the IMF. The nation’s government also agreed to sell the Chivo wallet system, allowing private companies to handle Bitcoin with limited restrictions. Despite this agreement, blockchain data suggests Bitcoin buying has continued. Data from Arkham Intelligence shows the government holds 7,508 BTC.

On November 18, Crypto2Community reported that El Salvador completed its largest single Bitcoin purchase after adopting the asset as a legal tender in 2021. According to the publication, the nation purchased 1,098 BTC, valued at approximately $101.14 million. The country also celebrated the fourth year of its Bitcoin legal tender law on September 7, 2025.

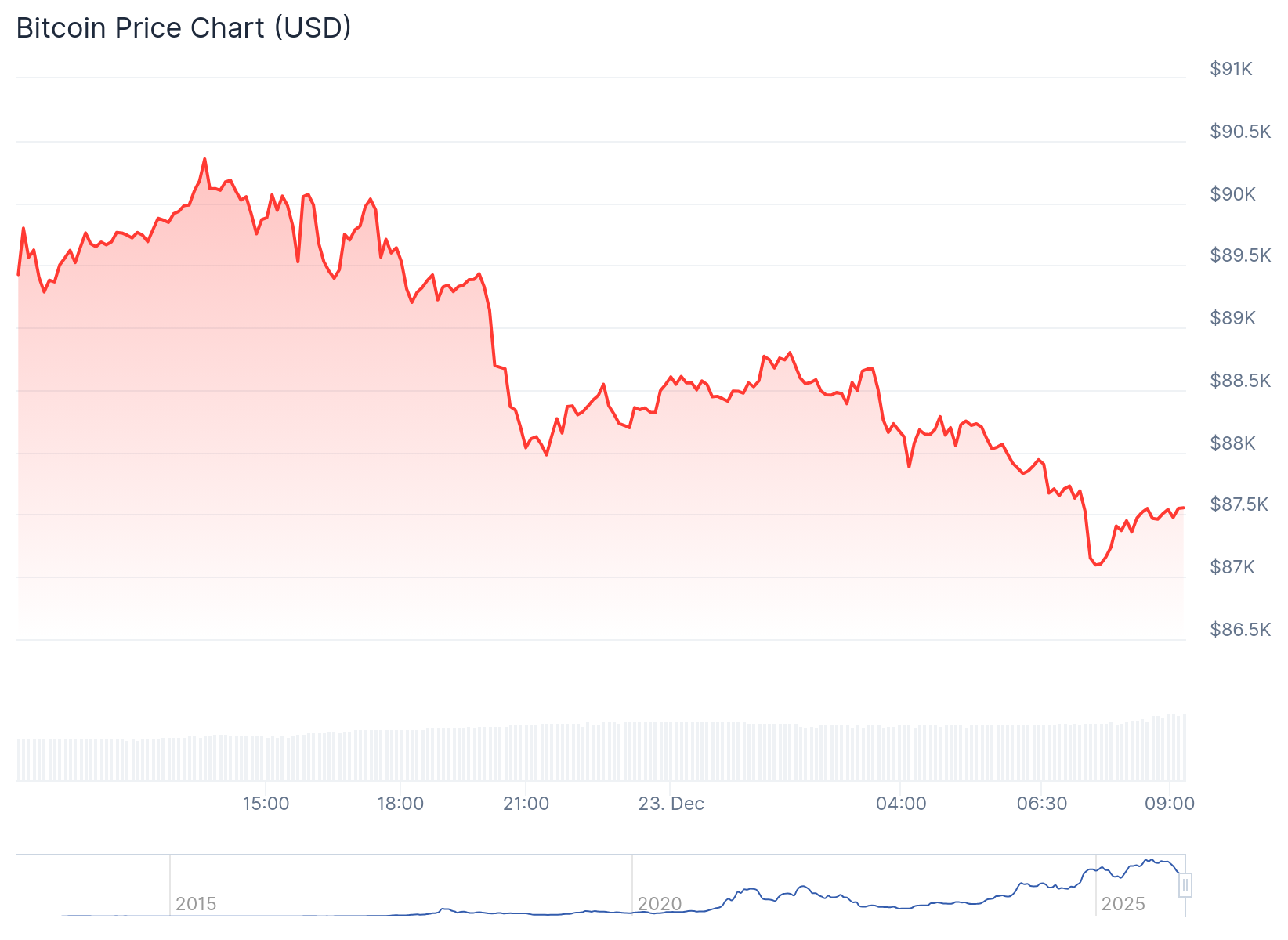

BTC Remains Below $90K Amid Progressing IMF and El Salvador Discussions

At the time of writing, Bitcoin is trading at $87,472 following a 1.9% decline in the past 24 hours, with a market cap of $1.75 trillion and a trading volume of $43.4 billion. In its 14-day-to-date and year-to-date price change variables, BTC dropped 3.1% and 8.5%, respectively. BTC’s supply inflation remains low at 0.85%, while volatility reflects medium at 2.22%.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.