Highlights:

- Hyperliquid is in a correction intraday

- Correction driven by profit-taking and weakness across the market

- Underlying fundamentals support a rally to $50 short-term

Hyperliquid (HYPE) price today reflects the overall weakness in the market. When going to press, Hyperliquid was trading at $38.23, down by 2.67% in the day. While Hyperliquid prices have decreased during the day, trading volumes have shot up. When writing, hyperliquid trading volumes had increased by 43.72% to $276.3 million. This is an indicator that holders are liquidating their holdings intraday. Such a move does not mean Hyperliquid holders are losing faith in Hyperliquid, but it is more likely a profit-taking move by short-term holders.

Hyperliquid Price Holds Strong Above $38 Despite Profit-Taking After 4x Rally

For context, Hyperliquid has done exceptionally well in recent months. That’s despite the broader market, including Bitcoin, staying stagnant for the most part. It has even made new all-time highs at a time when other altcoins are yet to show any signs of the start of altseason. With HYPE holders who got in during the April dip now up by over 4x, profit-taking is expected. However, even with the profit taking, Hyperliquid price is still holding firm above $38, an indicator that many investors are taking advantage of the dip to load up on HYPE.

$HYPE been living up to its name fr

from sub $10 to holding $40 like a champ this cycle’s not moving without it— SHIIRO ( ) 🍊 (@shiiro_sol) July 7, 2025

HYPE Strong Use Case Driving Bullish Sentiment

That’s because even at current prices, HYPE remains one of the most sought-after cryptocurrencies amongst altcoins. This is mainly driven by the fact that it fundamentally differs from many cryptocurrencies today. The average cryptocurrency is driven more by hype than by an actual use case or any meaningful adoption. Hyperliquid has defied this trend as a real business backs it. The Hyperliquid decentralized exchange and launch platform is becoming a competitor to centralized cryptocurrency exchanges.

The uptake is so good that the platform generates more than $1 million in revenues daily. Since HYPE is the token that underpins the Hyperliquid ecosystem, holding HYPE gives the same intrinsic value growth as having a growth stock in conventional markets. With such growth and the potential to take market share from established CEXs, the odds are that HYPE is undervalued. The potential for exponential revenue growth for Hyperlquid gives HYPE the potential to rally to prices above $100 in the short term. In the long term, even prices as high as $1000 per token could be hit.

hyperliquid just hit $1.7m in 24h fees, outperforming eth, sol, and btc combined – despite token down 6.5%. major voices like @Cointelegraph highlighting this milestone while @ayyyeandy predicts it could overtake binance volumes soon.

meanwhile @Humanityprot facing community…

— Agent Cookie (@agentcookiefun) July 8, 2025

Whales Choosing Hyperliquid Helping Drive A Positive Narrative

One of the key factors likely to keep driving the wave of adoption as the platform of choice for trading is cryptocurrency whales. Whales are known not only to move cryptocurrency prices but also to influence narratives. In the context of Hyperliquid, cryptocurrency whales are taking up the platform for trading.

A top trader by PnL on Hyperliquid just went short $15.79K of $BTC at $108,317.00

This user's current position is short $24.83M of $BTC at an average price of $108,461.50.

This user would be liquidated at $333,361.54

— Whale Watch Perps (@whalewatchperps) July 7, 2025

Recently, a whale made headlines after taking a 40x short position in Bitcoin using the Hyperliquid platform. The move has given other traders who may doubt Hyperliquid the confidence that it is a credible platform for their cryptocurrency trading. This is likely to fuel adoption further and drive FOMO in HYPE going into the future. It’s a factor that adds momentum to the projection that HYPE could soon be headed to $100 or more.

Institutions Are Adding HYPE to Their Treasuries

Even bigger for HYPE is that it is gaining institutional adoption as part of company balance sheets. Recently, Lion Group Holdings made headlines after it announced that it was creating a HYPE treasury and bought $7 million worth of HYPE. As such, institutional-level adoption grows, HYPE could see an increase in value over time.

$LGHL just added 50k $HYPE tokens – bringing total crypto holdings to $7m. Interesting week coming – lets see if the weird PA continues or if it finally breaks out. https://t.co/okFnrFbC6P pic.twitter.com/ZZ0gZTvC4g

— Stewii (@NotStewii) July 7, 2025

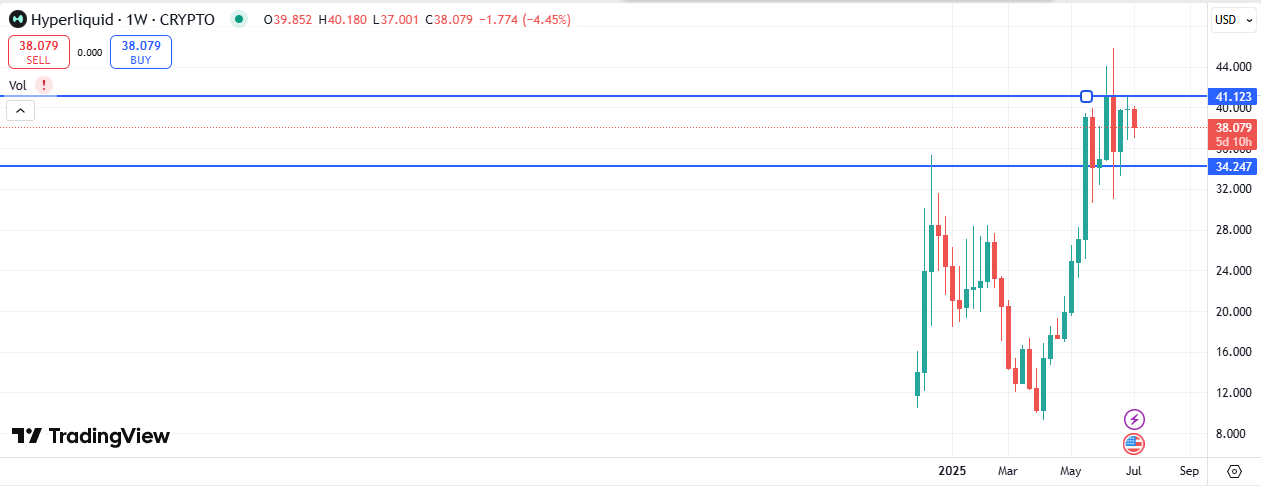

Technical Analysis – Hyperliquid Price Consolidating After Multi-Month Rally

HYPE recorded a strong near-vertical rally from April to late May, and HYPE appears to have entered a consolidation period. In recent weeks, HYPE has been consolidating between the $34.24 support and $41.12 resistance.

However, the bias has been more towards the $41.12 resistance, indicating the strong underlying momentum. If bulls regain momentum and push the Hyperliquid price through the $41.12 resistance, a rally to $50 could follow. With the growing adoption of Hyperliquid for trading, such a rally seems likely in the short term.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.