Highlights:

- Hyperliquid denied insider trading claims after concerns about a wallet shorting HYPE.

- The wallet sold 4,000 HYPE tokens, but the controller left the company last year.

- Hyperliquid stressed zero tolerance for insider trading and reinforced strict trading policies.

Hyperliquid Labs denied insider trading allegations. On-chain activity raised concern over a wallet shorting the HYPE token. The company issued the clarification just days before a key validator vote. The vote could remove nearly $1 billion worth of HYPE from circulation.

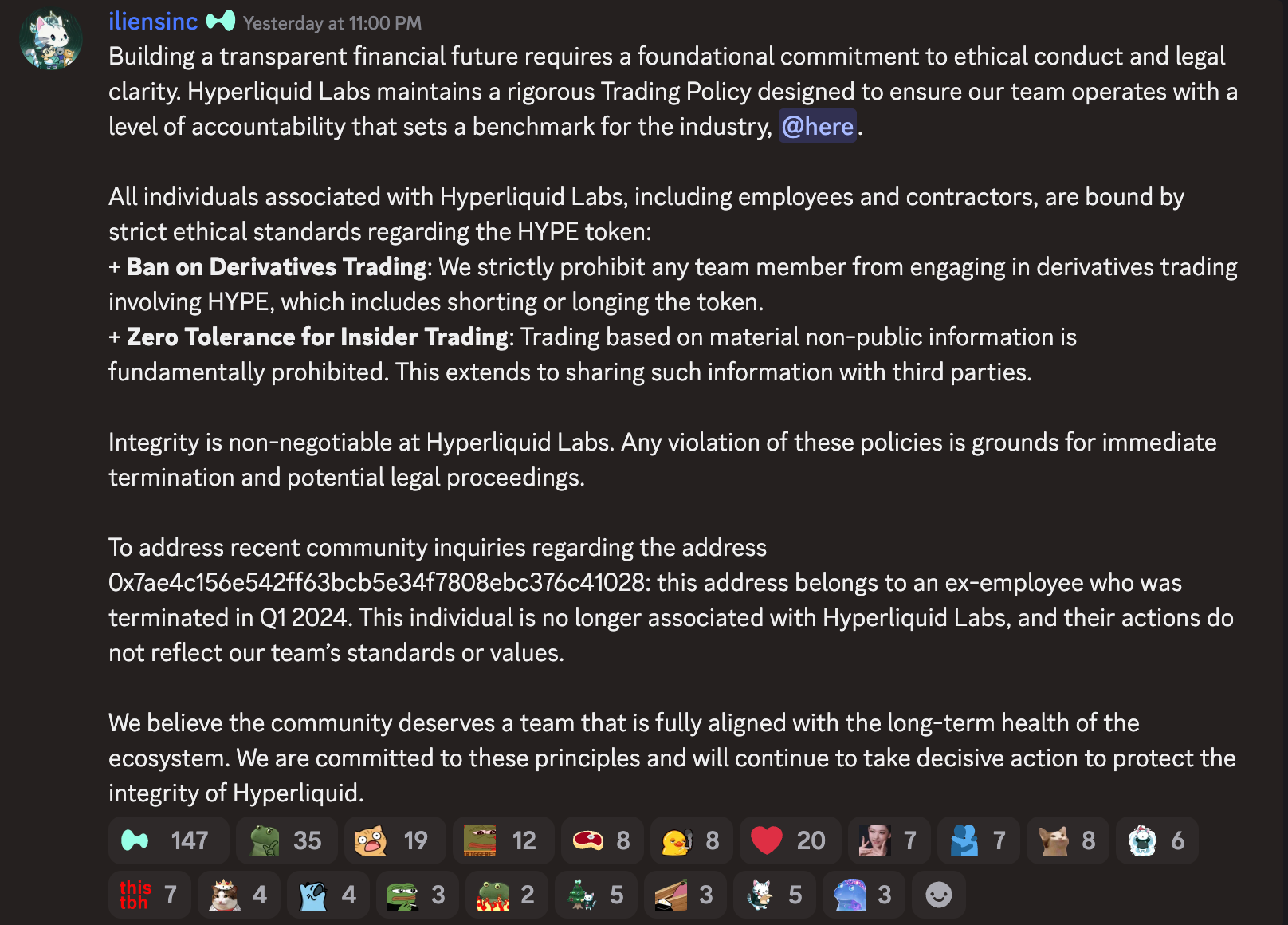

A HyperLiquid team member said on Discord that all Hyperliquid Labs personnel, including employees and contractors, are subject to strict rules on the HYPE token, including a ban on derivatives trading and zero tolerance for insider trading. The team added that the 0x7ae4…

— Wu Blockchain (@WuBlockchain) December 22, 2025

Hyperliquid Clarifies Wallet Controversy and Reinforces Trading Policies

The clarification came weeks after a community member, cobe.hype, claimed the wallet address 0x7ae4c156e542ff63bcb5e34f7808ebc376c41028 belonged to a Hyperliquid team member. The claim followed a sale of about 4,000 HYPE tokens, worth roughly $134,000, in a single day during November. Hyperliquid said the wallet address is not linked to any current employee or contractor. The company confirmed the wallet’s controller left Hyperliquid in Q1 of last year.

This wallet sold a total of ~4k HYPE ($134k) today through TWAP

— cobe.hype (@codeboc_eth) November 30, 2025

Hyperliquid said, “Building a transparent financial future requires a foundational commitment to ethical conduct and legal clarity.” The clarification included Hyperliquid’s trading rules. It explained that all team members are prohibited from trading HYPE derivatives in any form. The company also emphasized its zero-tolerance approach to insider trading. Hyperliquid highlighted that integrity is essential and non-negotiable. Any breach of these rules can result in immediate termination and possible legal action.

Regarding the wallet, the team stated that the individual is no longer associated with Hyperliquid Labs. They added that the actions of this person do not reflect the company’s standards or values. ‘

The statement also stressed the firm’s responsibility to maintain long-term stability in the HYPE ecosystem as the token continues to gain attention. “Integrity is non-negotiable at Hyperliquid Labs,” the team added. “Any violation of these policies is grounds for immediate termination and potential legal proceedings.”

Hyperliquid’s alleged insider trading occurred just as a key governance decision approached. The vote will officially burn all HYPE tokens in the Assistance Fund. It is scheduled to conclude on December 24, a move that could significantly impact the circulating supply.

Hyperliquid Growth and HYPE Price Changes

Founded in late 2022, Hyperliquid quickly grew and became a leader in the perpetual DEX market. In fact, the platform recorded $653 billion in trading volume during Q2 this year, which made up about 73% of the market, according to CoinGecko. This strong performance shows Hyperliquid’s importance, even during periods of market volatility.

Moreover, Arthur Hayes, co-founder of BitMEX, recently called Hyperliquid the “best story” of this cycle. He pointed out that HYPE started at “two or three dollars” last November and later surged to nearly $60. This highlights the token’s rapid growth in both popularity and adoption.

HYPE saw large swings in value throughout this year. For example, it reached an all-time high near $60 in mid-September, but selling pressure soon brought it down. Currently, HYPE trades at $25.22, showing a 10% decline over the past year but still a 287% gain since its launch, according to CoinGecko.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.