Highlights:

- Hyperlane price rises 23% to $0.46, as trading volume soars a whopping 1627%.

- The HYPER derivatives market suggests increased investor confidence, as the volume and open interest surge.

- The overbought RSI could ignite a short-term pullback before the next leg up to $0.63.

The Hyperlane price has surged a whopping 23% to $0.46, as its daily trading volume has increased by 1,627% to $897 million. Hyperlane has emerged as one of the top gainers today, as investor confidence in the market bolsters. Despite its volatility, HYPER appears to be recovering from this period of selling, and the technical indicators suggest that the token may rally higher in the coming days.

$HYPER gradually bouncing back🔥💰 https://t.co/KjLelzjq3t pic.twitter.com/IN4U1wLHLW

— Julius Elum (@JuliusElum) July 24, 2025

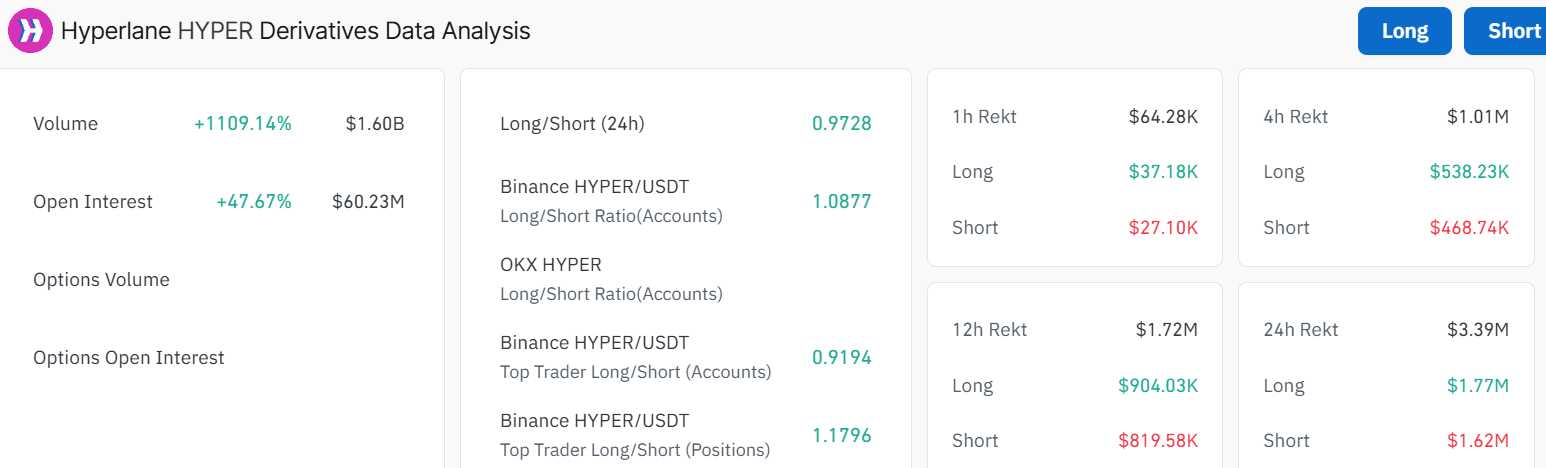

The rise of HYPER has also been accompanied by a significant increase in trade volume, which has skyrocketed to 1,109%, reaching $1.60 billion, according to Coinglass data. Such an increase in volume indicates an increase in investor activity. This comes as many traders view the recent devaluation as an opportunity for accumulation.

The open interest has also increased by 47.67% to $60.23 million. This suggests that traders are showing interest in the derivative market, which in turn exposes the cryptocurrency. The bulls are notably showing strength, as the long-to-short ratio hits 0.9728, aiming at 1.

Hyperlane Price Poised for Further Upside

A quick look at the 4-hour chart reveals that the Hyperlane price is boasting splendid bullish momentum. The bulls have established a key support around $0.3727. Moreover, the immediate support zone at $0.3745, which aligns with the 50-day MA, tilts the odds towards the bulls.

The Relative Strength Index (RSI) is at 77.77, indicating overbought conditions in the Hyperlane price. In such a case, a slight pullback may be imminent, allowing the bulls to sweep through liquidity and offering great entry points. Meanwhile, the rapid RSI momentum shows intense buying activity in the Hyperlane market.

The Moving Average Convergence Divergence (MACD) provides a buy signal. The orange signal line (0.01077) was crossed above by the MACD line (0.02168), and the green histograms are increasing. This suggests that bullish momentum remains in play in the market.

How High Can HYPER Go?

A quick glance at the technical indicators suggests that Hyperlane’s price is currently in overbought territory. This could cause a slight dump towards the $0.3745 support zone, aligning with the 50-day SMA. Further downside will cause the token to revisit the $0.3727 area, cushioning against further downside.

Meanwhile, the volume is solid, up 1627% in the last 24 hours. This signals that, although the RSI is overbought, HYPER may continue higher until buyers become exhausted and profit-taking takes hold. Furthermore, the buy signal from the MACD reinforces further upside.

The recent 23% pump and the key support zone at $0.3745 suggest that the Hyperlane price could rally toward the $0.48-$0.53 resistance zone in the coming days. A break above $0.53 might ignite a run to $0.63 or beyond in the coming weeks. In the meantime, traders will want to keep an eye on that RSI as overbought conditions might force a dip before the next leg up.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.