Highlights:

- The price of Hyperlane has rallied 13% to $0.15 in the past 24 hours.

- Analyst foresees a potential rally to $0.4 in the medium term.

- CoinGlass and technical indicators bolster a bullish outlook, as the bulls target $0.20 soon.

The Hyperlane price is boasting a bullish muscle, spiking 13% to trade at $0.15 in the past 24 hours. Investors’ willingness to buy has gone up, fueled by rising trading volume surging 194% to $30M. This recent spike could push HYPER to new highs during the upcoming days. Moreover, the token has obtained several listings, including Binance, increasing investor adoption.

Hyperlane Price Outlook

Furthermore, the line at $0.15 from the 50-day moving average is key support for those expecting a bullish breakout. If this zone holds steady, the bulls could rally towards higher levels at $0.18 or $0.20 in the coming days. An analyst has highlighted via X that the token would hit $0.4 in the medium term, as $0.17 remains the short-term target.

#HYPERLANE has a short-term price target of $0.17.

I believe it can aim for $0.4 in the mid-term.$TRUMP @elonmusk @cz_binance @binance $TST $SUI $IP $PEPE $SHELL $IP $PI $BTC $VINE $HYPER $ETH $B2 $SXT $QNT $BOOP

— にゃあち🇯🇵 (@cryptoman4545) May 20, 2025

On a 4-hour chart, HYPER is found in a consolidating period, staying within a rectangular channel. The price is now $0.158, close to good resistance levels. Strong buying pressure persists since the RSI gauge is at 67.74, close to overbought levels. In the meantime, further upside may occur before pulling back.

The Moving Average Convergence Divergence indicator is now pointing toward more bullish momentum. This is evident as the MACD line has moved above the signal line. This calls for more buy orders from traders and investors as the green histograms increase in size.

Derivatives Data Reflect Positive Sentiment and Long Positioning

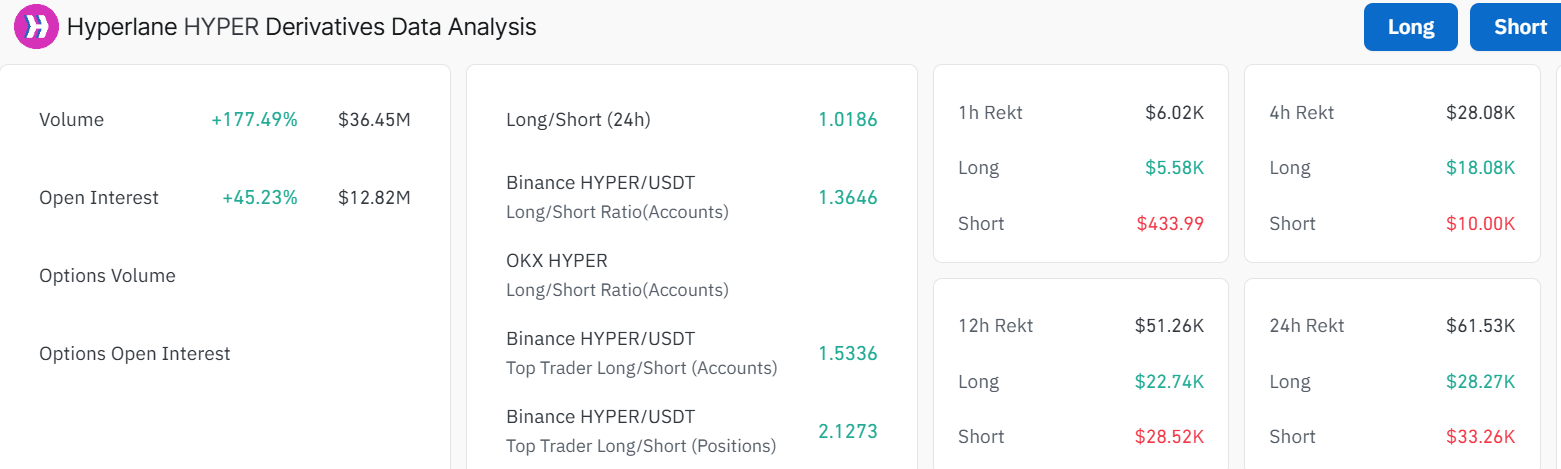

According to Coinglass data, the volume and open interest for HYPER derivatives are seeing significant growth. Volumes have grown by a massive 177%, now standing at $36.45 million, and open interest is up 45% at $12.82 million. Strong activity and higher liquidity on these metrics are positive indicators of how the token will perform.

Further data from the derivatives market confirms a good outlook for HYPER. Out of 443,975 trades over the last day, 1.0186 suggests the market is slightly more bullish now. When looking at Binance, the ratio shows that most of the traders currently expect the price to rise.

Further, OKX data reveals that the number of long positions to short positions is close to 1:1. A similar grow in interest for cryptocurrencies from huge investors and traders suggests confidence among traders. Despite a few cancellations, the market is still mainly set up for gains, as the majority of outstanding derivatives take a long position. Having both a little risk and a lot of optimism could support ongoing growth.

What Traders Should Watch for in HYPER Market

Having both HYPER’s charts and derivatives show the same signal. The Hyperlane price seems set for a possible breakout. Once the price breaks through the $0.16 resistance, there could be a strong rise over the next few days. As long as the market continues to improve, the price might test $0.18 and $0.20 in the short term. If the price action continues, you may see the markets move higher, which can make the cryptocurrency more interesting for traders.

At the same time, traders should be aware of a drop in momentum. Should HYPER drop under the important support of the 50-day simple moving average, it might pull back toward its lower support levels. In such a case, the $0.13 area will be in line to absorb potential selling pressure.

According to recent activity and data on derivatives, HYPER is drawing more positive interest from investors because of strong technical factors. There is a real chance that barring any surprises, the next few days’ price actions could be significant if bullish tendencies remain.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.