Highlights:

- An expert has predicted when Grayscale’s ETHE outflows will wear down.

- Grayscale’s ETHE records outflows for eight consecutive days.

- Bitcoin and Ethereum price changes reflected declines across specific periods.

A renowned expert has predicted that Grayscale’s Ethereum ETF (ETHE) outflows will no longer negatively impact ETH’s market selling price. In a new post on X, McKenna related Ethereum’s ETF sales with Bitcoin’s, drawing discrepancies and subtle similarities.

Following Ethereum ETFs’ unimpressive netflows, there have been growing concerns that the price impacts could be disastrous. However, McKenna’s assertion has projected otherwise. Hence, it invariably disperses market participants’ fears and encourages investments in ETH ETFs.

Brief Overview of Ethereum ETFs Netflows With Emphasis on Grayscale’s

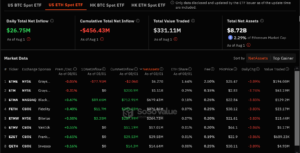

According to the most recent netflows data, Ethereum ETFs have witnessed five days of outflows against three days of inflows. On its part, Grayscale’s ETHE has recorded only outflows for eight consecutive days, compounding ETH ETFs’ poor run.

Despite recording $26.7 million losses in its August 1 statistics, Ethereum ETF’s total net inflow still read losses of about $456.43 million. The total net asset was $8.72 billion, representing 2.29% of Ethereum’s $363.3 billion market cap, while the total value traded was roughly $331.11 million.

Expert Predicts When Grayscale’s ETHE Outflows Impacts Will Subside

Per McKenna, Grayscale’s ETHE ETFs will wear down after about 50 days of gracing the market space. In his write-up, the expert remarked, “50 days after the ETH ETF launches, the ETHE outflows will no longer matter.” For context, ETH ETF sales started on July 23, implying that a fifty-day timeline will fall within September. Hence, market participants, especially ETH enthusiasts, should anticipate Ethereum’s rally around September.

Comparison Between Grayscale’s ETHE And Bitcoin’s GBTC

Aside from projecting when Grayscale’s ETHE outflow impacts will reduce, McKenna also compared ETH’s ETHE and Bitcoin’s (BTC) Grayscale’s Bitcoin Trust (GBTC). For context, both ETHE and GBTC have been registering outflows consistently.

In the most recent netflow statistics, ETHE witnessed $78 million in outflows, culminating in total negative netflows of roughly $2.055 billion. Similarly, GBTC’s latest data revealed $71.3 million in losses, summing up total losses of about $19.013 billion.

According to the expert, ETHE outflows are happening more rapidly than GBTC. Consequently, the impact is evident on ETH and BTC’s market actions, with Ethereum suffering more price declines than BTC. Despite the declines, the market expert is confident that Ethereum will bounce back sooner than expected.

50 days after the $ETH ETF launches the ETHE outflows will no longer matter.

Note ETHE outflows are happening much faster than GBTC and market has become more efficient at pricing this dynamic in.

Even though ETH remains at $3150. Up Only soon. pic.twitter.com/IJTybCEEwu

— McKenna (@Crypto_McKenna) August 2, 2024

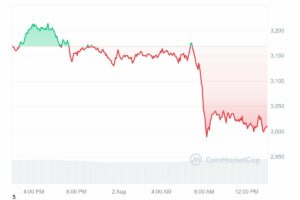

ETH Vs. BTC Price Readings – Ethereum Suffering More Declines

At the time of writing, ETH is changing hands at about $3,000, reflecting a 3.5% decline. Ethereum’s price changes across different specific periods have shown only declines, underscoring a marked declining phase. Notedly, ETH’s 7-day-to-date, 14-day-date, and month-to-date variables dropped by about 8%, 14.1%, and 8.8%, respectively.

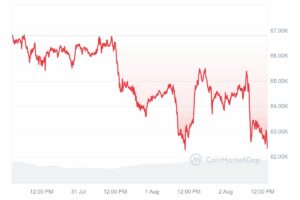

On its part, Bitcoin is selling for about $62,700, reflecting a 1% decline in the past 24 hours. Contrary to Ethereum, only BTC’s 7-day-to-date and 14-day-to-date variables recorded declines. To clarify, they registered declines of roughly 7.2% and 6%, respectively. In its 30-day-to-date index, BTC recorded a 4.5% positive price change.

In summary, the above price statistics might seem unimpressive. However, BTC’s variables were slightly better than ETH’s. ETF sales might have impacted both tokens’ price actions. However, the general market outlook does not appear favorable. Hence, it could be a significant driving factor in ETH and BTC’s price declines.