Highlights:

- Bitcoin historically exits the reaccumulation phase 154 to 161 days post-halving.

- Analyst suggests Bitcoin is in a breakout window this week.

- September’s gains surpass 2016, signaling a strong performance for Bitcoin.

In a recent post on X, analyst Rekt Capital noted that in past cycles, Bitcoin (BTC) has historically exited its reaccumulation phase between 154 and 161 days after the halving. The latest BTC halving event occurred on April 20, marking 157 days. Rekt Capital pointed out that Bitcoin is now within the potential breakout window.

Rekt Capital said:

“History suggests it is ‘breakout time’ for Bitcoin.”

Bitcoin Breakout Imminent as Historical Patterns Suggest Strong October Ahead

In 2016, BTC broke out of its accumulation phase 154 days after the halving, and in 2020, the breakout occurred 161 days later. The analyst emphasized that while history doesn’t repeat exactly if this cycle follows previous patterns, Bitcoin could break out from its reaccumulation range within the next few days, possibly this week.

He stated:

“Then Bitcoin should be breaking out from its re-accumulation range in the next handful of days, this week.”

The analyst also analyzed historical returns, highlighting that September is typically bearish for Bitcoin, while the fourth quarter tends to bring stronger gains. However, on Sept. 21, he remarked, “Who would’ve thought Bitcoin would achieve its highest-ever average return for September in this cycle?”

BTC has gained approximately 9% this month, surpassing its second-best September performance in 2016, when it saw a 6% rise. Additionally, nine out of the last eleven October have delivered positive returns for Bitcoin, with notable bull market months like October 2017 and 2021 showing gains of 48% and 40%, respectively.

Historically, Bitcoin has broken out from its ReAccumulation Range 154-161 days after the Halving

It is 157 days after the Halving now

History suggests it is "Breakout Time" for Bitcoin$BTC #Crypto #Bitcoin https://t.co/Ydqlu4JKSf pic.twitter.com/CwRvUYnHW0

— Rekt Capital (@rektcapital) September 23, 2024

BTC Could Reach New All-Time High in Q4 2024: 10x Research

Cryptocurrency research firm 10x Research predicts that Bitcoin could hit a new all-time high in the fourth quarter of 2024. Markus Thielen, founder and CEO of 10x Research, noted that the chances of a significant breakout increase as we enter the October-to-March period. The report indicates that this trend could repeat this year, particularly given the market cycles observed in 2014, 2017, and 2021.

The report highlights several external factors that could impact Bitcoin’s end-of-year performance. Increased liquidity is expected to boost bullish momentum. Key macroeconomic elements, such as Federal Reserve interest rate decisions, inflation, and the upcoming US election, may influence BTC’s price.

Additionally, the bankrupt crypto exchange FTX plans to distribute $16 billion to creditors. Analysts believe this liquidity could flow back into Bitcoin and the wider crypto market, potentially igniting significant activity.

While several bullish factors exist for BTC, the report advises caution due to the asset’s history of experiencing up to 70% drawdowns in past cycles. 10x Research emphasized that BTC needs to retest two key levels before confirming the prediction.

Thielen wrote:

“The two key levels to watch for Bitcoin are the previous cycle high of $68,330 and the 21-week moving average. Dropping below the moving average could signal the end of the current cycle, while breaking above it— especially if the previous cycle high comes into play — could indicate an extension.”

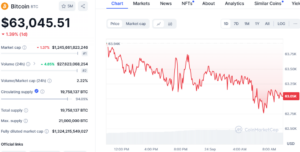

Bitcoin has been moving sideways for the past six months but needs to surpass its previous high of $73,738 to enter a new price discovery phase. Currently, it is just 13% below that level. As of writing, BTC is down 1.4% in the past 24 hours, trading at $63,045, according to Coinmarketcap. It reached a monthly high of $65,600 on Sept. 23.