Highlights:

- Helius Medical has purchased 760,190 SOL tokens for $167 million.

- The company purchased the tokens at an average price of $231 per token.

- Helius Medical still holds over $300 million in cash after the purchase.

Neurotech firm Helius Medical Technologies, Inc. has acquired its first set of Solana (SOL) tokens with a new investment worth $167 million. The company announced the purchase in a press release on September 22, 2025, noting that it now holds 760,190 SOL acquired at an average price of $231 per token.

Despite spending over $160 million, Helius Medical still holds $335 million in cash, which it plans to use to drive its Solana-focused treasury. Overall, the purchase reflected the company’s strong faith in the Solana ecosystem and its long-term potential as a sustainable store of value.

Helius Medical Technologies (NASDAQ: HSDT) announced the purchase of over 760,000 SOL at an average price of $231, totaling approximately $167 million. The acquisition is part of its $500 million digital asset treasury strategy led by Pantera Capital and Summer Capital. The…

— Wu Blockchain (@WuBlockchain) September 22, 2025

Reacting to the purchase, Cosmo Jiang, Helius Medical Board Observer and Pantera Capital’s General Partner, expressed excitement over the move. He also praised the company’s team for purchasing SOL at discounted prices and still retaining part of the initial capital for more opportunistic acquisitions. Meanwhile, Joseph Cheers, Helius Medical’s Executive Chairman, appreciated the support from stakeholders across many crypto projects, including the Solana ecosystem, staking providers and Decentralised Finance (DeFi) protocols.

The Executive Chairman added:

“We take our responsibility to maximise shareholder value seriously and are eager to execute against our plan.”

Initial Fundraising to Back Helius Medical Solana-Based Treasury

On September 15, Helius Medical announced its plans to establish a Solana-focused treasury. The initiative will leverage funds from capital market raises to generate steady on-chain yields. The company also disclosed the pricing of an oversubscribed private investment in public equity (PIPE) offering as part of fundraising efforts to drive its SOL acquisitions.

The PIPE financing deal was expected to close on September 18, 2025, raising over $500 million, with the possibility of bringing in an additional $750 million through stapled warrants exercisable within three years. Helius Medical pegged its common stock and pre-funded warrants at $6.81 per share. On the other hand, stapled warrants will be exercisable at $10.134 for three years.

🚨BREAKING: Helius Medical Technologies, Inc. (Nasdaq: HSDT) announced an oversubscribed $500M PIPE led by @PanteraCapital and Summer Capital to launch a Solana treasury company. The vehicle includes $750M in stapled warrants, with potential to scale above $1.25B. pic.twitter.com/VxAXgDp44d

— SolanaFloor (@SolanaFloor) September 15, 2025

Summer Capital and Pantera Capital led the PIPE round, with support from other high-quality investors, including FalconX, Big Brain Holdings, Animoca Brands, Republic Digital, Avenue SinoHope, Arlington Capital, HashKey Capital, Aspen Digital, Borderless, and Laser Digital.

With the capital realized from the PIPE round, Helius Medical plans to significantly scale its SOL holdings over the next 1 to 2 years. The company also plans to raise more capital by incorporating at-the-market (ATM) programs and other proven fundraising strategies.

In addition, Helius Medical intends to pursue staking and lending opportunities, aiming to generate yields while maintaining a conservative risk profile. Overall, the neurotech firm will uphold transparency by providing regular updates on matters relating to its SOL acquisition strategy.

The company’s Executive Chairman stated:

“Our thesis is that all capital markets transactions, from tokenisation to payments, are moving onto blockchain rails, and Helius aims to bridge public markets with the Solana network, where we expect the majority of that activity to take place.”

SOL Slips Slightly Despite Token Accumulations

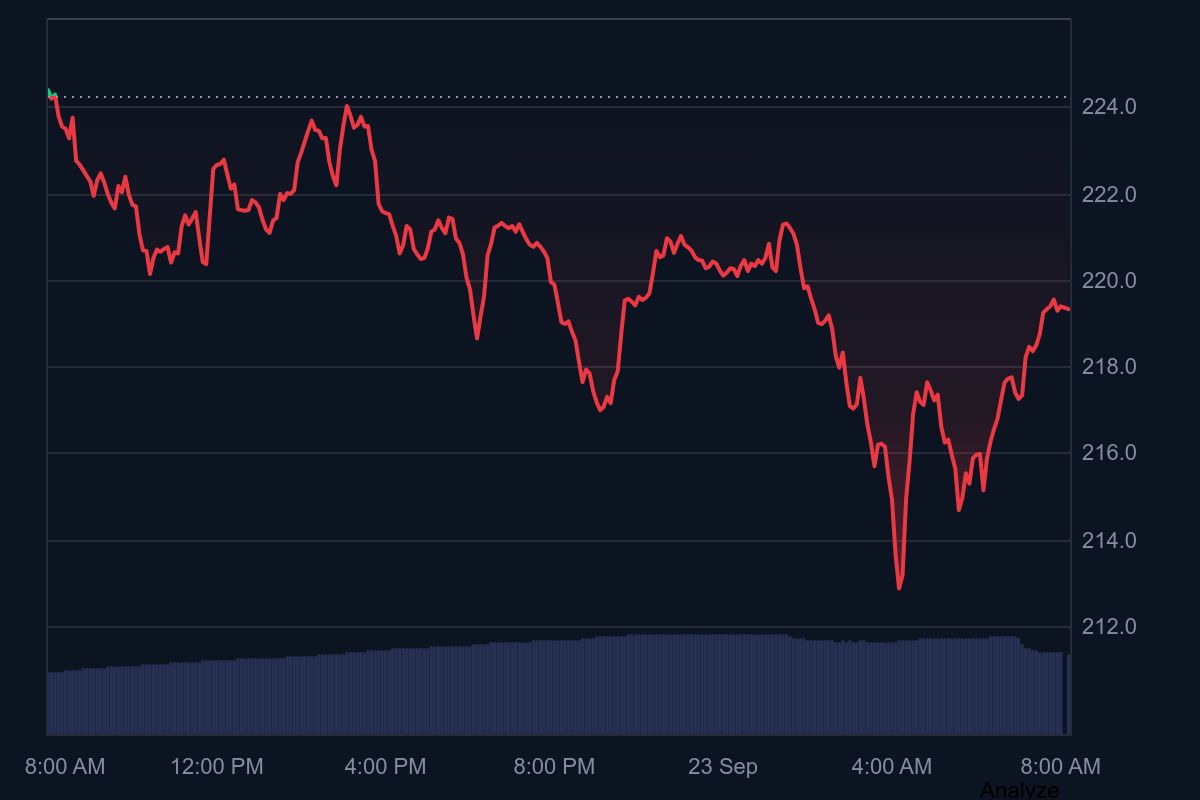

Solana is changing hands at about $219, following a 2.3% decline in the past 24 hours. Within the same timeframe, SOL oscillated between $212.94 and $224.39 with a trading volume of $10.2 billion. Solana’s current price drop tilted its ”Fear & Greed Index” towards fear with a neutral sentiment. Supply and volatility are high at 15.99% and 7.07%, respectively, while dominance is 3.05%.

Beyond its market metrics, Solana has emerged as one of the fastest-growing networks, processing over 3,500 transactions per second. It also leads other blockchains in adoption, averaging roughly 3.7 million daily active wallets and exceeding 23 billion year-to-date transactions.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.