Highlights:

- The price of Hedera spikes 6% to $0.27 as trading volume surges 37%.

- Hedera has garnered significant attention following its mention in a White House report on decentralized finance.

- Technical indicators suggest a breakout to $0.30, and bullish sentiment bolsters.

The Hedera price has surged over the last 24 hours, rising by 6.32% to 0.2744. The volume of trade on a given day increased by 37% to reach $616 million, indicating increased market activity. As a result of the recent surge, HBAR has seen a 13% gain over the last week, in addition to an 83% gain over the last month. This is an indication of high hype in the HBAR market as investor confidence builds.

Hedera (HBAR) has garnered significant attention following its mention in the White House report on the decentralized finance (DeFi) ecosystem. This fact highlights the growing popularity of the blockchain ecosystem, particularly with blockchain networks such as DeFi.

🚨BREAKING: #HEDERA mentioned in a White House Report about DeFi Ecosystem!! 🇺🇸$HBAR to $10 is FUD 🚀🚀🚀 pic.twitter.com/sDRbFjRWXt

— WSB Trader Rocko 🚀🚀🚀 (@traderrocko) July 30, 2025

With growing institutional demand on the Hedera network, market statistics and derivatives indicate its increasing impact on the digital financial flow of global trade. Let us dive into its position in the DeFi sector, including its recent performance and market dynamics.

Hedera Price Poised For a Breakout Above the Consolidation Channel

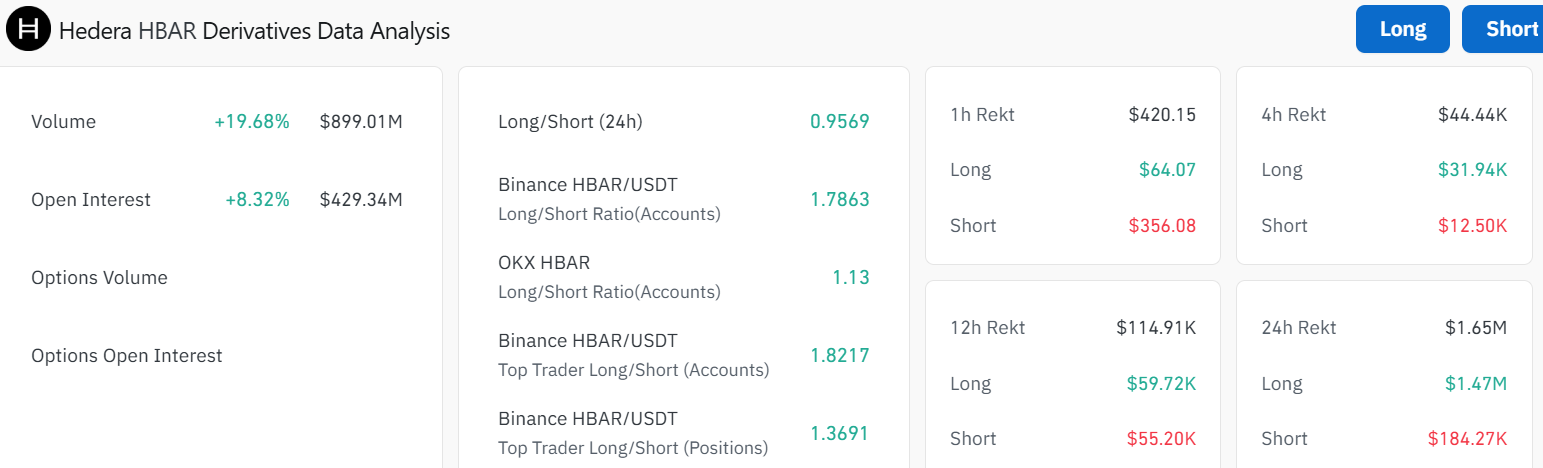

The Hedera derivatives market is active. The market showed a 19.68% increase in volume, with a trading amount of $899 million, indicating increased interest from investors in the market. The open interest has also surged by 8.32%, indicating that traders are positioning themselves to anticipate future price movements. The recent outlook from on-chain metrics indicates a healthy market condition, as the long-short ratio sits at 0.96. This indicates that a balance exists between bullish and bearish traders in the market, despite a slight tendency towards long trades.

The data also shows the market’s instability, as expressed in the liquidation data. Within a 24-hour period, around $1.65 million in liquidations occurred. The longs have taken the lion’s share of $1.47M while the shorts take the rest, totalling $184.27K. This indicates that traders who placed bets against the price movement of Hedera have incurred losses, as the price continues to show an upward trend. Moreover, the long position is strong in the market, and the mood is more positive, as more traders expect further price increases.

The 4-hour chart outlook suggests that the Hedera price has entered a consolidation phase, with the bulls maintaining the upper hand. This is evident as the 50-day SMA ($0.2643) and the 200-day SMA ($0.2155) are acting as immediate support zones, tilting the odds in favor of the bulls. Hedera price dynamics indicate a favorable market mood with a clear trend of growth in demand for its decentralizing services.

HBAR’s Relative Strength Index (RSI) is at 56.01, indicating that it is not yet overbought. Moreover, there is more room for the upside before the token is considered overbought. The Moving Average Convergence Divergence (MACD) is indicating bullish momentum, as the MACD line (-0.0019) has crossed above the signal line (-0.0021). The histogram is turning green as well, a sign of increasing bullish momentum

HBAR Bulls Eye $13% Gains in the Short-Term

There are several supports at $0.2155 (200 SMA) and $0.2643 (50 SMA), which have held strong. With Hedera mentioned in President Trump’s official White House Crypto Announcement titled “American Leadership in Financial Technology,” traders are betting on a dovish outcome, which could lead to increased volatility.

In the short term, the Hedera price may test $0.30463, marking a 13% gain, especially if volume spikes. Long-term, if it breaks past the ATH, the crypto might soar to the $0.40-$0.50 target by mid-August.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.