Highlights:

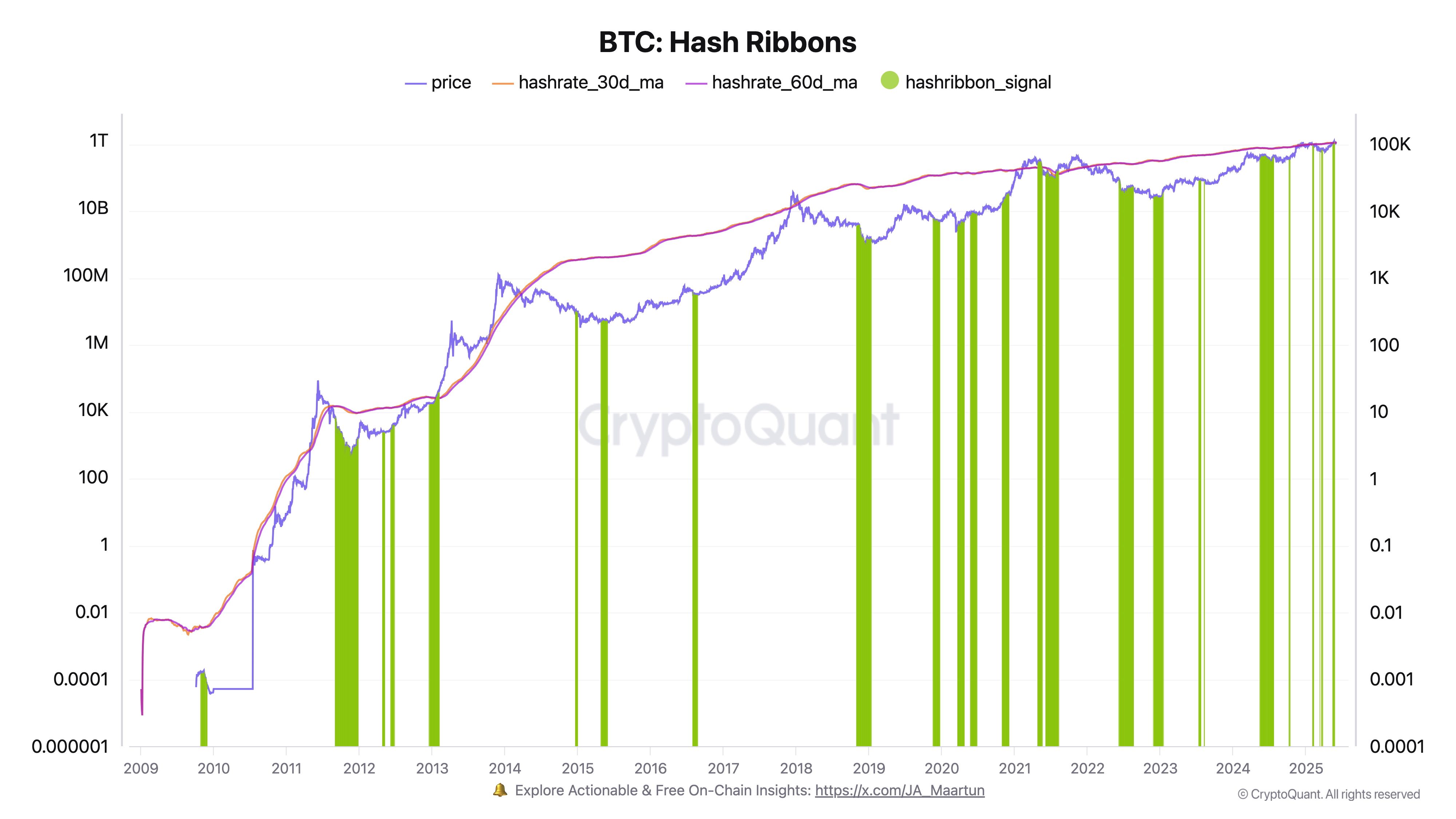

- Hash Ribbons turned green for the third time in 2025, showing miners stopped selling.

- BTC’s 30-day and 60-day hashrate averages crossed, often before the price rises.

- Tim Draper predicts Bitcoin will reach $250,000 by 2025 despite past challenges.

Onchain analytics platform CryptoQuant reports that the Hash Ribbons indicator has flashed green for the third time in 2025. This signal often means miners have stopped selling their Bitcoin, which may support a price increase.

In a June 5 update, analyst Darkfost explained that Bitcoin’s 30-day and 60-day hashrate averages just crossed. This pattern usually appears when less efficient miners shut down due to falling profits. Historically, such signals have often come before strong price recoveries.

Darkfost explained that when mining is no longer profitable for some miners, they are forced to sell their Bitcoin to cover costs. This can cause short-term price drops. However, it often helps the market recover later, as the selling slows down and the Bitcoin supply becomes tighter. The latest Hash Ribbons signal appeared soon after Bitcoin’s hashrate reached record levels, showing that miners are facing tough competition and rising energy costs. Except for the 2021 mining ban in China, Darkfost says this kind of setup has often matched strong buying phases in the past.

Darkfost said few people noticed the signal this time. He said this signal shows buying now could be a good idea. Meanwhile, miners have kept their BTC reserves steady in 2025 after selling a lot last year. By June 4, miner wallets held about 1.8 million BTC.

Long-Term Holders Accumulate as BTC Supply Tightens

New on-chain data from CryptoQuant contributor Amr Taha supports a positive outlook for Bitcoin. He reports that long-term holders, who keep Bitcoin for more than 155 days, have started accumulating again. Their net realized cap has now passed $20 billion. Historically, when long-term holders increase their holdings like this, it often signals upcoming strong price gains.

BTC Bullish Momentum: Binance Spot Volume Increases, LTHs Show Strength, & Outflows Indicate Growth

“The convergence of rising exchange dominance, LTH confidence, and supply tightening paints a bullish picture for Bitcoin.” – By Amr Tah

Link ⤵️https://t.co/GZUr9bObsI pic.twitter.com/CNq0Jj79Cb

— CryptoQuant.com (@cryptoquant_com) June 4, 2025

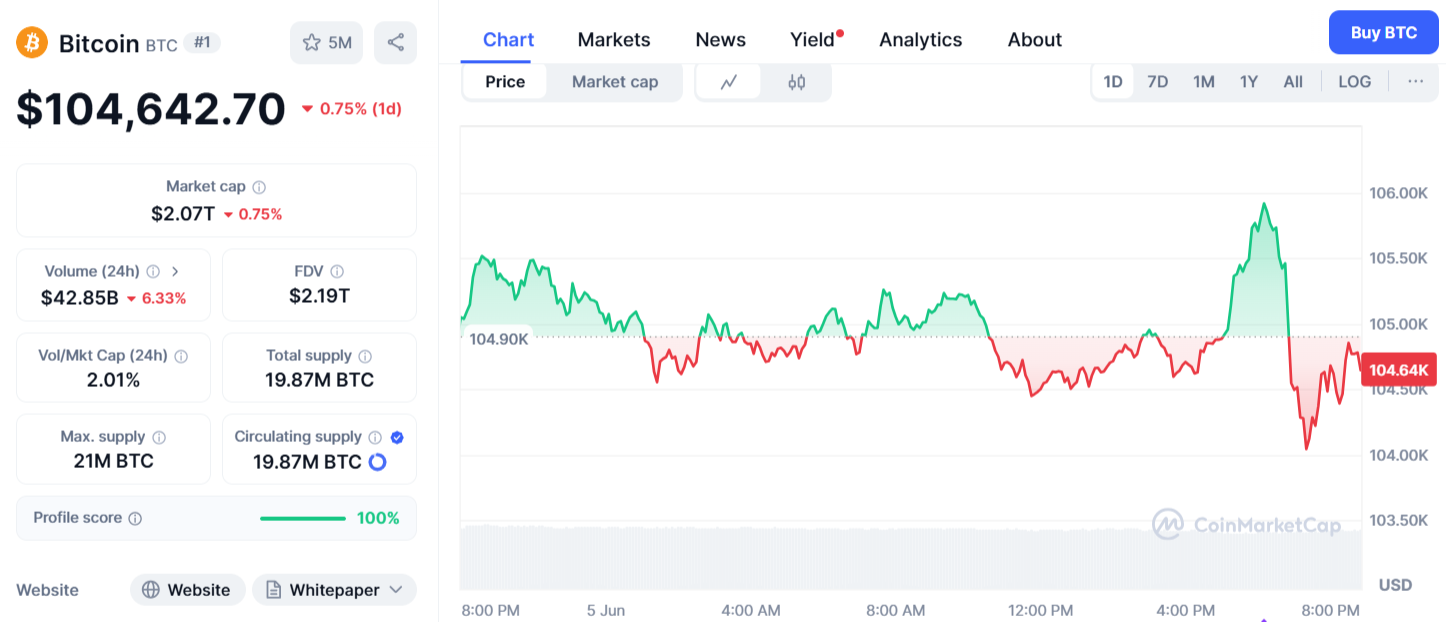

Centralized exchange data also shows Bitcoin supply is shrinking. In just two days, over 20,000 BTC were withdrawn from Bitfinex and Kraken. At the same time, Binance’s share of spot trading grew from 26% to 35% in early June. These trends suggest stronger investor interest and rising demand. At the time of reporting, Bitcoin is priced at $104,642, dropping 0.75% in the last 24 hours. It is currently 6.4% below its all-time high of $111,970 reached on May 22. Over the past week, Bitcoin’s price has fluctuated between $103,414 and $108,776.

Tim Draper Holds Firm on $250K Bitcoin Forecast

Silicon Valley investor Tim Draper repeated his prediction that Bitcoin will hit $250,000 by 2025. He explained several reasons why the price will rise. Draper said Bitcoin could become much more valuable than the US dollar, which he believes won’t exist in 10 years. He shared on X that after Bitcoin’s recent rise, he still expects it to reach $250,000 this year. Tim Draper made this prediction in 2018 and expected it by 2022. But 2022 was tough for crypto because of the FTX collapse and a long market downturn.

Bitcoin might go infinite against the dollar.

On the heels of the recent surge, I’m still expecting Bitcoin to reach $250,000 this year.

Whether Bitcoin will keep gaining ground that fast, who knows.

But the main factors pushing it forward right now are:

→ General optimism… pic.twitter.com/EiD36iYbRy

— Tim Draper (@TimDraper) June 4, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.