Highlights:

- Harvard reduced its iShares Bitcoin Trust (IBIT) exposure by 21% but still held $265.8M.

- At the same time, it entered iShares Ethereum Trust (ETHA) with an $86.8M position.

- Harvard’s Bitcoin strategy faces criticism as academics call it risky.

Harvard’s endowment made a noticeable shift in its crypto exposure at the end of last year. New regulatory filings show the university reduced its Bitcoin (BTC) exchange-traded fund (ETF) holdings by more than one-fifth during the fourth quarter. At the same time, it opened a sizable new position in an Ether fund.

Harvard Cuts $177M in Bitcoin ETF Holdings, Adds $86M Ethereum Position

According to a 13F filing submitted to the United States Securities and Exchange Commission (SEC), Harvard Management Company held 5.35 million shares of BlackRock’s iShares Bitcoin Trust (IBIT) as of Dec. 31. That stake was valued at $265.8 million.

🏛️ HARVARD SHIFTS FROM $BTC TO $ETH

New filings show Harvard sold 1.48M shares of BlackRock’s $IBIT, cutting its Bitcoin ETF holdings from $442.8M to $265.8M.

At the same time, it opened a fresh $86.8M position in BlackRock’s $ETH ETF. pic.twitter.com/ah72zAOYQE

— Coin Bureau (@coinbureau) February 16, 2026

In the previous quarter, the endowment reported owning 6.81 million shares worth $442.8 million. Harvard cut about 1.48 million shares over three months, reducing the total value of its Bitcoin ETF holdings by roughly $177M. Even after the reduction, Bitcoin remains one of Harvard’s largest publicly disclosed equity positions. The $265.8 million allocation still stands above several major technology stocks in its portfolio.

At the same time, Harvard made a new move into ether. The filing shows the endowment acquired 3.87 million shares of BlackRock’s iShares Ethereum Trust (ETHA). That position was valued at roughly $86.8 million at the end of the quarter. It marks the first time Harvard has publicly disclosed exposure to an Ether-linked fund.

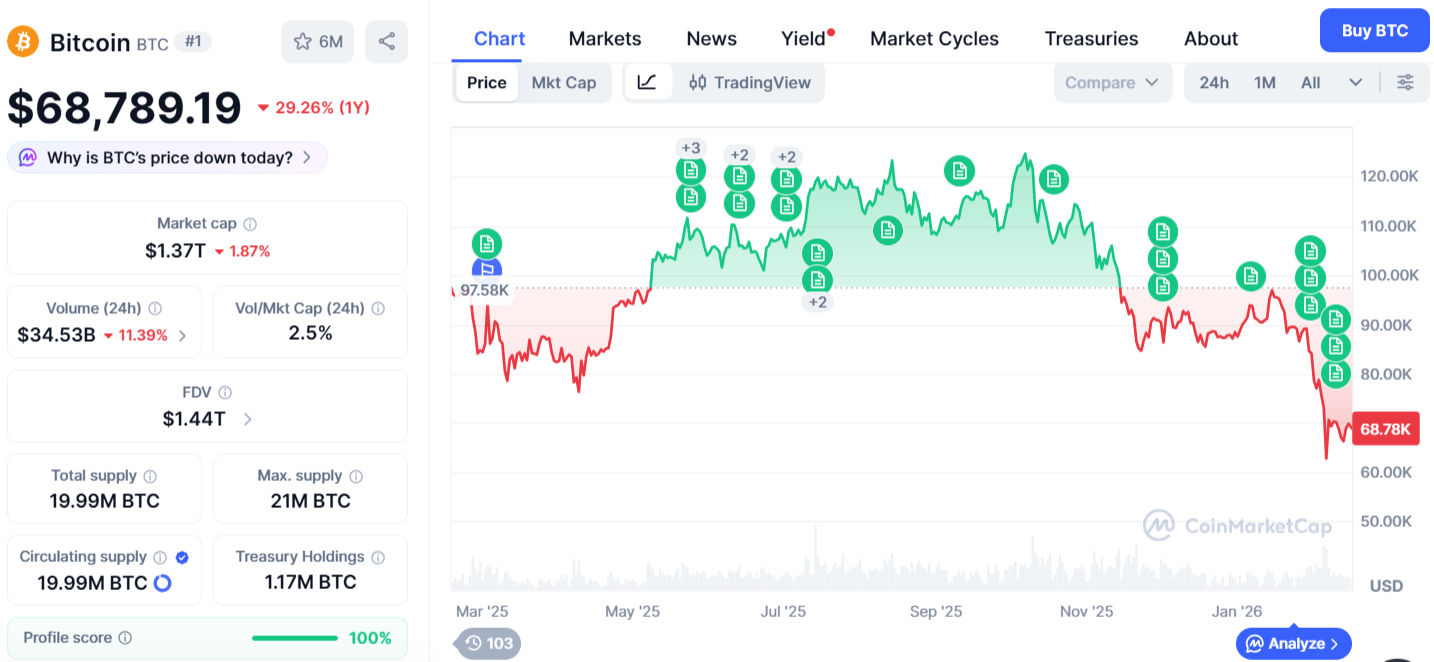

The portfolio adjustment happened during a sharp swing in crypto prices. Bitcoin reached around $126,000 in October before dropping to $88,429 by Dec. 31. Ether also faced pressure, falling about 28% during the same period. As of this week, Bitcoin trades near $68,800, while Ether sits around $1,900.

Portfolio Shift, Not an Exit

The reduction in BTC exposure does not suggest a full withdrawal from crypto. Instead, it appears to be a portfolio rebalance following sharp market moves. Institutional investors tend to trim their holdings following strong rallies. However, the simultaneous establishment of the new ether position also suggests that the endowment is diversifying its digital assets portfolio rather than withdrawing from it.

Still, Harvard’s crypto strategy continues to face scrutiny. According to reporting by The Harvard Crimson, some finance academics remain skeptical. Andrew F. Siegel described the Bitcoin investment as “risky” and noted it was down 22.8% year to date. He added that the risk of Bitcoin is “partly due to its lack of intrinsic value.” Avanidhar Subrahmanyam also questioned the strategy, saying cryptocurrency remains an unproven asset class with unclear valuation methods.

Why This Matters

The Harvard endowment is one of the largest endowments in the world and is closely watched. Therefore, any change in its digital asset exposure is important in the sense that it shows how large institutions view crypto risk. It is important to note that the filing does not show an exit but a rebalancing of the portfolio. Bitcoin was retained but reduced, while Ether made its first appearance. The overall allocation of $352.6 million is important in the sense that it shows the investment in the asset class is still there.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.