Highlights:

- H100 Group AB makes a bold BTC investment move by raising $2.2 million to fund Bitcoin investments.

- Adam Back spearheaded the health services provider fundraiser.

- Several other investors contributed to the over $2 million fundraising.

Swedish healthcare firm H100 Group AB said it had raised 21,000,000 Swedish Krona ($2.2 million) via convertible loan agreements to fund its Bitcoin (BTC) buying strategy. The healthcare firm broke the news via a tweet on its verified X handle on May 25.

In the circulating publication, H100 Group AB stated:

“The financing was led by Adam Back, who subscribed for SEK 13,500,000 ($1.4M). The remaining SEK 7,500,000 ($791,392) was contributed by an investor group comprising Morten Klein, Alundo Invest AS, Race Venture Scandinavia AB, and Crafoord Capital Partners.”

The health institution noted that it will solely use the capital for Bitcoin acquisition, aligning with its agreement with investors and the company’s long-term Bitcoin treasury strategy. H100 Group added that the capital will boost its balance sheet to support its vision of establishing advanced infrastructure for healthcare providers.

$2.2M for our Bitcoin treasury strategy!🍊 pic.twitter.com/WWkrBFMR2x

— H100 (@H100Group) May 26, 2025

Details About H100 Group Convertible Loans Structure

The convertible loans will attract zero interest with a maturity date set for June 15, 2028. Notably, converting loans to the company’s share will cost investors SEK 1.3 ($0.14) per share. The conversion rate was agreed upon after discussions between the company and investors to ensure it met the needs of both parties.

H100 hinted at the possibility of forced conversion. It also described how full loans-to-shares conversion could increase the share capital dilution by 12%. “Assuming full conversion into shares, the Company’s share capital may increase by SEK 1,615,384.6 through the issue of 16,153,846 new shares,” the health services provider explained.

Notably, converting loans into shares remains subject to necessary resolutions from the board or the general meeting. The resolution must be within an authorization framework contained in the company’s guiding principles.

Fundraiser Options and the Company’s Preference

H100 Group noted that it considered raising funds via rights issuance. However, the board opted for a convertible loan structure, citing that it suits the company’s best interest. Per the H100 Group publication, convertible loans allow for flexible and easy access to capital. In addition, it guarantees lower expenses and simplicity, making it ideal for a start-up Bitcoin treasury firm.

21,000,000 SEK has been raised in a convertible round led by the legendary @adam3us 🍊

Accelerating our Bitcoin treasury strategy and strengthening our focus on sovereign health — let’s build! pic.twitter.com/SrpbKM2TID

— H100 (@H100Group) May 25, 2025

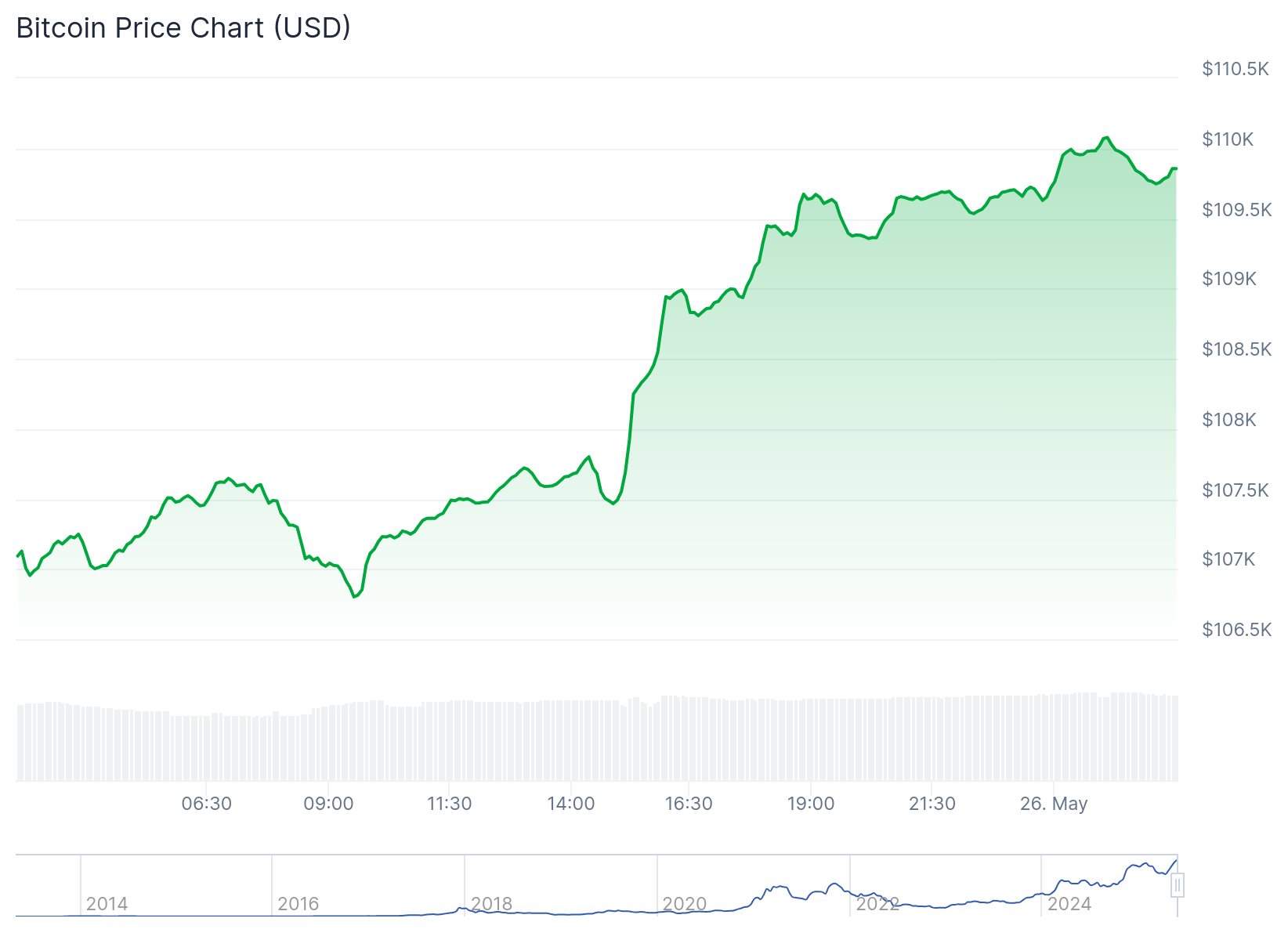

Meanwhile, Bitcoin’s price is up 2.1% in the past 24 hours, oscillating between $106,802 and $109,994. At the time of writing, Bitcoin has a market value of $109,950 with a market cap of about $2.185 trillion. BTC’s long-term data, including its 7-day-to-date, 14-day-to-date, month-to-date and year-to-date metrics, reflected increments, underscoring marked bouncebacks. For context, these variables showed upswings of about 7.4%, 5.3%, 16.1%, and 59.1%, respectively.

On May 22, H100 became the first Swedish health services provider to incorporate BTC into its treasury after buying 4.39 BTC for about $475,000. The health company noted that the capital for the purchase was from excess liquidity, forming part of its long-term Bitcoin investments strategy.

Meanwhile, at BTC’s current price, the company could procure approximately 20 BTC, which will expand its coin holdings to about 24.39 BTC. Observers await how the company sustains its Bitcoin investment strategy in the coming months. Hopefully, it will draw inspiration from related firms like Strategy, Metaplanet, and Semler Scientific.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.