Highlights:

- Garyscale’s ETHE leads outflows as Ethereum ETFs record negative netflows.

- Bitcoin ETFs record near zero inflows, as BlackRock’s ETF leads inflows.

- Ethereum recent flow data implies that the token’s ETFs have recorded outflows on five occasions.

Grayscale Ethereum (ETH) ETF (ETHE) has maintained consistent outflow trends, resulting in Ethereum ETFs recording losses on five occasions. On the other hand, Bitcoin (BTC) ETFs have shown resilience by recording more gains than losses. In recent statistics, ETH ETFs saw $77 million in outflows, while BTC witnessed near zero flows with $0.3 million.

🚨 US #ETF 31 JUL: 🟢$0.3M to $BTC and 🔴$77M to $ETH

🌟 BTC ETF UPDATE (final): +$0.3M

• The net flow turned barely positive after a day of outflow.

• The new #Grayscale Bitcoin Mini Trust (BTC) received an inflow of $19M on its first trading day, preceded by only BlackRock… pic.twitter.com/6iMJdvXP2P

— Spot On Chain (@spotonchain) August 1, 2024

Grayscale’s ETHE Sustains Outflows for Seventh Consecutive Day

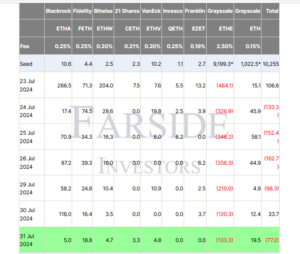

According to Farside statistics, Grayscale Ethereum ETF has maintained successive outflows for seven consecutive days. A July 31 data noted that only ETHE out of the nine Ethereum ETFs witnessed outflows at about $133.3 million. Meanwhile, out of the remaining eight ETH ETFs, six recorded inflows, while two saw zero flows.

For context, Grayscale Mini Ethereum ETF (ETH) led inflows with $19.5 million. Fidelity Ethereum ETF (FETH) followed closely with $18.8 million. BlackRock ETH ETF (ETHA), VanEck Ethereum ETF (ETH), Bitwise Ethereum ETF (ETHW), and 21Shares ETH ETF (CETH) all saw inflows of less than $10 million. They recorded $5 million, $4.8 million, $4.7 million, and $3.3 million, respectively.

Franklin Ethereum ETF (FETH) saw zero inflows despite recording three consecutive days of inflows before July 31. On its part, Invesco Ethereum ETF (QETH) witnessed zero flows, completing four days’ zero flow steak. Summarily, July 31 recorded about $77 million in losses.

Bitcoin ETFs Record Near Zero in Inflows

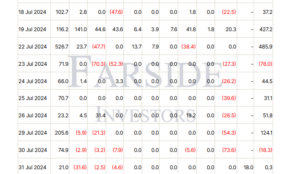

While Bitcoin must have recorded inflows, its most recent flow reflected only $0.3 million in net positive flows. Out of the eleven Bitcoin ETFs, only two witnessed inflows. BlackRock Bitcoin ETF (IBIT) led the inflows with $21 million. Grayscale Mini Bitcoin ETF (BTC) also registered positive netflows with $18 million.

Unlike Ethereum ETFs, Grayscale Bitcoin ETF saw zero flows with five other ETFs. Bitwise Bitcoin ETF (BITB), ARK 21Shares Bitcoin ETF (ARKB), and Fidelity Bitcoin ETF (FBTC) all registered outflows. To clarify, they recorded $2.5 million, $4.6 million, and $31.6 million in losses.

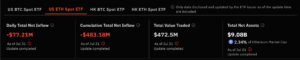

ETH’s Cumulative Total Net Inflow Remains Negative After 7 Days

According to Sosovalue Bitcoin ETFs statistics, cumulative total net inflow is negative with about $483.18 million. The total value traded was roughly $472.5 million, while total net assets were approximately $9.08 billion, representing 2.34% of ETH’s $382.2 billion valuation.

Overall, the variables above underscore an apparent unimpressive ETH ETF sales. However, positive findings could stem from the fact that the network is busy with transactions despite recording more outflows than inflows. In addition, ETH ETF sales are still in their early stages, implying that time abounds for spontaneous turnarounds. At the time of writing, Ethereum’s price has been down by about 4.1% in the past 24 hours, with a valuation of $3,180.

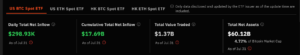

Bitcoin Total Net Assets Hits 4.72% of BTC’s Total Valuation

Per Sosovalue Bitcoin ETFs statistics, BTC’s total net assets in ETFs were about $60.12 billion. The net total assets represented 4 72% of Bitcoin’s $1.27 trillion market capitalization. Meanwhile, the cumulative net inflow was $17.69 billion while the total value traded was $1.37 billion.

The statistics highlighted above underscores Bitcoin’s remarkable ETF sales trend. In addition, it depicts traders’ growing interest in commodity sales, which would undoubtedly influence BTC’s market actions. BTC is changing hands at about $64,330, mirroring a 2.4% decline from the previous day.