Highlights:

- Grayscale’s new MakerDAO Trust provides institutional investors with streamlined access to MKR, supporting the growing demand for crypto exposure.

- The MakerDAO Trust is a closed-end fund designed to offer investors exposure to MKR, an essential governance token on Ethereum.

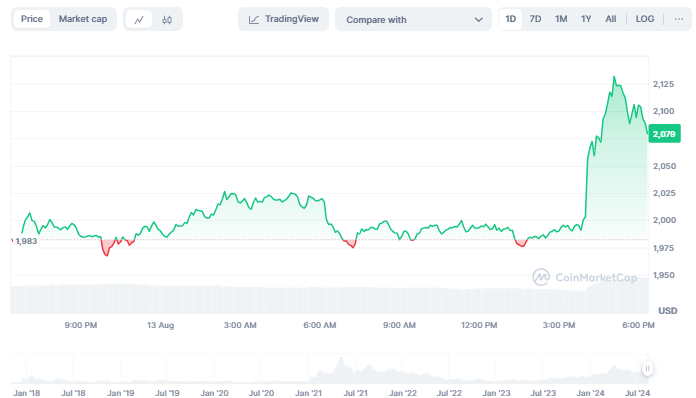

- Following the announcement of the Grayscale MakerDAO Trust, the price of MKR surged 5%, reflecting strong market interest.

Grayscale Investments has expanded its crypto investment offerings with the launch of the Grayscale MakerDAO Trust, a new single-asset fund focused on MakerDAO’s governance token, MKR. The Trust announced on August 13 that it enables institutional and individual accredited investors to gain exposure to MKR, a key asset in the decentralized finance (DeFi) ecosystem.

We are proud to announce the creation of a new single-asset crypto investment fund, available through private placement: Grayscale MakerDAO Trust $MKR.

Available to eligible accredited investors.

Read the press release: https://t.co/hOOWHk3bqO pic.twitter.com/5pIMaLUHwI

— Grayscale (@Grayscale) August 13, 2024

Investment Opportunities Grow with MakerDAO Trust

The MakerDAO Trust is the latest addition to Grayscale’s portfolio of over 20 crypto investment products. This Trust offers streamlined access to MKR, the utility and governance token that powers MakerDAO’s ecosystem on the Ethereum blockchain. Grayscale’s Head of Product and Research, Rayhaneh Sharif-Askary, emphasized the company’s commitment to meeting the growing demand for crypto exposure, stating:

As demand for crypto exposure continues to grow, Grayscale remains dedicated to broadening its range of offerings and delivering innovative investment opportunities.

The Trust’s launch follows Grayscale’s recent introduction of similar single-asset funds for Bittensor’s TAO and Sui’s SUI tokens. The MakerDAO Trust is structured like Grayscale’s other single-asset trusts. In addition, it is designed to facilitate investor access to the DeFi space without the complexities of directly purchasing and storing digital assets.

We are proud to announce the creation of two new single-asset crypto investment funds, available through private placement: Grayscale Bittensor Trust $TAO and Grayscale Sui Trust $SUI.

Available to eligible accredited investors.

Press release: https://t.co/Xplh81KI9W

1/3 pic.twitter.com/pGcLhcZSdD

— Grayscale (@Grayscale) August 7, 2024

Market Reaction and Strategic Positioning

MKR’s price surged by 5% following the announcement, reflecting strong market interest. Despite the broader crypto market downturn in 2024, MKR has demonstrated resilience, with a 68% increase since in the past year. This performance underscores the market’s confidence in MakerDAO’s role within the DeFi sector.

Sharif-Askary highlighted that the MakerDAO Trust allows investors to engage with the growth of the entire MakerDAO ecosystem. This aims to reduce DeFi’s reliance on traditional financial systems by offering a decentralized, permissionless stablecoin platform. This Trust exposes investors to MakerDAO’s on-chain credit protocol, stablecoins, and real-world assets.

Grayscale’s continued expansion of its product suite reflects its commitment to providing investors with innovative ways to engage with the evolving crypto landscape. As one of the world’s largest digital asset managers, Grayscale sets the standard for crypto investment products, with over $25 billion in assets under management.

Ethereum ETF Inflows Surge as Grayscale ETHE Rebounds

Ethereum ETFs are experiencing a resurgence as Grayscale’s ETHE ended a 14-day outflow streak on August 12, signaling renewed investor interest. This turnaround marks a potential shift in the market, particularly for Grayscale’s ETHE, which has been under pressure for weeks.

Grayscale’s ETHE reported zero flows on Monday, ending the consistent outflows that spanned nearly three weeks. This development has caught the market’s attention, indicating a possible change in sentiment toward Ethereum ETFs. The broader market for ETH ETFs has struggled to gain momentum, especially compared to their Bitcoin counterparts. However, the recent inflows into Grayscale’s ETHE suggest a renewed confidence among investors.

The Grayscale Ethereum Trust (ETHE) has notched its first day of zero outflows, bringing an end to a 14-day onslaught that saw the fund bleed nearly $2.3B.

Could this be a bullish for $ETH? pic.twitter.com/u4BMcQHzZN

— Cointelegraph (@Cointelegraph) August 13, 2024

Additionally, other major Ethereum ETFs have also shown signs of recovery. Fidelity’s ETH ETF reported inflows of $4 million, and Bitwise attracted $2.9 million. Despite these positive signs, BlackRock’s ETHA, the largest player in the Ethereum ETF market, reported no inflows on the same day.

Moreover, data from Farside Investors highlights that funds flowing into ETHA have reached $901 million, approaching the significant $1 billion milestone. The recovery in Ethereum ETFs, alongside Grayscale’s turnaround, points to a potential revival in the market. However, the broader Ethereum market remains cautious as the cryptocurrency struggles to maintain upward momentum, keeping a close eye on the $3,000 resistance level.