Highlights:

- Google’s updated policy requires FCA registration for crypto exchanges and wallet providers in the UK to advertise products.

- Ads for hardware wallets are allowed without FCA registration but cannot promote buying or trading services.

- Google’s crypto ad policies evolve, with more regulatory changes expected across platforms in the future.

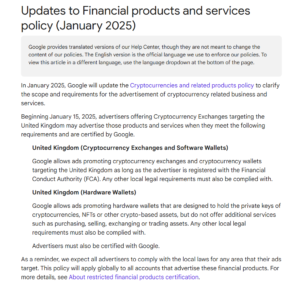

Google has updated its financial products and services policy, which will take effect in January next year. According to the new rules, crypto exchanges and wallet providers in the UK must register with the Financial Conduct Authority (FCA) before they can advertise on the platform.

Google has released an update to its financial products and services policy, which will update the cryptocurrency and related products policy in January 2025. As long as the advertiser is registered with the Financial Conduct Authority (FCA), Google will allow it to run…

— Wu Blockchain (@WuBlockchain) December 21, 2024

Google to Allow Hardware Wallet Crypto Ads in the UK Without FCA Registration

However, hardware wallet ads follow different rules. Google will allow ads for hardware wallets in the UK without FCA registration. These ads can promote devices for storing cryptocurrencies, NFTs, and other digital assets. Google limits crypto ads to FCA-registered entities to ensure user protection. This helps reduce scams and fraud in the crypto market.

Google’s Evolving Approach to Crypto Ads

Google’s approach to crypto ads has changed over time. In 2018, it banned all crypto-related ads due to concerns about scams and market instability. In 2021, Google recognized the increasing legitimacy of the cryptocurrency market. As a result, it adjusted its policy. The company started allowing ads from regulated crypto exchanges and wallet providers. However, this was only permitted under strict conditions.

The shift occurred with the launch of spot Bitcoin ETFs in the US. Last year Google revised its ads policy. Starting January 29, it began allowing ads for “Cryptocurrency Coin Trusts.” This change occurred as both Wall Street and the crypto world focused on the SEC’s decision regarding spot Bitcoin ETFs. Only weeks later, on January 10, the SEC gave official approval for these funds to be traded.

Reports are circulating that Google will be changing their policy and allowing #Bitcoin ETF ads starting on Jan 29th.

Google processes 100K searches/sec 🤯

Bitcoin is going to have unprecedented levels of institutional and retail exposure.

Prepare accordingly

— The ₿itcoin Therapist (@TheBTCTherapist) January 25, 2024

FCA Research Reveals Growing Crypto Adoption in the UK

Last month, FCA released new research on UK consumer attitudes towards crypto. The research reveals that 12% of UK adults now own crypto, an increase from 10% in previous reports. Crypto awareness also grew from 91% to 93%. Additionally, the average value of crypto held by individuals rose from £1,595 to £1,842.

Respondents shared that family and friends were the main sources of information for those who hadn’t bought crypto. Only 10% of participants said they didn’t conduct any research before purchasing.

About one-third of individuals felt they could lodge a complaint with the FCA if an issue arose. They hoped for recourse or financial protection. Crypto remains mostly unregulated in the UK and involves significant risks. In case of issues, there is no assurance of protection, and individuals should be ready to potentially lose their money.

Matthew Long, the FCA’s Director of Payments and Digital Assets, previously stated:

“Our research results highlight the need for clear regulation that supports a safe, competitive, and sustainable crypto sector in the UK. We want to develop a sector that embraces innovation and is underpinned by market integrity and consumer trust.”

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.