Highlights:

- Tyler Winklevoss has challenged the criteria that qualify Solana, Cardano, and XRP as strategic reserve assets.

- The Gemini co-founder argued that only Bitcoin has met the conditions for inclusion in the crypto reserve.

- Tyler’s assertion elicited widespread reactions from market participants, who faulted his claims on several basis.

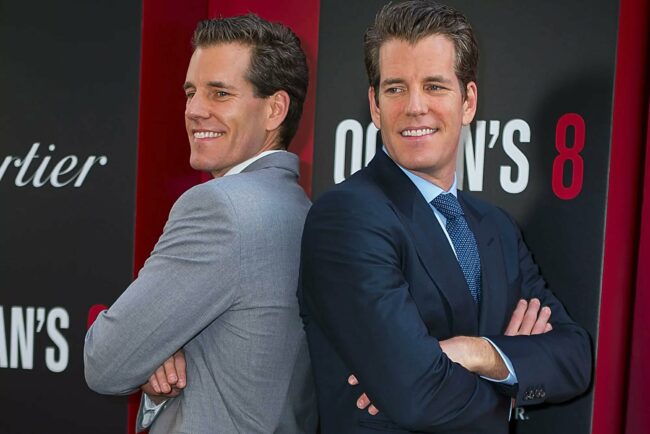

Gemini co-founder Tyler Winklevoss has criticized Solana (SOL), Cardano (ADA), and XRP’s inclusion in the United States crypto strategic reserve. The co-founder’s remarks, which appeared on X, come amid growing debates on which digital assets best qualify for the United States Reserve.

On March 2, Donald Trump announced plans to create a strategic Bitcoin reserve via his Truth Social platform. The president’s initial announcement raised eyebrows because it exempted Bitcoin while including Solana, Cardano, and XRP as reserve options. However, Trump clarified in another post that Bitcoin and Ethereum (ETH) will be at the heart of the reserve.

Tyler’s Argument Against Solana Cardano and XRP

In the X post, the Gemini co-founder argued that only one digital asset, Bitcoin, has met the criteria for inclusion in a strategic reserve. He added that his assertion does not stem from having reservations against other digital assets, including SOL, ADA, and XRP.

Part of the co-founder’s tweet read:

“Many of these assets are listed for trading on Gemini and meet our rigorous listing policy criteria, but with respect to a Strategic Reserve, it is another standard.”

Tyler cited the above instance to strengthen his claims of being satisfied with ADA, SOL, and XRP as mere digital assets other than options for the US strategic reserve. Rounding up his argument, Tyler mentioned that an asset must be hard money and a proven store of value like gold before being considered for a strategic reserve inclusion.

I have nothing against XRP, SOL, or ADA but I do not think they are suitable for a Strategic Reserve. Only one digital asset in the world right now meets the bar and that digital asset is bitcoin.

Many of these assets are listed for trading on @Gemini and meet our rigorous… pic.twitter.com/q32qlaFDKJ

— Tyler Winklevoss (@tyler) March 3, 2025

Market Participants React as Gemini Co-Founder Criticizes Solana, Cardano, and XRP

As expected, Tyler’s tweet gained significant traction courtesy of his over one million X followers and market observers’ interest in his argument. At the time of writing, the tweet has generated over a million views, with thousands of likes, comments, and retweets.

Among the numerous comments, one that has attracted considerable attention was from Dave, Cardano’s Stake Pool Operator (SPO). Dave did not agree with Tyler’s claims of not having anything against Cardano. The SPO wrote, “You have nothing against ADA but just missed out on $8.2 billion of trading volume fees in just 24 hours because you refuse to list it despite being a top 10 blockchain.”

Another comment questioned Tyler’s rationale, which qualified Bitcoin for a strategic reserve inclusion. According to the verified user, Bitcoin isn’t the fastest Blockchain in terms of number of transactions completed per second. Also, he does not envisage BTC as having more utility than the digital assets the Gemini co-founder had criticized.

While Tyler never entertained any of the arguments under his comment section, he hinted at the possibility of listing ADA on Gemini in a separate post. In response to Charles Hoskinson’s tweet, which queried if Gemini is finally considering ADA for listing, Tyler reiterated that while he does not consider Cardano as an option for a strategic reserve, the digital asset appears viable for listing on Gemini. He added that his team at Gemini will look into the request.

I have nothing against XRP, SOL, or ADA but I do not think they are suitable for a Strategic Reserve. Only one digital asset in the world right now meets the bar and that digital asset is bitcoin.

Many of these assets are listed for trading on @Gemini and meet our rigorous… pic.twitter.com/q32qlaFDKJ

— Tyler Winklevoss (@tyler) March 3, 2025

Before Tyler’s remarks, Peter Schiff, a known Bitcoin critic, was among the early few to react to Trump’s post, suggesting the possible inclusion of SOL, ADA, and XRP in the reserve. Like the Gemini co-founder, Schiff said he understood the rationale for Bitcoin’s inclusion in the reserve. However, he does not seem to understand the basis for an XRP reserve.

I get the rationale for a Bitcoin reserve. I don't agree with it, but I get it. We have a gold reserve. Bitcoin is digital gold, which is better than analog gold. So let's create a Bitcoin reserve too. But what's the rationale for an XRP reserve? Why the hell would we need that?

— Peter Schiff (@PeterSchiff) March 2, 2025

Hoskinsom also reacted to Schiff’s claim, where he supported XRP’s inclusion in the reserve. According to the Cardano founder, XRP is a great technology. He added that XRP is a global standard that has survived over the decade despite harsh and unfavorable market conditions. He also noted that XRP boasts a formidable community, making it an ideal reserve asset.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.