Highlights:

- Trump’s supportive stance on crypto fuels renewed market interest and potential IPOs.

- Gemini has confidentially filed for an IPO, collaborating with Goldman Sachs and Citigroup.

- Kraken explores a 2026 IPO, following Gemini’s lead amid a shift in crypto regulation.

The crypto industry is experiencing renewed public market interest due to President Donald Trump’s administration’s supportive stance on crypto. Asset management firm Ark Invest anticipated this rising interest months ago, suggesting that Trump’s crypto stance could pave the way for multiple Initial Public Offerings (IPOs).

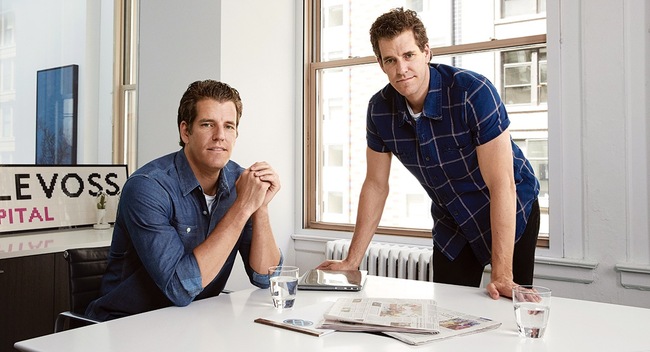

Gemini, the crypto firm founded by Tyler and Cameron Winklevoss, has confidentially filed for an IPO with the U.S. Securities and Exchange Commission (SEC). On March 8, Bloomberg reported that the company is collaborating with Goldman Sachs and Citigroup on the plan. The New York-based crypto exchange could go public this year. However, the IPO remains in the planning stage with no final decisions yet.

Gemini, the cryptocurrency firm backed by the billionaire Winklevoss twins, has filed confidentially for an initial public offering https://t.co/0N3wq5uZOe

— Bloomberg Crypto (@crypto) March 7, 2025

Gemini Moves Toward IPO as Regulatory Battles Conclude

Gemini’s recent decision to pursue an IPO follows the conclusion of significant regulatory matters. The SEC recently closed its investigation into the crypto exchange without recommending enforcement action.

The SEC launched its investigation into Gemini nearly two years ago over concerns that its “Earn” program involved unregistered securities. The program let users lend crypto for interest, prompting regulatory scrutiny over potential securities law violations.

After the SEC closed the case, Cameron Winklevoss criticized the agency on X (formerly Twitter). He stated that its retreat “does little to make up for the damage this agency has done to us, our industry, and America.”

Cameron and Tyler Winklevoss joined 30 top crypto leaders at the White House’s Digital Assets Summit on Friday. Trump’s administration supports the industry, giving crypto firms more chances to go public. On Thursday, Trump made a bold announcement to create a national Bitcoin reserve and stockpile other cryptocurrencies seized through legal actions. This marks a significant shift in the U.S. government’s view of Bitcoin’s role in the financial system.

Cameron and Tyler Winklevoss speaking at the Crypto Summit 🇺🇸 pic.twitter.com/9yHkl1Q1ZE

— Gemini (@Gemini) March 7, 2025

Kraken Explores IPO in 2026 Following Gemini’s Lead

Following Gemini’s lead, Kraken, officially known as Payward Inc., is exploring an IPO in early 2026, though plans may change. Bloomberg first reported the news on March 8, citing sources close to the matter.

Cryptocurrency exchange Kraken is readying to go public as soon as the first quarter of 2026 amid a friendlier regulatory climate in the US under President Donald Trump. https://t.co/pwoHktkZIZ

— Bloomberg Crypto (@crypto) March 7, 2025

The exchange recently disclosed its financials for last year. It reported $1.5 billion in revenue and $380 million in adjusted earnings. Like Gemini, the SEC recently dropped its lawsuit against Kraken over alleged securities law violations. This marks a shift in crypto enforcement.

The company told Bloomberg:

“We recently disclosed 2024 financial highlights to be more transparent about our business, which is something we started by being the first to publish proof of reserves and we’re going to continue to prioritize going forward.”

Moreover, earlier this year, eToro, another prominent trading platform, reportedly filed a registration statement with the SEC for a US IPO, targeting a $5 billion valuation. The company aims to list by the second quarter of 2025. Major Wall Street firms like Goldman Sachs, Jefferies, and UBS support the plan.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.