Highlights:

- GameStop explores Bitcoin investments amid a 20% sales drop and shifting market trends.

- After the announcement, GameStop shares soared, with a related memecoin rallying dramatically.

- GameStop CEO’s photo with Michael Saylor fuels widespread crypto speculation among investors.

Video game retailer GameStop is considering investing in Bitcoin and other cryptocurrencies, according to a CNBC report citing three sources familiar with the matter. However, GameStop has not yet decided whether to proceed with crypto investments. One source said the firm is still evaluating whether such a move aligns with its overall business strategy.

GameStop Stock and GME Memecoin Surge Amid Crypto Investment Buzz

Following the news, GameStop shares experienced a sharp rise in after-hours trading. The stock briefly surged over 18%, reaching $31.30, according to Google Finance. GameStop shares have pulled back slightly, now trading at $28.34 at the time of writing, though still up 7% in after-hours trading.

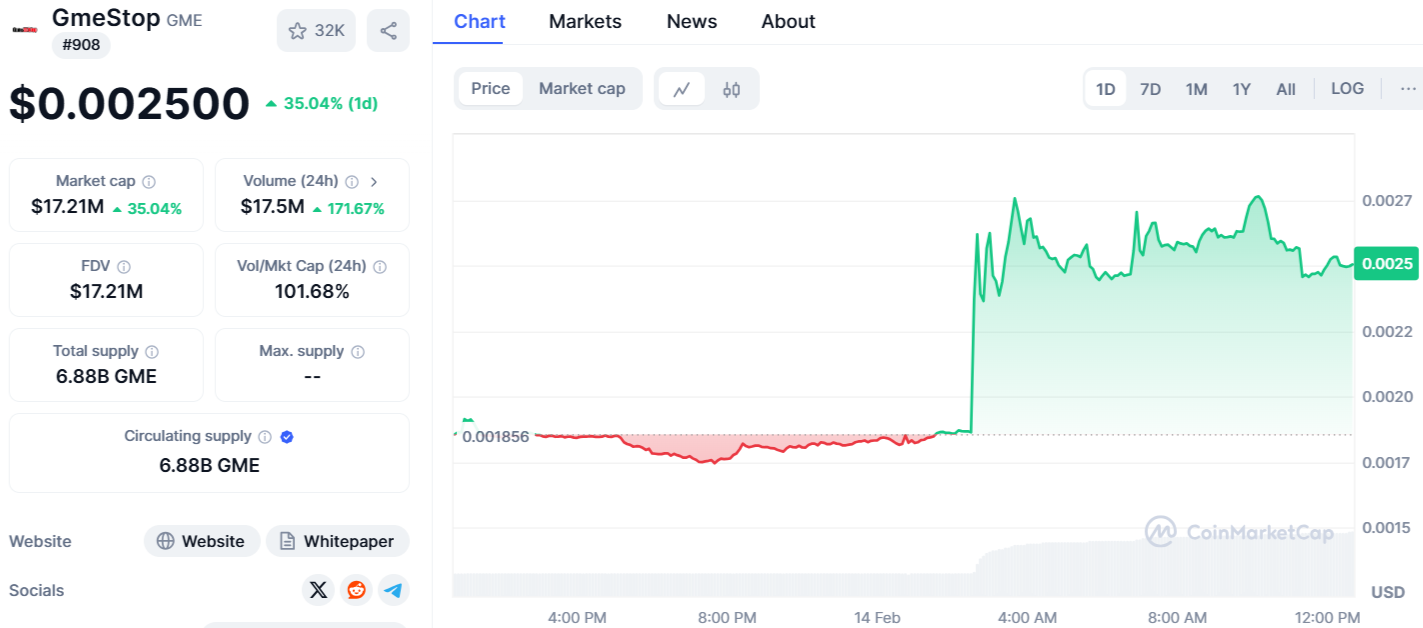

Meanwhile, a Solana-based memecoin named GameStop (GME), which is not linked to the company, jumped 45% to $0.0027 before slipping to $0.0025, according to CoinMarektCap.

GameStop CEO’s Photo with Saylor Fuels Crypto Speculation

Fueling further speculation, GameStop CEO Ryan Cohen recently shared a photo on social media platform X, showing himself with Michael Saylor, the co-founder and chairman of MicroStrategy, the largest corporate holder of Bitcoin.

Earlier this month, MicroStrategy rebranded as Strategy to emphasize its increased focus on Bitcoin and artificial intelligence. The company introduced a new logo featuring a stylized “B” to reflect its Bitcoin strategy. Additionally, it adopted orange as its primary color, symbolizing the cryptocurrency’s identity. The rebrand comes after Strategy’s aggressive expansion of its Bitcoin holdings. In the fourth quarter, the company revealed it had purchased 218,887 BTC, investing $20.5 billion.

This following Cohen’s recent transfer of $GME shares from his LLC to his personal name on January 27

Hinting at a possible bitcoin strategy?

Hinting at another share offering?

Wasn’t expecting this duo on my 2025 bingo card #GameStop

— Wolf of My Street🏡 (@Ryan__Rigg) February 8, 2025

However, two sources indicated that Saylor is not directly participating in GameStop’s internal discussions on crypto investments.

GameStop Eyes Bitcoin as Sales Decline and Digital Shift Intensifies

GameStop is considering Bitcoin and crypto investments after a 20% sales drop in Q3 despite holding $4.6 billion in cash. Both its hardware and software segments performed worse than the previous year, while its brick-and-mortar model struggles against the rise of digital game downloads. A Seeking Alpha analysis suggests that with its declining core business, GameStop could shift toward becoming a “Bitcoin Consumer Bank,” which might boost its stock value.

If GameStop moves forward with the planned investments, it will not be its first venture into crypto. Previously, the company introduced a crypto wallet service, allowing users to store and manage cryptocurrencies and NFTs. However, the service was discontinued due to regulatory uncertainty.

More companies are adopting Strategy’s approach by adding Bitcoin to their balance sheets. Japanese mobile gaming firm Gumi recently joined the trend, purchasing $6.6 million (1 billion yen) worth of Bitcoin on Feb. 10. Meanwhile, Metaplanet announced on Feb. 12 that it raised $26.1 million (4 billion yen) to buy more Bitcoin, bringing its total holdings to 1,762 BTC, valued at $170 million.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.