Highlights:

- Galaxy moved 3,782 BTC worth $447M, sparking fears of further market dumping.

- Bitcoin dipped to $117K but recovered quickly, which shows strong buying interest below.

- ETFs returned to inflows with $157M and, helping Bitcoin stay stable above $118K.

Galaxy Digital wallets are active again, just days after a historic Bitcoin sell-off. Blockchain tracker Lookonchain revealed that the firm moved 3,782 Bitcoin (BTC) earlier today, worth about $447 million at current market rates. Most of the funds were sent to major centralized exchanges like Binance, Crypto.com, Bitstamp, and Gemini. This has sparked talk of a possible big sell-off coming.

Is #GalaxyDigital helping clients sell $BTC again?

In the past 12 hours, GalaxyDigital has transferred out another 3,782 $BTC($447M), most of which went to exchanges.https://t.co/lD8tgkBx00https://t.co/u8s0VjLG5p pic.twitter.com/4wqf8DZx2y

— Lookonchain (@lookonchain) July 29, 2025

Galaxy hasn’t revealed the reason for the transfers, but the timing has caught attention. This movement comes shortly after Galaxy completed a historic Bitcoin sale. The firm sold over 80,000 BTC, worth $9 billion, from a Satoshi-era wallet that had been inactive for 14 years. The transaction was done on July 25.

Bitcoin Holds Steady Above $118K Despite Galaxy Moves and Sell-Off Fears

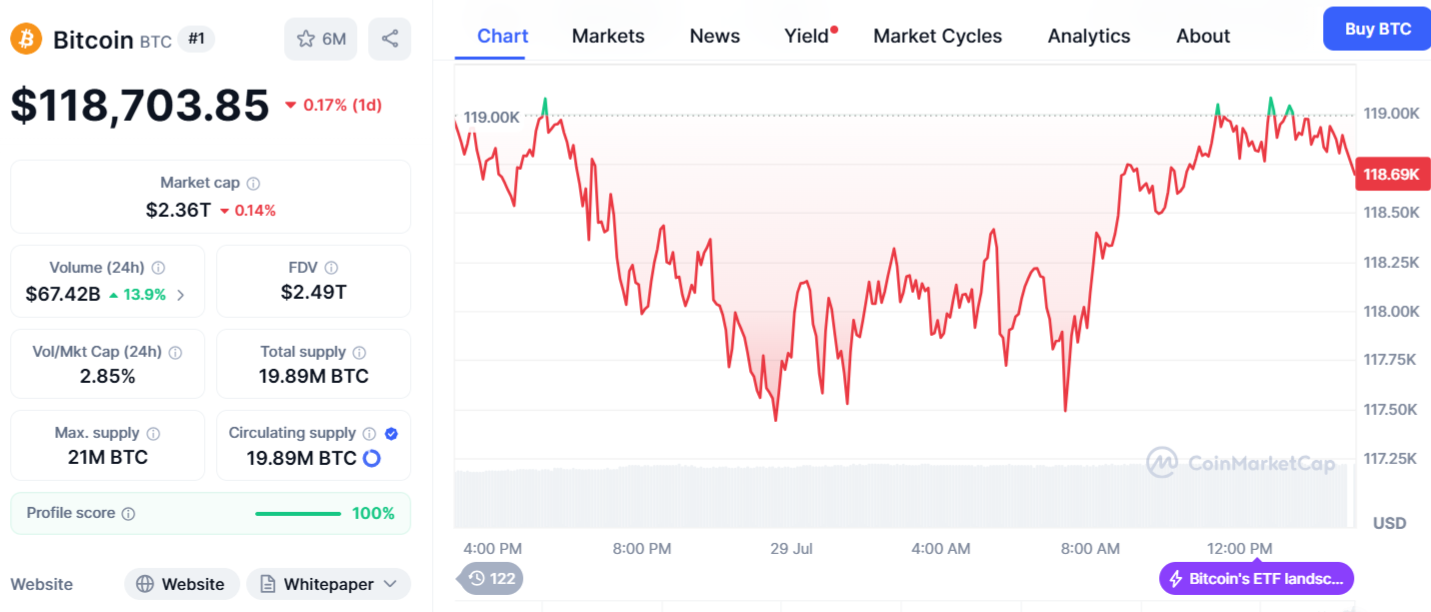

After reports of the transfer surfaced, Bitcoin saw a quick dip to $117,427. However, it soon began to bounce back. At the time of writing, the price had recovered to $118,703. The brief decline caused some panic, but the recovery shows that buyers are stepping in at lower prices. BTC is in a quiet phase now, trading between $116K and $120K. This comes after a strong rally earlier this month that pushed it to new highs.

Some of Bitcoin’s recent price stability is being linked to rising demand from exchange-traded funds (ETFs). After a stretch of consistent outflows, these funds have now returned to inflows, with the latest session showing a $157 million gain, according to SoSoValue. However, Bitcoin is still trading 3.5% below its all-time high and has moved mostly sideways this week. If more large-scale sell-offs happen, short-term price swings could still occur.

Experts Share Bullish Outlook as Bitcoin Holds Key Support Level

Market analyst Kevinn Nguyen recently highlighted the key role of the $116K support level. He explained that if Bitcoin holds strong at this point and trading volume keeps rising, it could trigger another bullish breakout. Nguyen added that if momentum continues to grow, BTC might soon test the $124,000 mark. Some hopeful investors are even predicting a seasonal rally that could push the price as high as $250,000.

Citigroup has also revised its Bitcoin outlook for 2025, citing growing institutional interest. The bank’s latest forecast sets a base case price target of $135,000. In a bullish scenario, Bitcoin could climb to $199,000, while in a bearish outcome, it may drop to $64,000 depending on broader macroeconomic factors.

🚨 NEW: Citi forecasts $Btc could hit $135K by year-end — with a bull case of $199K and a bear case of $64K. pic.twitter.com/ol1W1FbOL8

— Cointel Global Research Center (@Cointel_GRC) July 25, 2025

Meanwhile, billionaire investor Ray Dalio has suggested a 15% portfolio allocation to gold or Bitcoin. He believes this mix offers the best return-to-risk ratio amid rising U.S. debt and ongoing currency devaluation. Speaking on the Master Investor podcast, Dalio emphasized BTC’s growing role in hedging financial risk. Dalio mentioned he owns some BTC, but not much, and still strongly prefers gold over Bitcoin.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.