Highlights:

- Franklin Templeton files for Solana ETF to offer price exposure and staking rewards.

- SEC intensifies its focus on crypto staking, seeking detailed industry reports and potential guidelines.

- Solana price drops amid Libra scandal as investor demand for crypto assets remains strong.

On Feb. 21, Franklin Templeton, a leading global asset manager overseeing trillions in assets, filed an S-1 registration statement with the United States Securities and Exchange Commission (SEC) for a Franklin Solana (SOL) exchange-traded fund (ETF). The fund aims to track Solana’s price movement, offering investors exposure without directly buying cryptocurrency.

A few days ago, the firm established the Franklin Solana Trust in Delaware to facilitate the launch of this ETF. Franklin Templeton joins several asset managers pursuing SEC approval for Solana-focused funds alongside Grayscale, Bitwise, Canary Capital, 21Shares, and VanEck. If approved, the Franklin Solana ETF will listed on the Cboe BZX Exchange, and Coinbase Custody Trust Company, LLC will serve as custodian.

Asset management firm Franklin Templeton has officially submitted the S-1 filing for a spot Solana ETF to the U.S. Securities and Exchange Commission. https://t.co/R1h5jGNPv7

— Wu Blockchain (@WuBlockchain) February 21, 2025

Several firms are now competing to launch a Solana ETF amid a shift toward a more crypto-friendly administration and new SEC leadership. Under the previous administration, former SEC Chair Gary Gensler maintained a cautious stance on crypto.

Franklin Templeton Eyes Staking for Solana ETF Amid Shifting Regulatory Landscape

Franklin Templeton plans to incorporate staking into its proposed Solana ETF. According to the filing, the fund’s staking activities will generate Solana token rewards, which could potentially be considered income. By incorporating staking into the ETF, the firm seeks to appeal to both institutional and retail investors looking for easier access and potential yield from digital assets.

Franklin Templeton’s decision to add staking follows similar efforts with Ethereum ETFs. The New York Stock Exchange has requested SEC approval for staking in Grayscale’s Ethereum ETFs, while the Cboe BZX Exchange seeks the regulator’s nod for 21Shares’ Ethereum ETF.

Previously, several firms removed staking from their registration statements before the SEC approved spot Ethereum ETFs last year. Former Chair Gary Gensler had earlier classified proof-of-stake tokens as securities. With new SEC leadership, the Solana ETF’s result could shape future crypto products.

Eleanor Terrett reported Thursday that the U.S. SEC is increasing its focus on crypto staking and could soon release new guidelines. Citing a source in touch with the regulator, she said the SEC had requested a detailed industry report on various staking methods and their benefits. Last week, the SEC’s Crypto Task Force met with Jito Labs and Multicoin Capital Management to discuss incorporating staking features into crypto exchange-traded products (ETPs).

🚨NEW: According to a source that recently spoke with the @SECGov, the agency is “very, very interested” in staking, even asking industry for a memo detailing the different types of staking and their benefits. This source expects to see some kind of agency guidance on staking in… https://t.co/U9V0aQqTBb

— Eleanor Terrett (@EleanorTerrett) February 20, 2025

Solana’s Price Dip

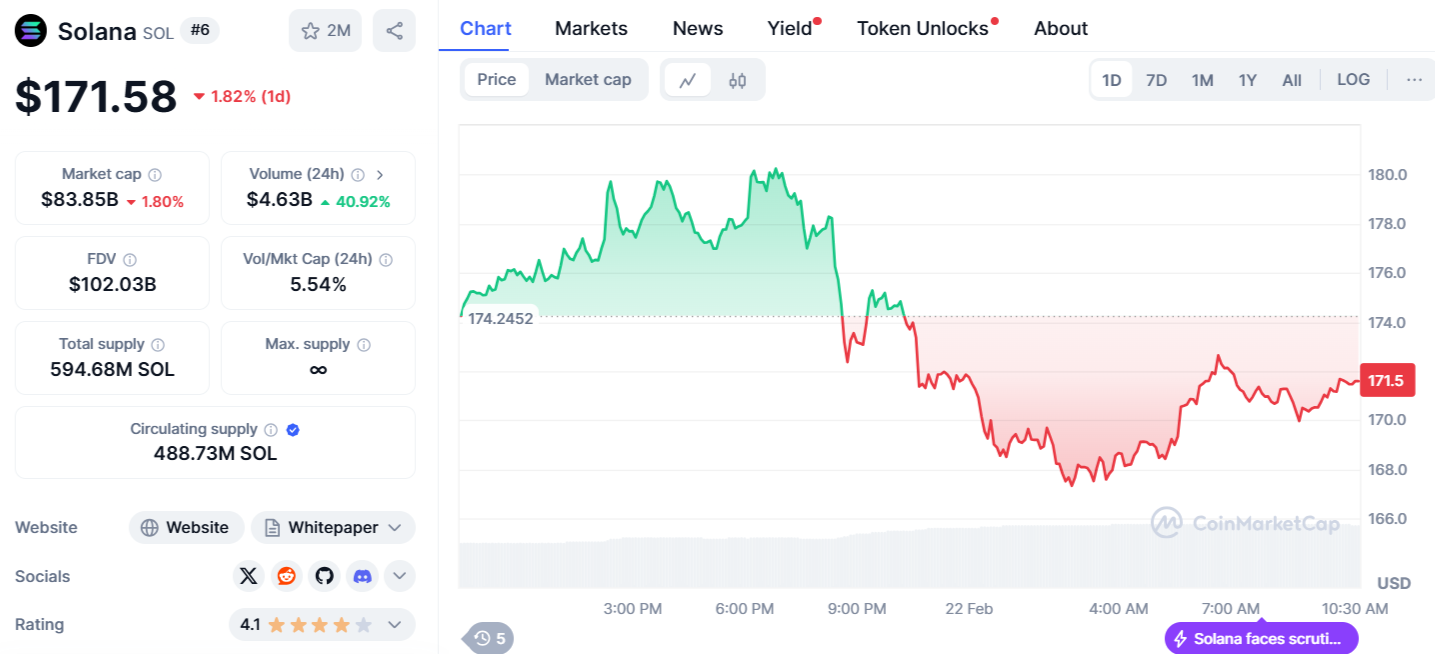

According to CoinGecko, Solana was trading at $168 at the time of writing, showing a slight dip in the past 24 hours. The smart contract blockchain’s token has fallen over 13% this week amid its link to a Libra token scandal and a broader slowdown in meme coin projects that typically support the network.

Investor demand for crypto-focused assets remains strong, fueled by the success of spot Bitcoin funds. Over the past year, the 11 Bitcoin funds have attracted over $40 billion in net inflows, paving the way for Ethereum price-tracking ETFs approved last July.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.