Highlights:

- The flare price has increased to $0.018, as the bulls dominate the market.

- Technical indicators point toward further upside, with a potential $0.02 resistance key.

- Flare derivatives data shows a bullish grip, indicating further upward movement.

The flare price shows intense buying activities, as it breaks above the descending parallel channel. The bulls are showing immense strength, having rallied about 10% to $0.018 in the past 24 hours. Its daily trading volume has spiked 50%, bolstering the heightened market activity in the Flare market.

$FLR price is rising with recent #Flare #Network developments.#FAssets will boost $FLR value in coming months.#FAssets will be a game-changer for the community.#Flaredrop #FLR pic.twitter.com/7KVNA9QT8r

— neiroFlare (@NeiroFlare) April 29, 2025

Meanwhile, the leading cryptocurrencies, such as Bitcoin and Ethereum, are boasting a bullish outlook. Bitcoin has broken through the $95K key level, as the second-largest cryptocurrency hurtles toward the $2000 mark.

Flare Price Outlook

Currently, the FLR token is dancing gracefully above the immediate support at $0.015, which aligns with the 50-day MA. However, bulls must break above the $0.02 technical barrier to enable further upside and validate the bullish outlook. In such a case, if the token flips the 200-day into a support area, the next key targets would be $0.0203, $0.0206, and $0.021.

On the other hand, the Flare technical indicators are showing a potential consolidation or reversal. This is evident as the Relative Strength Index sits at 65.06. The RSI shows consolidation signs. However, if the buying appetite intensifies in the Flare market, there is still more room for further upside before FLR is considered overbought.

A closer look at the MACD indicator also shows that it has crossed above the neutral area (0.000) to the positive territory. This signals intense buying activities, calling for traders and investors to rally behind the Flare token.

Meanwhile, if the current upward movement slows, the Flare price may experience a slight pullback. This will only be evident if the $0.02 resistance zone proves too strong for the bulls in the market. Such a correction may see Flare price finding rest around the $0.016 support area. Intense selling pressure may cause a further slip toward $0.015 and $0.014.

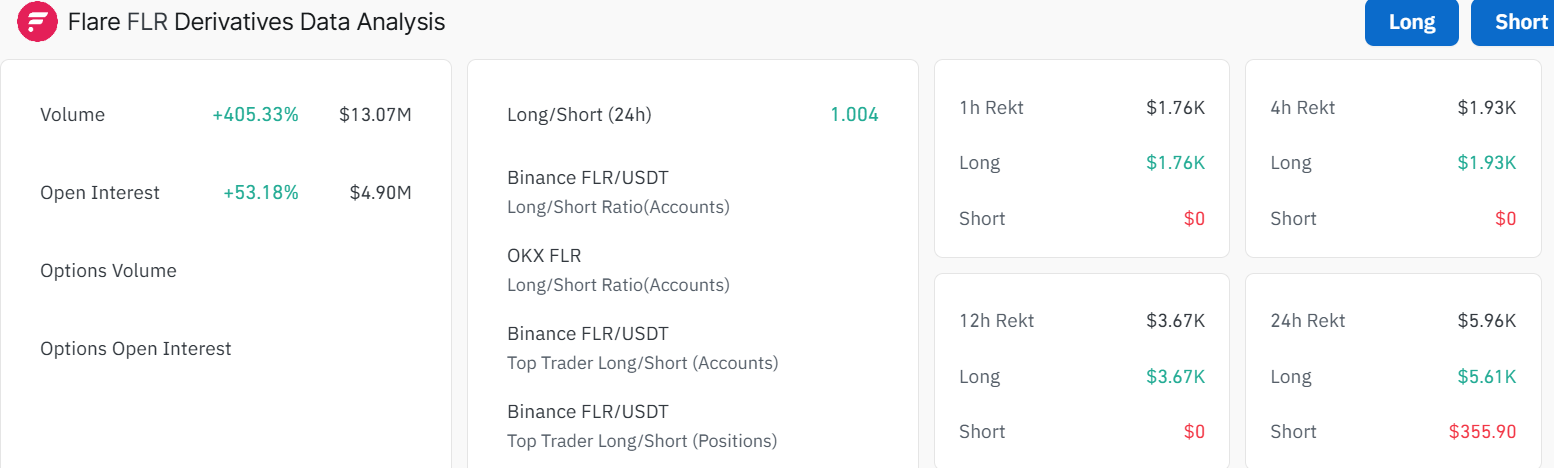

Flare Derivatives Data Analysis

According to CoinGlass data, Flare still upholds a bullish outlook. The Flare derivatives data analysis shows a volume and open interest surge of 405% and 53% to $13M and $4.90M, respectively. This outlook indicates that trading activities are surging in the Flare market, and hence, new money is flowing in.

However, Flare’s long liquidations in the past 24 hours have hit $5.61K, surpassing the short liquidations that sit around $355.90. It is evident that the bullish traders are facing heightened pressure from the beras, as their trading positions are forcefully closed. This calls for traders to be cautious in the market, as it may call for a reversal. In the meantime, traders should monitor the key support and resistance levels, and trading volume to spot the next direction inthe Flare market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.