Highlights:

- Evertz Pharma’s Bitcoin reserves have grown with the addition of 100 BTC.

- The pharmaceutical company reported that it spent $10.8 million on its most recent BTC acquisition.

- Evertz Pharma said it will consistently seek funds to expand its BTC portfolio.

According to a June 11 press release, German pharmaceutical firm Evertz Pharma GmbH has added 100 BTC worth €10 million ($10.8 million) to its growing crypto portfolio. The purchase aims to boost the company’s group-wide treasury portfolio.

🚨Proud to share: Evertz Pharma, the first German company with a strategic #Bitcoin reserve has

added another 100 BTC (~$ 10 million) to its balance sheet.

Inspired by @saylor’s vision — we believe #Bitcoin is the best long-term treasury asset in the world.

Sound money. Bold… pic.twitter.com/91C1xAgeZt— Dominik Evertz (@evertz_dominik) June 11, 2025

Initial Bitcoin Investments

According to the publication, the acquisition formed part of Evertz Pharma’s long-term investment strategy. For context, the company ventured into Bitcoin investments in 2020, becoming the first German firm to make such a bold move. Evertz Pharma marked its Bitcoin treasury reserve journey by investing about €2 million ($2.3 million) in BTC at an average rate of €19,200 ($22,130) per token.

After acquiring its first set of BTC in 2021, the company have consistently sought means of expanding its holdings. Notably, Evertz Pharma has adopted an approach that entails allocating its corporate profits to Bitcoin investments. Over the years, this financing pattern has strengthened the company’s financial outlook

Long Pathway to Attaining its Robust BTC Holding Target

In the press release, the pharmaceutical company noted that, aside from reaffirming its long-term commitment to BTC investments, this recent purchase underscores its strategic focus on integrating BTC into its treasury management. The company emphasized it still has a long way to go to achieve a robust and modern financial foundation through BTC investments. Evertz Pharma hopes to actualize this goal by consistently allocating excess liquidity to fund BTC purchases.

Tobias Evertz, Group Chief Financial Officer (CFO) of the Evertz Group, remarked:

“We will continue to invest corporate profits in Bitcoin and are constantly evaluating additional ways to increase our holdings sustainably.”

German cosmetics firm Evertz Pharma bought additional 100 $BTC in May

German cosmetics company Evertz Pharma GmbH bought an additional 100 BTC totaling $10.8 million in May, according to Bitcoin Magazine. Since its initial purchase of €2 million worth of BTC in December 2020,…

— CoinNess Global (@CoinnessGL) June 12, 2025

Potential Bitcoin Investment Benefits

Beyond announcing its latest purchase and commitment to consistent Bitcoin acquisitions, Evertz Pharma highlighted how BTC investments could be crucial for the company. First, it will help sustain the firm’s capital, which guarantees long-term financial stability. Second, Bitcoin’s strong liquidity will allow the pharmaceutical firm to reallocate funds cost-effectively. Third, like every other firm seeking treasury diversification, Bitcoin can seamlessly fit into such roles for Evertz Pharma.

Dominik Evertz, Managing Director of Evertz Pharma GmbH, stated:

“Bitcoin is not just an investment but a strategic asset that perfectly complements our vision. At the same time, we are aligning our financial approach with the needs of a modern, sustainably operating company.”

Evertz Pharma Draws Inspiration from Leading Bitcoin Investment Companies

The largest corporate holder of Bitcoin, Strategy and leading Japanese Bitcoin investment firm Metaplanet have evolved into becoming models for most Bitcoin-focused companies. Despite being a private firm, Evertz Pharma has also drawn investment strategy ideas from these two companies.

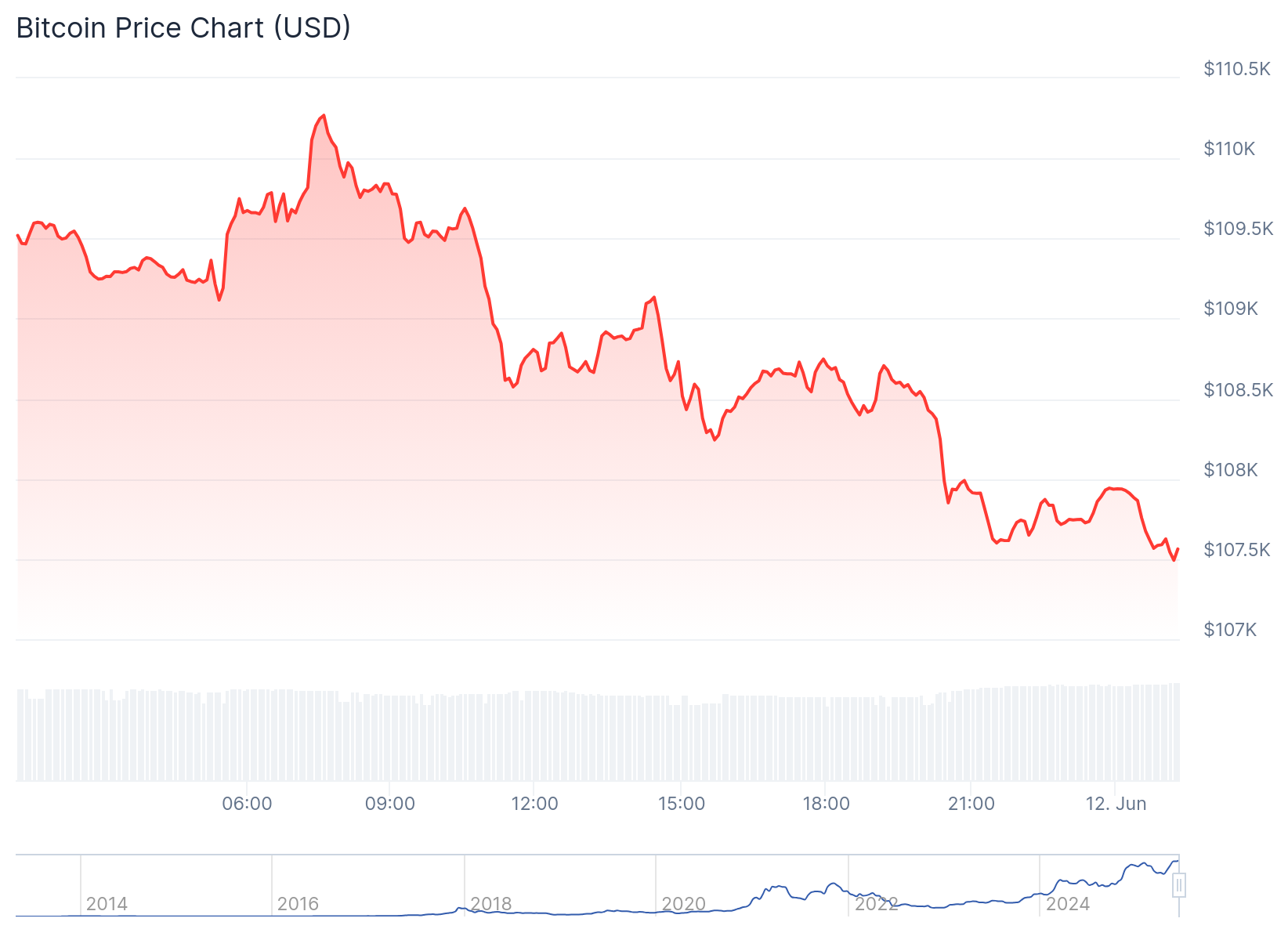

Bitcoin’s Records Slight Price Drop

At the time of press, Bitcoin’s price reflected a 1.5% drop in the past 24 hours. The flagship crypto is changing hands at about $107,900, with price extremes fluctuating between $107,601 and $110,269. BTC’s 7-day-to-date and month-to-date price change variables reflected upswings, implying that the current declines might be transient. For context, these longer-period variables recorded increments of about 2.9% and 4.9%, respectively. BTC’s market cap and fully diluted valuation were above $2 trillion, while its 24-hour trading volume reflected approximately $34.5 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.