Highlights:

- Two Ethereum whales have elicited the deposit of 135,548 into Bitfinex after being dormant for about six years.

- The token dumping happened a few hours before the generalized crypto market slumps.

- According to Spotonchain, the investors realized profits worth $378.3 million from the sales.

Just a few hours before the general crypto market crashed, two dormant whales suddenly resurfaced after six years, eliciting the transfer of 135,548 ETH to Bitfinex. Considering the significant blood bathe that has plagued the crypto space, one could assert that large investors anticipated the crash. Hence, they made the decision to take profits at the right time.

According to Spotonchain, the two whales procured the ETH tokens in early January 2019. At the time of making the purchase, the investors paid $153.65 per token, amounting to about $20.8 million for the 135,548 ETH tokens. Quantifying the profits from the deposits, Spotonchain stated, “If they truly bought then and sold now, they’d be locking in a $378.3M profit (+1,817%)!”

In crypto, transactions like the one described above are renowned for eliciting fears among investors, particularly retailers. The Fear, Uncertainty, and Doubt (FUD) even became worse with the general market crash that emanated from Donald Trump’s newly announced tariffs on imported goods.

Two dormant Ethereum whale wallets just woke up after 6 years and deposited 135,548 $ETH ($399M) to #Bitfinex 8 hours—just before the market crash!

These wallets originally withdrew $ETH at just $153.65 (then $20.8M) on Jan 5, 2019.

If they truly bought then and sold now,… pic.twitter.com/j2RqIZFw0a

— Spot On Chain (@spotonchain) February 3, 2025

Ethereum Price Reaction Following the Generalized Market Crash

At the time of press, the entire crypto market has plummeted by 9.6% in the past 24 hours, resulting in the entire market capitalization dropping to about $3.2 trillion. While still plagued with losses, the market has shown subtle recovery attempts relative to its state earlier today. Notably, Bitcoin has reclaimed $95,000 from $93,000, underscoring significant rebound efforts.

JUST IN: Almost $200 BILLION wiped out from crypto market in just 24 hours. pic.twitter.com/UGVPT748Ax

— Radar 𝘸 Archie🚨 (@RadarHits) February 3, 2025

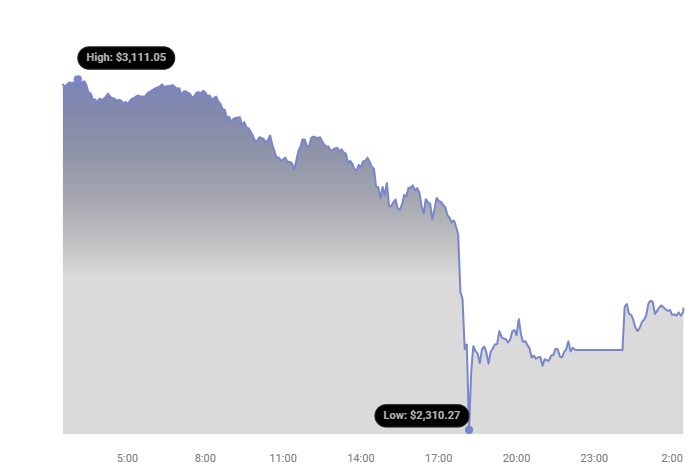

On its part, Ethereum has dropped by about 16.7% in the past 24 hours, reflecting about $2,590 in selling price. Within the same timeframe, ETH minimum and maximum prices have fluctuated between $3,111.05 and $2,310.27, respectively. The price extremes underscore the significant decline over the past few hours. In addition, it highlighted the coin’s recovery efforts amid the prevailing market turmoil.

In other relevant market statistics, Ethereum’s capitalization has dropped to approximately $312.01 billion. Meanwhile, despite the unimpressive trend, ETH’s 24-hour trading volume jumped significantly by about 268.87%, boasting a valuation of $85.76 billion. The markedly raised trading volume suggests a busy network from those dumping Ethereum or traders capitalizing on the declines to expand their ETH holdings.

Profitable ETH Holders Remain Above 50% Despite the Declines

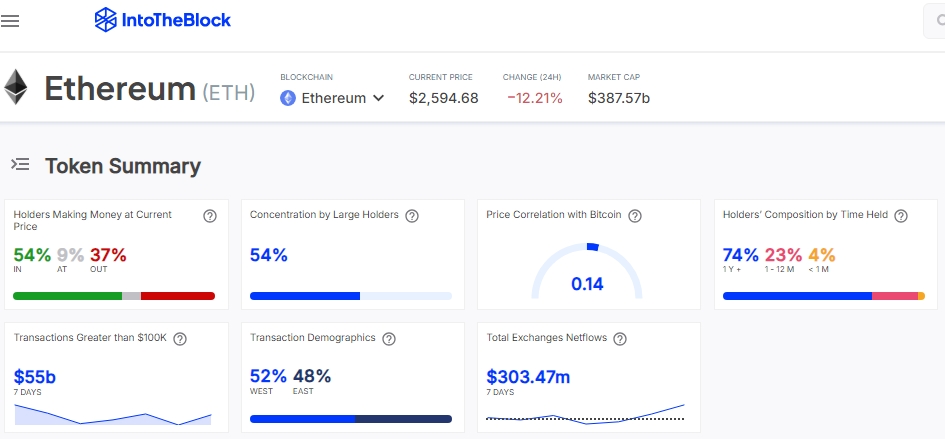

On the popular analytical intelligence outlet IntoTheBlock, profitable ETH holders have dropped significantly. However, the statistics remained at 54%, which invariably implies that most investors bought the token at prices higher than ETH’s current price.

Notably, Concentration by large holders was 54%, which suggests that ETH has more large holders than retailers. Hence, whales are likely to depict Ethereum’s price trajectory based on their market actions. In the past seven days, more Ethereum has returned to exchanges than the amount leaving. IntoTheBlock noted that the net exchange netflows was $303.47 million, highlighting marked dumping actions.

Whale Investor Increases ETH Holdings Amid Market Crash

While retailers and some large investors are dumping their ETH holders, an ETH whale with a wallet labeled “7 Siblings” capitalized on the declines to expand his ETH stores. Per Lookonchain, the whale took advantage of the general market crash to add 50,429 ETH, worth $126 million. Lookonchain mentioned that the trader is renowned for taking advantage of market declines. “The last time 7 Siblings bought a large amount of $ETH at the bottom was on Aug 6, 2024, when the market crashed,” Lookonchain added.

Another wallet of "7 Siblings" bought 5,382 $ETH($14.5M).

7 Siblings bought a total of 50,429 $ETH($126M) today.

The last time 7 Siblings bought a large amount of $ETH at the bottom was on Aug 6, 2024, when the market crashed.https://t.co/BSIe7tIJUy pic.twitter.com/dC3ej4vSQA

— Lookonchain (@lookonchain) February 3, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.