Highlights:

- Ethereum is attracting significant interest from large spending investors.

- Thirteen new wallets have increased their ETH holdings above 10K to ascend to the Ethereum whale status.

- The increasing accumulation pattern signifies faith in Ethereum as a store of value.

Ethereum (ETH) has been making waves in the crypto space courtesy of increased institutional and individual investors’ interest in the token. Ali Martinez spotted the growing trend in one of his most recent tweets, which has garnered considerable attention. In the X post, Martinez shared a new tweet displaying the number of new entrants into the Ethereum Whales league.

According to him, thirteen new wallets have increased their ETH holdings above 10K. He added that the acquisition to raise their ETH holdings happened within 24 hours. Consequently, the investors now qualify as Ethereum whale investors, which invariably underlies massive ETH accumulation trends in a very short timeframe.

In the last 24 hours, 13 mega whales, each holding over 10,000 #Ethereum $ETH, have joined the network. This signals significant accumulation activity! pic.twitter.com/ODIMeCO4Ry

— Ali (@ali_charts) January 28, 2025

Ethereum Price Actions Provide the Best Accumulation Opportunity for Investors

While Martinez did not specify the possible average price the whale investors spent in buying the tokens, chances abound that they took advantage of Ethereum price woes to increase their holdings. For context, ETH is changing hands at approximately $3,170, reflecting a 2.2% upswing in the past 24 hours.

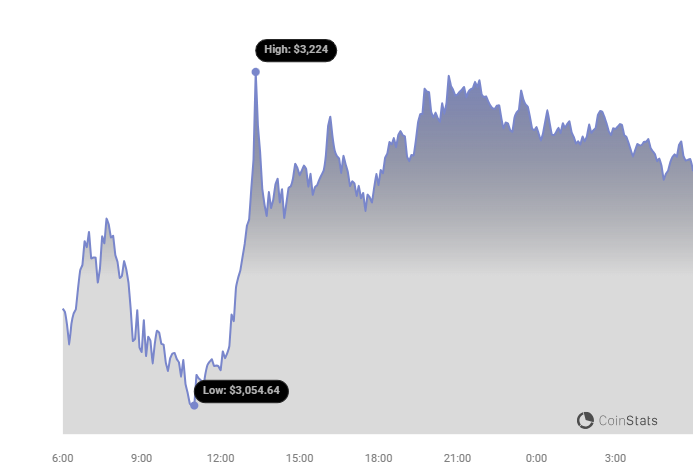

Meanwhile, within the same timeframe, Ethereum’s minimum and maximum selling prices fluctuated between $3,054.64 and $3,224, respectively. The price extremes suggest that the investors might have spent less than ETH’s current selling price during their purchases.

In other market variables, Ethereum’s 7-day-to-date, 14-day-to-date, and month-to-date statistics displayed decrements of about 3.7%, 1.1%, and 6.3%, respectively. The depreciations imply that while ETH might have witnessed increments in its short interval data, it has not fully recovered from the long-term plunge that saw it break above $4,000 at some points.

Following the declines, Ethereum’s market capitalization reduced to about $383.097 billion. Similarly, the world’s number one altcoin 24-hour trading volume has depleted by about 18.71%, dropping the valuation to approximately $24.86 billion.

World Liberty Financial Increases ETH Holdings with Fresh $10 Million Investment

While individuals continue to increase their ETH holdings, institutions are not backing off, as they have also maintained consistent buying sprees. Recently, Donald Trump’s family-backed investment firm World Liberty Financial (WLFI) increased its ETH stores with a new $10 million investment.

Reporting the purchase, renowned on-chain crypto transactions tracker Spotonchain noted that the invested capital was enough to buy 3,247 ETH during the token’s dip. “Over the past 7 days, the investment company has spent $129.95 million to buy 39,242 ETH at an average price of $3,312, now down by 5.12 million (-3.94%),” Spotonchain added.

Since Donald Trump’s inauguration as the 47th president of the United States, the latest procurement will be the umpteenth time the investment outlet has spent to accumulate ETH and other cryptocurrencies. According to the popular analytical intelligence platform Santiment, WLFI Ethereum holdings have reached 59,269 tokens, a 3,921% jump since pre-inauguration.

Still, in the same tweet, Santiment stated that the investment firm now holds 647 Wrapped Bitcoin (WBTC). It added that the company’s WBTC stores have increased by 3,570% since pre-inauguration. Finally, another crypto asset with significant holdings increment was Staked Ethereum (STETH). The analytical intelligence platform said that WLFI STETH stores have reached 19,399 coins, signifying a 309% jump since pre-inauguration.

📈🇺🇸 World Liberty Financial (WLF), the cryptocurrency-focused financial venture linked to Donald Trump and his family, continues to accumulate cryptocurrencies aggressively via its public wallet.

Among key assets, the venture's holdings now sit at:

📌 59,269 ETH (+3,921% since… pic.twitter.com/qeDbqpePAh

— Santiment (@santimentfeed) January 27, 2025

Overall, data obtained from Arkham Intelligence revealed that World Liberty Financial’s entire crypto holdings are worth roughly $391.29 million. The company does not seem to be reducing its purchasing power soon, which invariably implies that WLFI’s net valuation will continue to surge.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.