Highlights:

- Ethereum price has risen 5% to the $1937 mark, following the recent PECTRA upgrade.

- The crypto market has rebounded 3% as the FED’s decision keeps the rates unchanged.

- ETH technical indicators indicate intense buying pressure, validating the bullish thesis.

The Ethereum price is pumping hard today, surging about 5% to $1,937, as the crypto market seems to regain strength. Its daily reading volume has increased 24% to $20.19B, signaling heightened trading activities. Meanwhile, the recent surge comes following the Ethereum PECTRA upgrade, which enabled a revolution in UX staking and network efficiency.

Meanwhile, the crypto market has seen a slight rebound, surging 3.03% as it reclaims the $3.09 trillion market cap. Leading the pack is Bitcoin, which is flirting around the 99K level, a 2.77% surge in the past 24 hours. Other altcoins such as Solana and XRP have notably soared 3% each, indicating increased market activity. This comes following the recent developments of the FED rate decision remaining steady. How high can the Ethereum Price go?

Ethereum Price Outlook

A quick look at the Ethereum daily chart shows it has pumped hard, breaking above the descending parallel line. Moreover, the bulls have established strong support at $1774, aligning with the 50-day MA. If this support holds, the bulls could ignite a short-term rally, obliterating the $2000 mark and hitting the $2076 mark.

The ETH relative Strength Index indicates rising buying activities, as the RSI sits at 65.94. Its position above the 50-mean level suggests intense buying pressure, which may rally towards the 70-overbought region.

On the other side of the fence, the Moving Average Convergence has flipped towards positive territory. Unless the MACD changes, more buy orders from traders and investors will be needed. Meanwhile, Ali Martinez, a popular crypto analyst, has highlighted a surge in Ethereum’s price as the altcoin broke through the $1860 resistance. This area acted as a strong resistance level, as about 4.54 million wallets held a total of 5.58M ETH.

#Ethereum $ETH moved past resistance. Send it! 🚀 https://t.co/zCoVMb0i4M

— Ali (@ali_charts) May 8, 2025

Increased buying appetite will cause further upside in the Ethereum price. However, the bulls must overcome the $2701 technical barrier, which aligns with the 200-day MA, to validate the bullish thesis.

On the flip side, if investors commence booking their profits early, the Ethereum price could drop. In such a scenario, the first safety net will be at $1830, offering immediate support for the bulls. However, if this level gives way, a deeper correction towards the $1774 area will be imminent. A breach below this key level may trigger panic selling, invalidating the bullish sentiment.

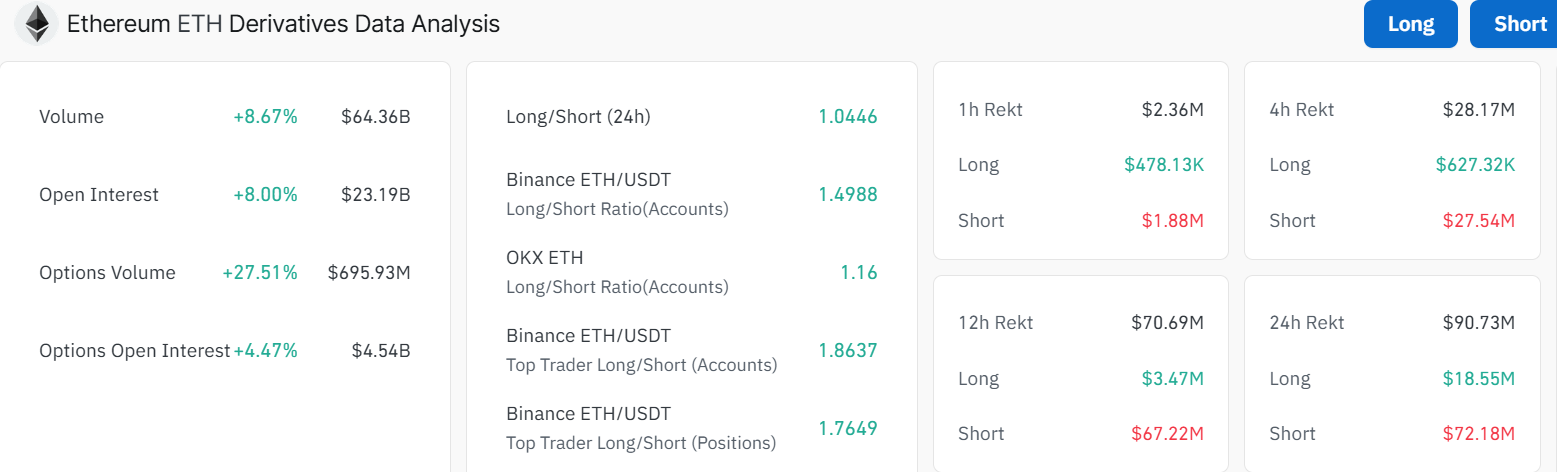

Ethereum Derivatives Data

On-chain metrics data shows increased trading activities in the ETH market. According to Coinglass data, the ETH volume has skyrocketed by 8.67% as the open interest soars by 8%. On the other hand, the options volume has also surged 27% to $695M, as the options open interest increased by 4.47% to $4.54B.

The positive outlook in ETH derivatives data suggests increased market activity and liquidity. Moreover, the spike in volume and open interest indicates that there is heightened market activity, as new money flows into the market. Meanwhile, it is prudent to keenly pay close attention to technical indicators and surging volume. This is because the heightened options volume and open interest may cause price volatility in the market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.