Highlights:

- Ethereum whales bought 200,000 ETH over the weekend, signaling strong confidence.

- Stablecoin supply reaches ATH of $121B, fueling Ethereum market growth.

- ETH price consolidates between $2,400-$2,600, eyeing a breakout to $2,800.

The Ethereum price is up 1% to trade at $ 2,573, as its daily trading volume has spiked 11% in the past 24 hours. ETH is now up 5% over the past week and 2% over the past month, as interest in the ETH market grows.

The recent whale activity over the past week highlights growing confidence in the direction of the Ethereum price. Last weekend, Ethereum whales purchased a significant amount of 200,000 ETH, indicating their confidence in the need for further growth in Ethereum, according to Ali Martinez.

Whales bought 200,000 Ethereum $ETH over the weekend! pic.twitter.com/QPOFXrHCrX

— Ali (@ali_charts) July 8, 2025

The increased accumulation of whales suggests that they are likely to accumulate ETH in the near future, before any potential price surge. In addition to the accumulation of whales, there has also been an increase in Ethereum’s market liquidity, as indicated by CryptoQuant data. The supply of stablecoins, the common platform for trading ETH, has reached an all-time high (ATH) of $121 billion. This shock in terms of the supply of stablecoins is directly affecting Ethereum, as investors are using these stablecoins to trade with ETH.

Stablecoin ERC-20 Supply Hits New ATH

“Currently standing at $121 billion, this milestone confirms the continued relevance and vitality of the stablecoin ecosystem.” – By @Darkfost_Coc pic.twitter.com/LNtqLwsJlE

— CryptoQuant.com (@cryptoquant_com) July 8, 2025

The growth of stablecoins constitutes one of the biggest drivers of Ethereum. This widens its bullish outlook case over the long term.

Ethereum Price Still Stuck in a Consolidation Channel

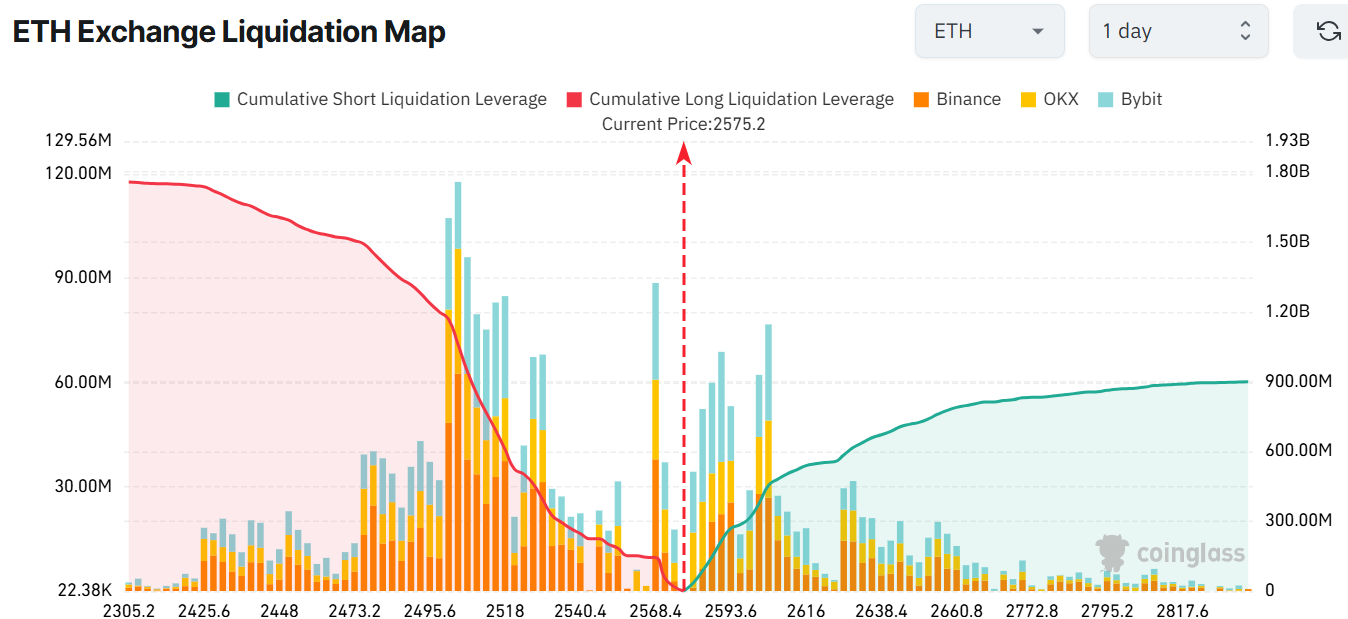

Together with whale activity, the action of Ethereum can be analyzed using the ETH Exchange Liquidation Map. This map clearly indicates the short and long positions in the market. The information indicates that numerous liquidations are yet to take place, as short traders are highly concentrated in the areas around the $2550-$2600 mark.

As the liquidation map indicates, long liquidations have outperformed short liquidations. The longs have taken the lion’s share of $1.76 billion and only $898 million in short liquidations. This imbalance implies that a breakout in price may prompt the shorts to close their positions, thereby pushing the prices up further.

The latest chart indicates that the Ethereum price remains within the consolidation channel, fluctuating between the $ 2,400-$ 2,600 levels. However, the bulls have flipped the $2488 and $2533 levels into immediate support zones, tilting the odds towards the upside.

The Relative Strength Index (RSI) of Ethereum stands at 55.27, indicating some bullish momentum. The MACD line remains above the signal line, indicating that buying momentum is increasing.

ETH Bulls Eye $2800 Mark in the Short-Term

The accumulation of whales is accompanied by rising market liquidity and positive technical indicators. This indicates that the Ethereum price is well-positioned for a breakout. Moving above the $2,600 barrier might create momentum to push Ethereum to the $ 2,800 level.

Moreover, the liquidation map indicates that a significant number of short positions are concentrated around the $2,600 level. In case Ethereum manages to overcome the resistance at $2,600, this would lead to a cascade of short squeezes that would gradually spark a rally to a range of $ 2,800 or beyond. On the downside, if the resistance is successful, ETH may continue to consolidate within its current range. However, the downside threats target the support levels of $2,400 and $2,300.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.