Highlights:

- Ethereum price soars 3% to the $2,076 as trading volume spikes 81%.

- On-chain metrics show increased strength which could trigger a rise to the 3,000 mark in the ETH market.

- Increased whale activity in the ETH market shows major institutional players are increasingly interested in Ethereum.

The Ethereum price has spiked 3% to $2,076 as the crypto market shows signs of recovery. Its daily trading volume has soared 81% to $12.55B, indicating heightened investor confidence. The crypto market has notably rebounded 3% to $2.87 trillion, indicating renewed investor confidence. ETH is up 10% in the past seven days despite a slight fall of 23% in a month.

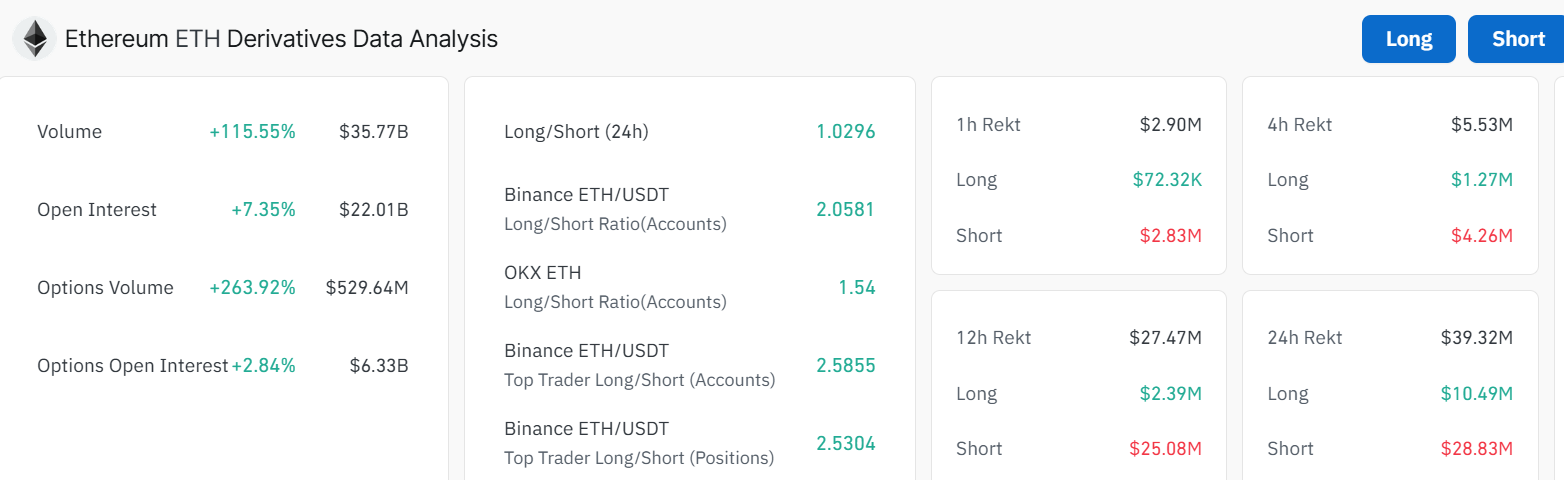

The on-chain metrics displayed across ETH’s blockchain system led to the Ethereum price rising back to $2,000. The market values of Ethereum tokens currently sit at $2,076, and trading operations have raised their daily volume to exceed $12.71.The Coinglass data indicates an ETH futures open interest expansion of up to $22.01 billion, marking a 7.35% growth. The rise in volume by 115% to $35.77B signals that new money flows to the ETH market, which could trigger the next price increase.

On the other hand, popular crypto analyst Ali Martinez has highlighted the substantial growth of Ethereum (ETH) whale transactions in his analysis. Largely successful investor participation during the previous week accounted for the acquisition of 470,000 Ethereum tokens owing to their conviction about ETH’s future performance. According to the sharp rise in whale investments, major institutional players are increasingly interested in Ethereum.

Whales have bought roughly 470,000 #Ethereum $ETH in the past week! pic.twitter.com/SfKKZzyw6u

— Ali (@ali_charts) March 24, 2025

Ethereum Price Outlook

The ETH/USD daily chart has broken out of a descending channel, currently trading at 2,076.87. The altcoin has been consolidating within the channel as bulls aim for a breakout to $2,400. Despite the slight surge, Ethereum is still trading below the 50-day and 200-day MAs, reinforcing the bearish trend. This positioning suggests that sellers are still dominant, with weak bullish momentum.

If Ethereum’s price fails to reclaim the 50-day MA as support at $2.356.24, the price may continue its downward movement, potentially retesting key support levels at $1,959,$1,894, and $1,776. These zones could attract buyers looking to enter at lower levels.

Technical Indicators Show Potential Upside

However, a zoomed-in view of the technical indicators shows potential upside in the ETH market. To start with, the Relative Strength Index (RSI) is northbound, currently reading at 47.33. If the buying momentum increases, the RSI could hurtle toward the 55 level, triggering a rally in the ETH price.

Moreover, the Moving Average Convergence Divergence (MACD) upholds a buy signal. The bullish crossover above the orange signal line calls for traders to buy more ETH. A decisive move toward the positive territory above the neutral level would indicate intense buying pressure, calling for traders to rally behind ETH.

Meanwhile, with the technical indicators flashing bullish, if Ethereum price spikes above the $2,356 mark, it could ignite a bullish reversal. A decisive breakout above $2,866 would validate the bullish momentum, painting the market as bullish. In such a case, if the ETH bulls reclaim the $2,356 mark, the bulls could eye the next resistance at $2,533, 2,827, and $2,866, indicating a shift in trend, leading to further upside potential

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.