Highlights:

- Ethereum price surges 18% in a week, as the trading volume skyrockets 4%.

- Ethereum has hit a new low in terms of exchange reserves.

- ETH bulls target new highs around $5200, as momentum remains strong.

The Ethereum price is starting to show strength, rising almost 1% to $4613, after the recent drop. The trading volume has notably risen 4% to $67.2 billion, showing increasing market activity. Meanwhile, ETH is up 18% over the past week and 46% over the past month, showing growing hype among investors.

On the other hand, Ethereum, just set a new low in terms of exchange reserves. There is only 18.5 million ETH left on exchanges, according to recent data published by popular crypto trader Merlijn The Trader. This has resulted in an optimal storm of demand as the available supply on exchanges has fallen. This could result in a possible price blast in the Ethereum price soon.

$ETH EXCHANGE RESERVES JUST HIT RECORD LOWS.

Only 18.5M Ethereum left on exchanges.

ETFs are buying. Institutions are stacking.

When scarcity meets demand, price doesn’t go sideways.SUPPLY SQUEEZE INCOMING. pic.twitter.com/HE3pif5GiG

— Merlijn The Trader (@MerlijnTrader) August 15, 2025

There is a traditional imbalance in supply and demand since the price of Ethereum has gradually increased as the reserves diminish. The decrease in the number of Ethereum provided on the exchanges makes the acquisition of ETH possible for new buyers at a higher price. This shortage, together with an upsurge in institutional purchases, indicates a possible supply crunch, which may lead to ETH rallying soon.

Ethereum Price Targets $4800 Key Resistance

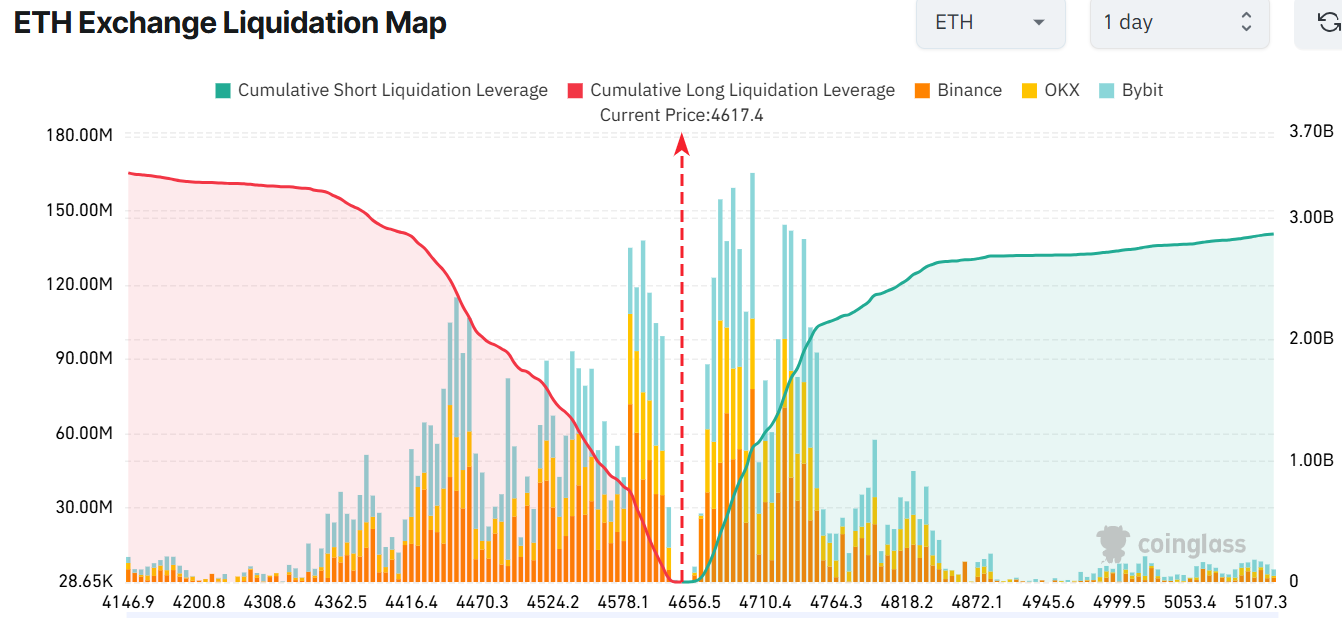

The high leverage in the market further adds to the market dynamics of Ethereum, as calculated based on the market liquidation map of the Ethereum exchange. The map indicates a large size between long and short liquidation levels, cumulative short liquidation levels, and cumulative long liquidation levels being noticeable within the current price level of around $4,617.

This shows that traders are employing a great deal of leverage, and this can have exaggerated impacts on changes in price. A closer look at the daily chart, the Ethereum price has been on a tremendous movement, trading within a rising parallel channel. The altcoin has been printing higher highs, rising to $4764, before retracing to $4613.

Despite the retracement, the bulls still have the upper hand, as they have established strong support around the 50-day ($3410) and the 200-day ($2552) SMAs. This further upholds a long-term uptrend in the ETH market.

Technical signals indicate that bullish momentum remains dominant. The Relative Strength Index (RSI) on the daily chart is currently at 72.02, which means ETH is in overbought territory. This often signals that the market could see short-term pullbacks as traders take profits. However, it also reflects high demand and strong investor confidence in the current rally. The Moving Average Convergence Divergence (MACD) also remains in positive territory, with the MACD line above the signal line and histogram bars growing slightly, indicating continued buying pressure.

Bulls Eye New Highs as Momentum Remains Strong

Ethereum price has maintained strong momentum, moving past $4,200 and now trading around $4,613. The move has been supported by strong buying pressure and the fact that the price is well above the 50-day and 200-day moving averages, two important indicators of trend strength. If Ethereum breaks through the $4,800 resistance level, it could pave the way for a push toward its all-time highs around $5,200. On the other hand, if the rally loses steam, the nearest support lies around $4279 with a stronger floor at $3,394. These levels could act as buying zones if the price dips.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.