Highlights:

- The Ethereum price has soared 16% this week, reaching $2,987, driven by increased institutional interest.

- The recent $259M in inflows to Ethereum ETFs highlights growing trust from financial institutions.

- The market awaits the CPI release, forecasting a 0.2% drop from 2.4%, which is expected to influence market sentiment.

The Ethereum price has declined 1.9% to $ 2,987 in the past 24 hours. Despite the drop, the daily trading volume has soared 25% indicating increased investor confidence. Meanwhile, ETH has increased by 16% over the past week and 18% over the past month. Notably, the financial markets are closely watching the release of the Consumer Price Index (CPI) report, scheduled for today. The CPI report is crucial in monitoring inflation rates.

All eyes on 8:30am ET.

CPI hits today – the market’s next trigger.

Forecast says headline CPI cools to 2.6%.A miss or a beat? Could flip the whole board.

Buckle up. pic.twitter.com/PlZ75jwlab

— Kyledoops (@kyledoops) July 15, 2025

According to Kyledoops, the market is geared towards the forecast, and the predictions are that the headline CPI will drop to 2.6%. This represents a significant decline compared to the previous month’s data, which was 2.4%. When the CPI data fluctuates, it in turn directly affects market expectations, such as equities and cryptocurrencies.

Booming Institutional Interests and Market Sentiments of Ethereum

On the other hand, the cryptocurrency market is experiencing the looming rise of institutional demand, particularly around Ethereum (ETH). Currently, there has been a surge in investments in the Ethereum market. According to Ted Pillows, approximately $259 million in inflows was registered around the Ethereum ETF level. This represents a significant milestone in the institutionalization of the digital asset.

$ETH ETF inflow + $259,000,000 yesterday.

Institutions are not fading Ethereum. pic.twitter.com/1maeRMS1v4

— Ted (@TedPillows) July 15, 2025

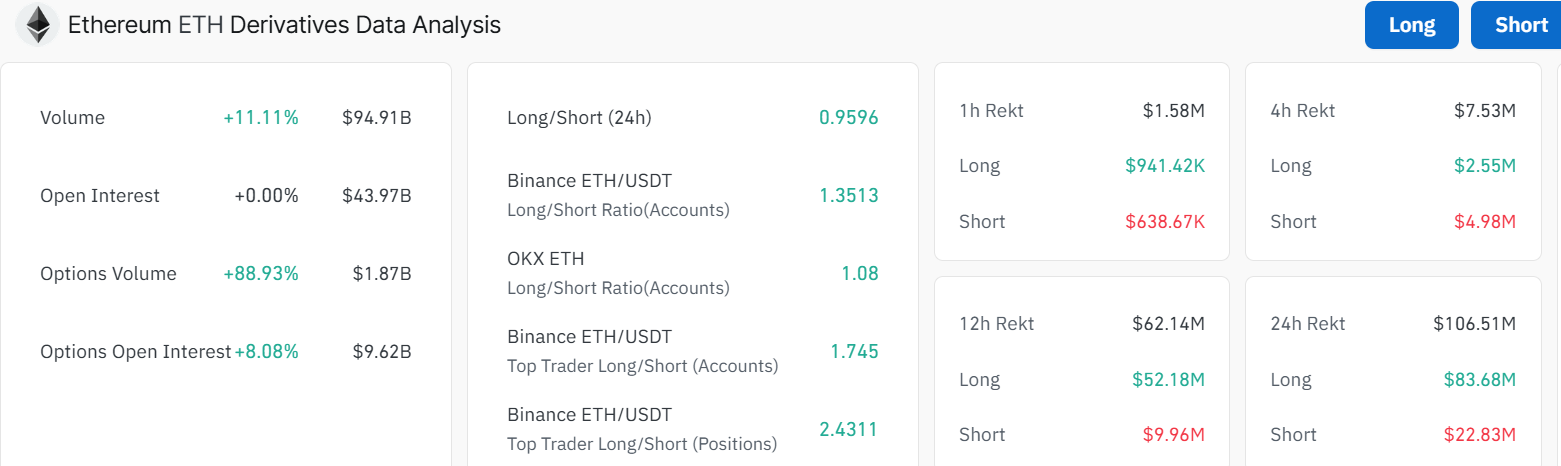

The market dynamics of the Ethereum price are also supported by the latest derivative reports. The volume rose substantially by 11.11% to $94.91 billion. Ethereum futures and options open interest have also been on the upward slope, reflecting high demand in the market from both retail and institutional investors.

ETH’s long-to-short ratio sits at 0.95, slightly below the 1 level, indicating a dropping bullish grip. Meanwhile, the long positions in the past 24 hours has surpassed the shorts, showing a building bullish grip.

How High Can Ethereum Price Go?

A quick glance at the daily chart reveals that the Ethereum price has broken out of the consolidation channel and reached the $ 3,000 mark in the past few days. Currently, the altcoin is flirting around the $2,987 region, above both the 50-day MA (2,587) and 200-day MA (2,472). The bulls remain in dominance, flipping the odds in favour of the upside.

The Relative Strength Index (RSI) is currently at 70.53, indicating that Ethereum has become overbought. This technical view, combined with the high influx of institutional money, suggests a positive market sentiment for Ethereum, as investors anticipate a price increase in ETH.

Additionally, the MACD momentum indicator suggests that traders and investors should place more buy orders. This is manifested by the blue MACD crossing above the orange signal line, entering positive territory. Looking ahead, if this momentum holds, the Ethereum price could retest the $3,000 high and possibly surpass it to reach $3,470 within the next week. This would represent another 13% gain. Conversely, a pullback to the $ 2,937-$ 2,784 support level could occur if profit-taking takes hold as the altcoin remains in an overbought region.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.