Highlights:

- The price of Ethereum has skyrocketed by 3.66% to $2,785, as trading volume surges by 51%.

- A crypto analyst has highlighted that ETH’s liquidity is lying above $3000.

- ETH liquidation data indicates a potential breakout to $3,000 as short liquidations face pressure.

The Ethereum price is flashing signs of a potential breakout, currently up 3.66% to $2785. The trading volume has notably spiked 51%, indicating heightened investor confidence. Meanwhile, the crypto market as a whole, led by Bitcoin and various meme coins, is showing a positive sentiment, indicating a bullish grip.

Recently, a leading cryptocurrency analyst, Ted Pillows, highlighted the crucial liquidity area of Ethereum. His analysis revealed that there is substantial liquidity at the $3,000 level. This suggests that the price may rise to the mentioned level due to the liquidity of the level acting as a magnet.

$ETH liquidity is laying above $3,000.

Liquidity is a magnet. 👀 pic.twitter.com/QznNqGCble

— Ted (@TedPillows) July 10, 2025

Considering the current market structure, the price dynamics of Ethereum are directly linked to the market liquidity above the $3,000 level. A breach of this resistance is likely to provoke a serious surge in the price, as the market displaces the orders above this level.

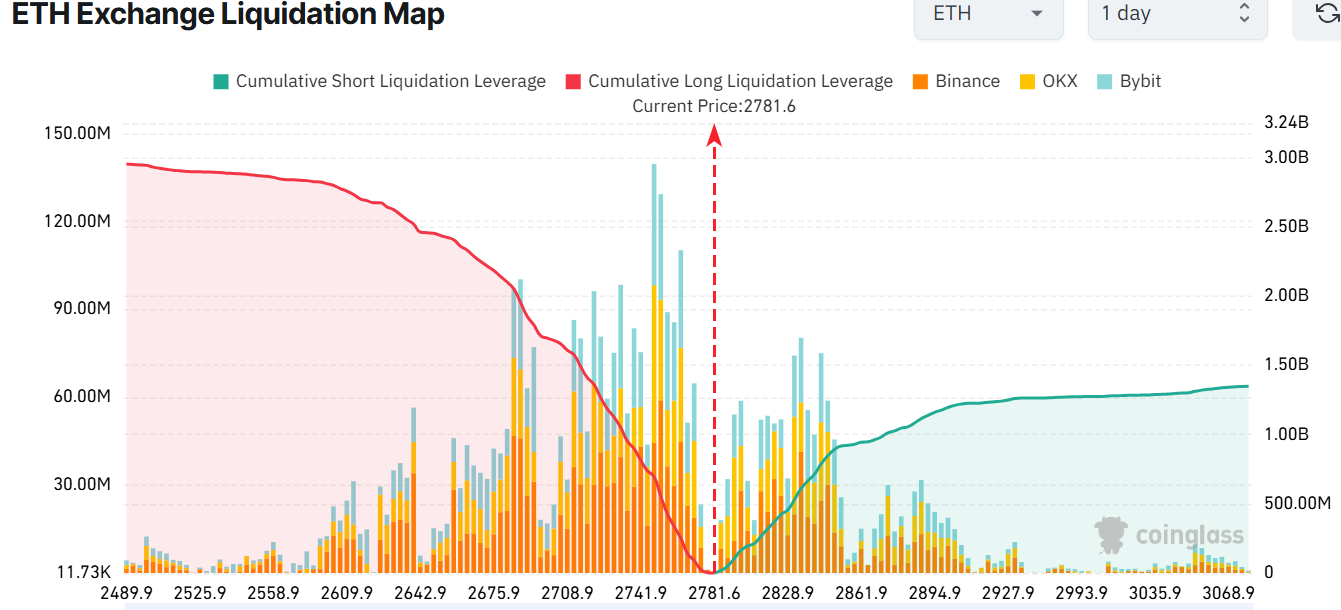

The Market Sentiment in Ethereum is Clear in the Liquidation Data

The Ethereum exchange liquidation map provides additional insights into market dynamics. The Ethereum price has currently hit $ 2,781.60. The price behaviour of Ethereum over the last few days indicates a significant shift in trader sentiment. As the liquidation map indicates, long liquidations have outperformed short liquidations.

The longs have taken the lion’s share of $2.95 billion and only $1.35 billion in short liquidations. This imbalance implies that a breakout in price may prompt the shorts to close their positions, thereby pushing the prices up further. Moreover, this intense short-liquidation pressure, together with the liquidity at the $3,000 mark, may serve to push the price even higher still.

Ethereum Price Poised for a Breakout to $3700

The Ethereum price has rallied to $2,785.40, and its price movement has taken on a bullish consolidation pattern, which may result in a breakout. The price is above the 50-day moving average (MA) at 2,543.04 and the 200-day MA at 2,483.12, indicating that the price has strong support lines to move upward. Additionally, the consolidation channel may act as an accumulation phase before the bulls strike past the $3000 level.

The Relative Strength Index (RSI) of Ethereum is at 65.81, indicating that the market is approaching overbought territory, but not yet to a significant extent. This leaves room for upside, and the price could reach the target of $3,000 in the short-term perspective. At the same time, the Moving Average Convergence Divergence (MACD) indicator is also trending in a bullish direction, as the MACD line is above the signal line. This further supports the argument in favour of continued upward movement.

In the meantime, the Ethereum price has been facing some resistance at around the 2,800 mark. However, should the momentum build and the volume surge, ETH may break through towards $3000. A break above $3000 opens the doors for more upside towards $3300-$3471.

Conversely, if the bears can control the price, ETH could plunge towards the $ 2,631-$ 2,542 support zones. In the long term, the Ethereum price could spike to $ 3,700-$ 4,000 if the overall market’s bullish trend sustains.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.