Highlights:

- The price of Ethereum is poised for a rally as on-chain data emerges positive.

- ETH TVL and open interest surge, showing growing investor optimism.

- ETH price eyes $4800 key resistance if the bullish momentum builds.

The Ethereum price is still roaming in the red today, down 1.77% to $4317. Despite the fall, its daily trading volume has increased 7.91% to $38.31 billion, indicating growing investor confidence. Meanwhile, last week alone, 500,000 ETH, worth around $2.10 billion, was withdrawn from crypto exchanges, according to Ali Martinez. These massive outflows of Ethereum suggest that investors and traders are likely to hedge their positions off-exchange in order to make a profit in case of a long-term price increase. As observed in the chart, there is a steep drop in the Ethereum exchange reserve, which might be a sign of increased investor confidence.

500,000 Ethereum $ETH, worth $2.10 billion, withdrawn from crypto exchanges in the past week! pic.twitter.com/tCOVSm5b8Q

— Ali (@ali_charts) September 3, 2025

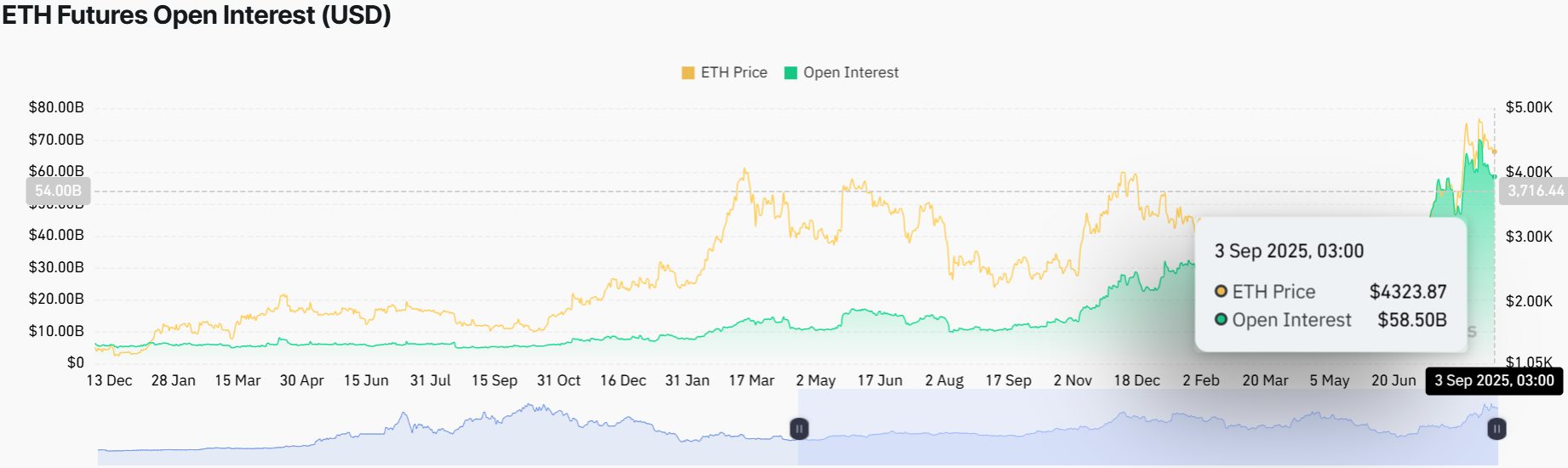

Ethereum Derivatives Market Sentiment

With the current upward trend of ETH, the number of people interested in Ethereum futures contracts has grown significantly, with open interest totalling $58.50 billion. The open interest indicates that traders are putting more bets on a further price rise of ETH.

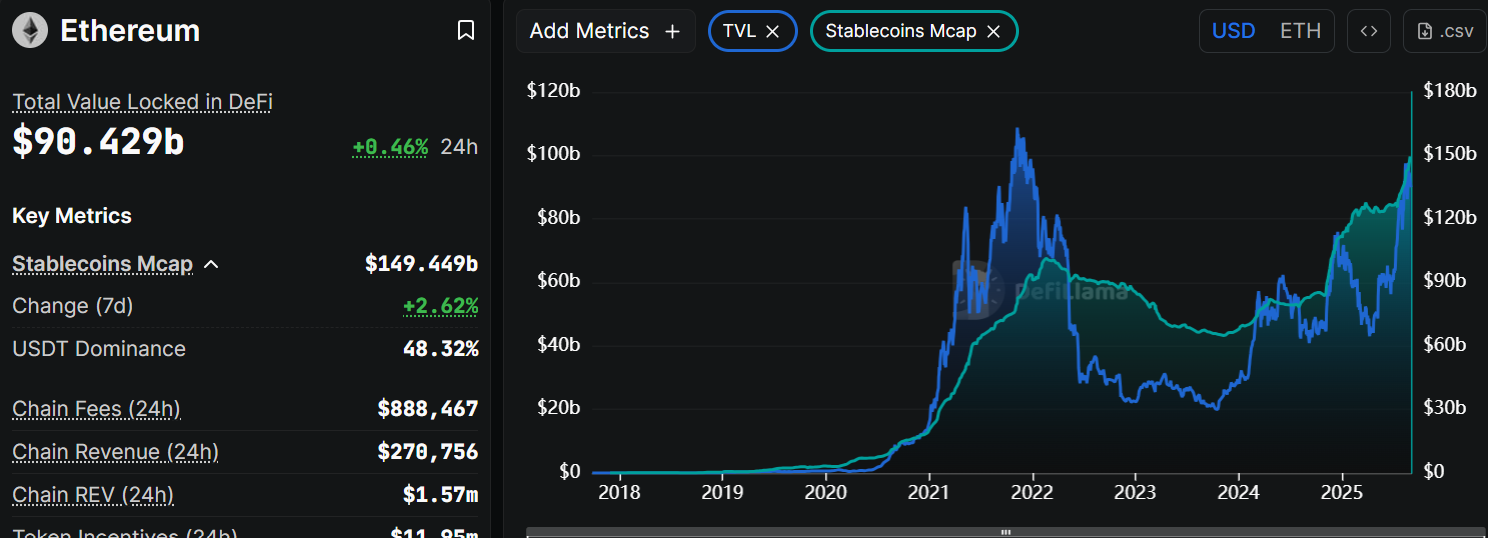

An increase in price and futures indicates an increase in speculation, where traders try to capitalise on price fluctuations. However, Ethereum continues to have a greater presence in the decentralized finance (DeFi) sector, with a total value locked (TVL) of $90.429 billion. This number underscores Ethereum’s position as the leader of the DeFi industry, which continues to grow despite fluctuations in ETH’s price.

The growth of DeFi can be attributed to the strong smart contract functionality of the Ethereum platform. It facilitates decentralized exchange, lending protocols, and additional financial products. The supremacy of Ethereum in the DeFi sector can be underscored by the fact that its stablecoin market capitalization stands at $149.449 billion.

The growing TVL in DeFi is an indication that Ethereum continues to be the backbone of the decentralized financial system. This may serve as a stabilizing factor to the price of ETH as more people race to use Ethereum in DeFi applications.

Can ETH Break Towards $4800?

The ETH/USD chart is showing strength as it trades in a bullish pattern. However, recently, ETH has been consolidating, with the traders eyeing a breakout towards $4800. Key support zones further reinforce the bullish picture at $4074 and $2703.

Technical indicators signal that bullish momentum remains dominant, as the RSI is at 50.74. A breakout in either direction will determine the direction of the ETH price as the odds lean towards the upside. Despite the 1% fall, ETH still boasts a positive outlook. The move is supported by intense buying pressure and its position above key moving averages. If Ethereum bulls build up momentum, the price could break out towards the $4800 mark. Conversely, if the selling pressure looms, reinforced by the sell signal from the MACD, a drop towards $4,200 is anticipated, with a stronger floor at $4,074.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.