The Ethereum price is winning on the charts today. It has soared 3% in the past 24 hours, with the ETH/USD trading at $2,553. However, its 24-hour trading volume has slipped 8% to $19 billion, signaling a recent fall in market activity. ETH is now up 8% in a week but has lost 1% in a month, although the cryptocurrency retains a healthy 56% gain in a year.

Meanwhile, the second-largest cryptocurrency just saw a $1.26 billion inflow, with over 547,600 ETH transferred to exchanges, signaling potential market volatility. Large transactions surged 13%, indicating rising interest from institutional investors, according to UPTX.

#Ethereum saw a $1.26 billion inflow, with over 547,600 #ETH transferred to exchanges, signaling potential market volatility. Large transactions surged 13%, indicating rising interest from institutional investors. pic.twitter.com/SYQmoDPCD8

— UPTX (@UPTX_official) September 20, 2024

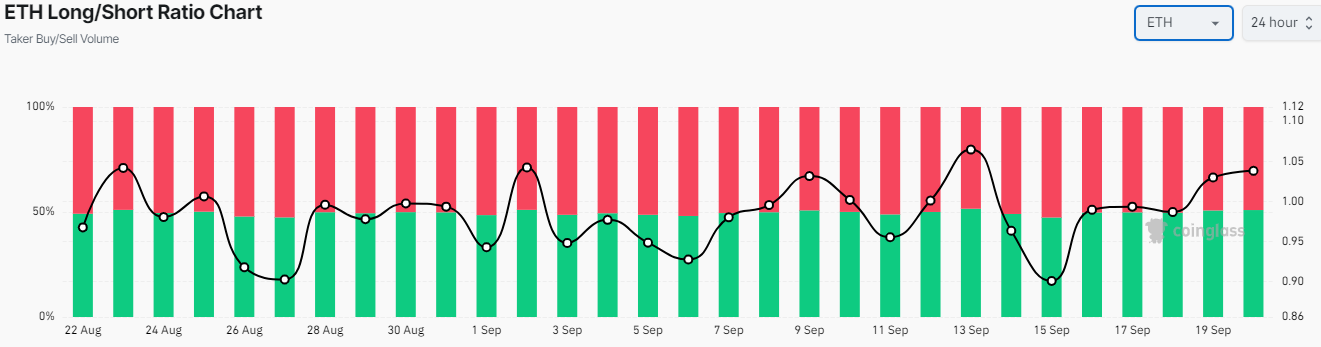

On the other hand, Coinglass data suggests that investors are confident about the price of Ethereum surging in the coming days. This is manifested as the bulls have pushed above the borderline, currently at 1.03. This suggests that the average open position is bullish, while a reading below the value of 1 indicates a bearish stance.

Ethereum Statistical Data

Based on CoinmarketCap data:

- ETH price now – $2,553

- Trading volume (24h) – $19 billion

- Market cap – $307 billion

- Total supply – 120 million

- Circulating supply – 120 million

- ETH ranking – #2

Can the Bulls Sustain the Momentum?

The Ethereum price has exited the red zone following the support establishment at $2,527. Bulls seem to leave no stone unturned, as they have taken the reins entirely after ETH dispersed the seller congestion at $2,527. This confluence area, the 50-day Simple Moving Average (SMA) (green ), has marked the turning point into what would later become a significant rally if the momentum continues.

However, the bulls are facing a tight hurdle at the $3,183 resistance zone, which coincides with the 200-day SMA. Flipping this zone into a support floor would give the bulls another opportunity to rally the price. Meanwhile, the bulls must flip the next technical barrier at $2,840, potentially giving them hind wings to hurtle above the key resistance at $3,184.

Meanwhile, the Relative Strength Index (RSI) upholds a bullish picture, as it sits above the 50-mean level. Currently, at 56, there remains room for potential upside before ETH is considered overbought.

On the other hand, traders are at liberty to hold their long positions in ETH intact, bolstered by the bullish outlook from the Moving Average Convergence Divergence (MACD) indicator. A buy signal validates the bullish outlook, with the blue MACD line stepping above the orange signal line. The momentum indicator also trends upwards into the positive region – above the mean line at 0.00. Meanwhile, traders and investors are inclined to add more ETH to their portfolios unless the MACD changes.

Ethereum Price Prediction

As per the 1-day chart above, the ETH bulls are showing the bears nothing but dust. With the resistance at $2,527 turned into immediate support, ETH’s rally is bound to continue. The next significant rendezvous for the bulls is the $2,840 level but with the ability to spread their wings to $3,184.

On the downside, if the bears capitalize on the 200-day Simple Moving Averages (SMA), which suggest some bearish prospects, the ETH price could drop. In such a case, the $2,527 support will act as a cushion against any further losses. If the $2527 support breaks, the ETH price could dwindle, retesting the $2,225 level.