Highlights:

- Ethereum price drops 12% in a week as the crypto market wobbles.

- ETH supply has risen to pre-merge levels, as analyst suggests that Dencun Upgrade may be the cause of inflation.

- Crypto analyst predicts a major move in ETH price potentially to $14,000.

Ethereum price is attempting a recovery, surging almost 1% to $2,843 mark at press time. Its daily trading volume is still low, plunging by 30% to $29.42 billion, signaling a fall in market activity. ETH is still swimming in the red zone, as it is down 12% in a week and 22% in a month. Can the Ethereum Bulls regain dominance?

Meanwhile, ETH supply has risen to pre-merge levels, as analyst suggests that Dencun Upgrade may be the cause of inflation. The supply of Ethereum has risen to its highest level since January 2023, comparable to the levels before the Merge update on September 15, 2022. Data from ultrasound money shows that Ethereum’s current supply stands at 120,521,523 ETH, approximately 383 ETH higher than on the day of the Merge upgrade.

#REPORT: #ETH supply hits pre-Merge levels; Dencun upgrade's changes reversed post-Merge deflation. Supply now at 120,521,673 $ETH due to lower fee burns from EIP-4844. Thanks a lot Vitalik. pic.twitter.com/XXCE3MTIb3

— Creek (@CreekMeta) February 6, 2025

Elsewhere, a well-known analyst, Ali Charts, speculates that the price of Ethereum is gearing up for a major move. A breakout above $4,000 could pave the way for a rally toward $7,400, $10,000, or even $14,000.

#Ethereum $ETH is gearing up for a major move! A breakout above $4,000 could pave the way for a rally toward $7,400, $10,000, or even $14,000! pic.twitter.com/9hmkSKNpKf

— Ali (@ali_charts) February 6, 2025

ETH Statistical Data

Based on CoinmarketCap data:

- ETH price now – $2,843

- Trading volume (24h) – $29.42 billion

- Market cap – $342.67 billion

- Total supply – 120.52 million

- Circulating supply – 120.52 million

- ETH ranking – #2

Ethereum Price Drops Below Key Levels; Can the Bulls Rebound?

The crypto market has been on a roller coaster ride in the first month of 2025, driven by unpredictability and major macroeconomic events. Digital assets like Ethereum have tumbled, losing key support zones, as the market struggles to regain momentum. Currently, the Ethereum price is trading at $2,841, near the 200-day MA (2,969).

If bullish momentum builds, the price could retest the first resistance at $2,969, a level aligned with the 200-day MA. A break above this could lead to further gains toward $3,289, the upper boundary of the falling wedge. Surpassing this threshold might enable a rally toward $3,699. However, the RSI, lingering at 37.50, reflects bearish sentiment, suggesting that buyers need substantial strength to overcome these resistances.

On the downside, immediate support is visible at $2,740, close to current trading levels. A breakdown below this level may expose the price to deeper declines toward $2,722. Should bearish pressure intensify, the Ethereum price could test the significant support zone at $2,403, potentially inviting further selling. Nonetheless, if the price stabilizes above these supports and the RSI begins to recover, it might inspire a rebound, signaling a potential shift in momentum.

What Next for Ethereum Price?

A quick look at the Relative Strength Index at 37.50 suggests intense selling pressure. However, with the altcoin in the oversold territory, the ETH bulls could ignite a buy-back campaign, leading to ETH rebounding above the key support zone. On the other side of the fence, the MACD indicator upholds a sell signal. This is evident as the blue MACD line has flipped below the orange signal line to the negative territory.

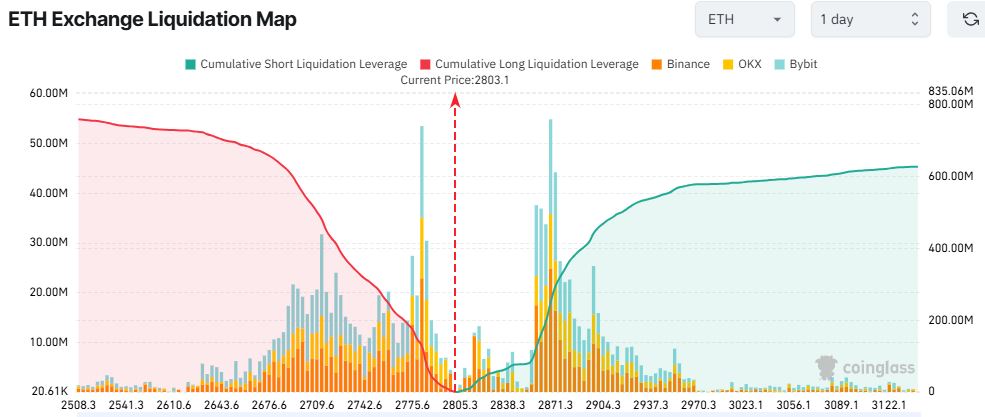

Elsewhere, Coinglass data shows that the cumulative long liquidation leverage is higher than the short cumulative leverage. This means that there are significantly more open long positions (prices going up) with high leverage compared to short positions.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.