Highlights:

- Ethereum price has tanked 6% to $1885, with the bearish sentiment bolstering.

- Technical indicators further contribute to Ethereum’s price decrease, signalling further downside.

- A well-known analyst says the ETH price is dumping because hackers are selling.

The Ethereum price has tanked 6% to $1885 at press time, with the bearish momentum intensifying. The altcoin is currently trading within a falling parallel channel, struggling below key moving averages. Cementing the bearish outlook is the death cross, manifested by the short-term MA (50-day) flipping below the long-term (200-day MA). Ted Pillow, a well-known analyst and investor, has further highlighted why the price of Ethereum is dwindling. According to Ted, the ETH price is dumping because hackers are selling.

$ETH is dumping because hackers are selling. pic.twitter.com/MOI1IiutIM

— Ted (@TedPillows) March 28, 2025

ETH/USD daily chart outlook, the bears took over after breaking the key support at $2,000, leaving the bulls in the dust. Can the bears regain dominance?

For the bulls to regain dominance, they must reclaim the key support zone at $2293, which aligns with the 50-day MA. A decisive move closer to that level would rekindle a short-term bullish reversal in the ETH market. Moreover, a close above the next resistance at $2549 will give the bulls the wings to fly towards the $2,860 barrier.

Further, the bears are currently dominating the market, making bulls completely invisible. If sellers maintain their dominant position, the ETH market will experience additional downward movement, leading to ETH retesting the $1771 support level. Further selling pressure would see a deeper correction towards the $1,609 level.

Factors Behind the Ethereum Price Downtrend

Technical indicators from the market point toward the bearish ETH price trends. The RSI indicator currently shows 37.52, which is below the 50-mean level. Markets experiencing this substantial amount of selling activity could continue to decline unless the bullish investors act to stop this downward trend.

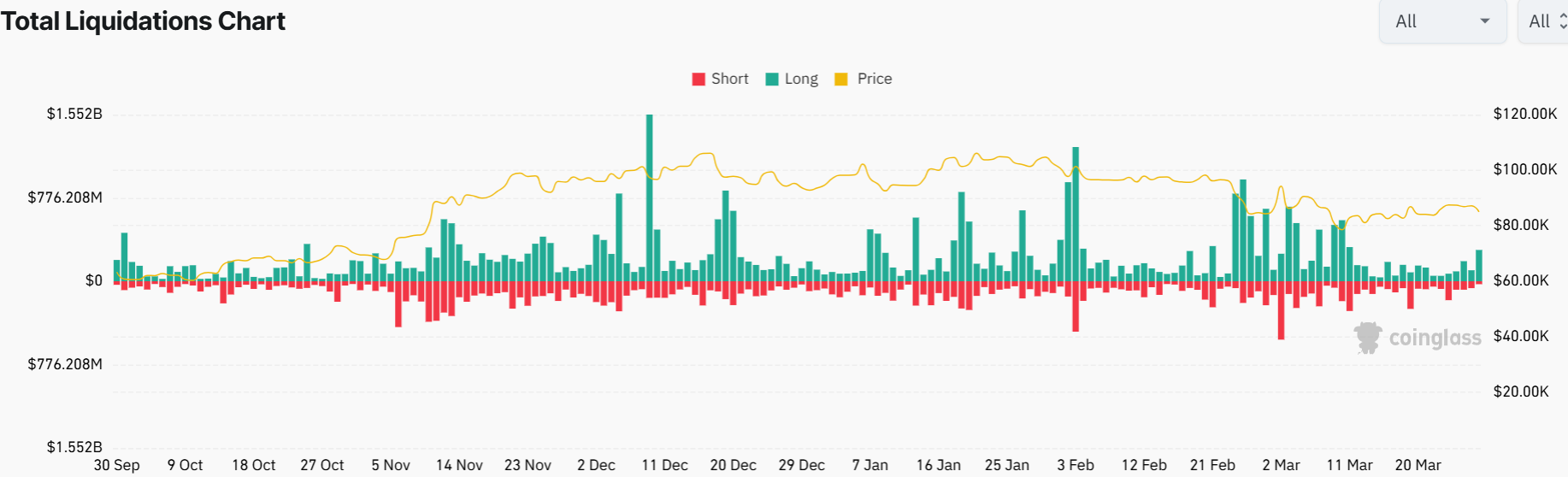

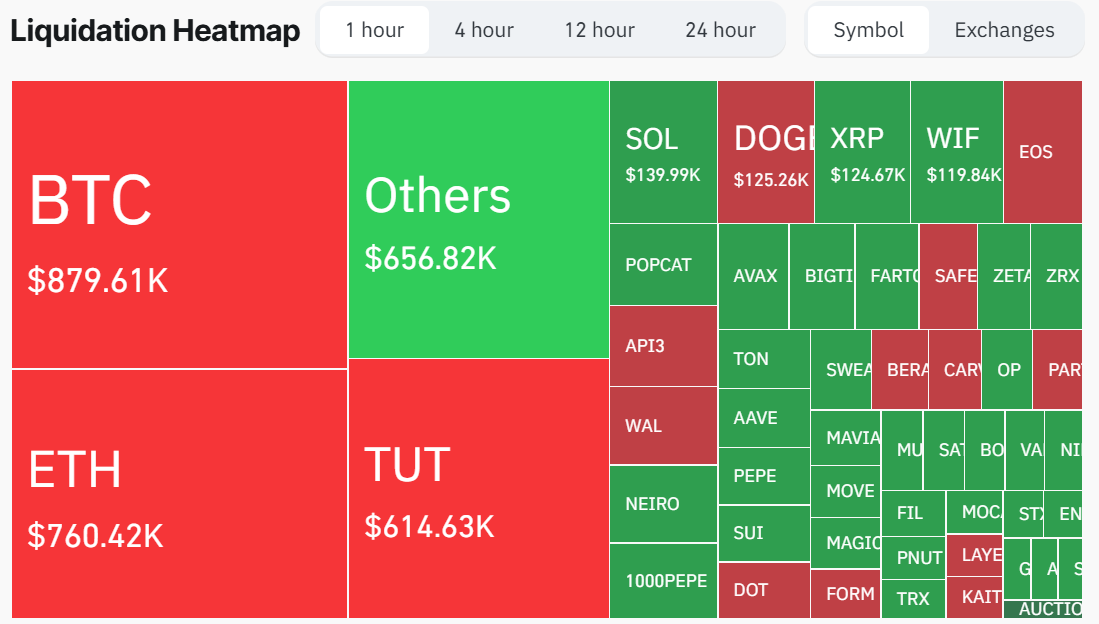

The ETH price dropped during the previous twenty-four hours as short-term and long-term market positions faced liquidation events, driving traders from leveraged trades. During the previous day, ETH liquidations soared over $97 million, with long positions being the main culprit responsible for $88.7 million of the losses.

The price cascade triggered trader-forced sell-offs as market participants involved in Ethereum price speculation were liquidated and then required to sell their assets to save their capital. Such liquidations worsen price declines.

The combined asset liquidations resulted in a significant market leveraging activity of $392.60 million. The crypto market has also faced instability because US President Donald Trump initiated new tariff wars.

President Trump imposed a 25% tax on US automobile sales, which is set to start on April 3, as he announced on March 26, 2025. Market participants anticipate another cryptocurrency market crash, which will reduce prices because of this event.

Trump defends his recent tariffs to support American automobile production, yet the global markets, especially, go after high-risk assets, including Ethereum. In early March, Trump’s introduction of tariffs led ETH prices to sink from $3,400 to $2,100 in less than 72 hours. Despite the drop, Ethereum’s future outlook remains optimistic, even with the present short-term difficulties. The decentralization platform leads the market through its Ethereum 2.0 upgrade procedure and maintains dominance in decentralized infrastructure.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.