Highlights:

- Ethereum price plunges 10% to $2,428 as the crypto market faces uncertainties.

- Despite the market crash, ETH’s volume has spiked, indicating intense market activity.

- Crypto analysts say ETH’s most critical support level sits at the $2,300 mark.

The price of Ethereum has plummeted 10% to $2,428 as the crypto market wobbles. The world’s second-largest altcoin is on the path to registering its worst February in history, with over 26% fall already this month. Furthermore, the recent Bybit exchange hack has dampened sentiment around ETH. However, market analysts remain hopeful of a potential bullish reversal ahead.

According to crypto analyst Ali Martinez, the much-anticipated altseason will be canceled if Ethereum’s price fails to maintain support at $2,600.

Altseason will be canceled if #Ethereum $ETH fails to hold $2,600! pic.twitter.com/7A37QsrIUU

— Ali (@ali_charts) February 24, 2025

The altcoin has already breached the support zone. However, the analyst has emphasized that one of ETH’s most critical support levels now sits at $2,300.

One of the most critical support levels for #Ethereum $ETH now sits at $2,300! pic.twitter.com/8QmbIyXCTG

— Ali (@ali_charts) February 25, 2025

ETH Statistical Data

Based on CoinmarketCap data:

- ETH price now – $2,428

- Trading volume (24h) – $36.53 billion

- Market cap – $293.24 billion

- Total supply – 120.57M

- Circulating supply –120.57M

- ETH ranking – #2

The Ethereum price is trading at $2,428, exhibiting a consolidation within a falling parallel channel. ETH faces a critical juncture amid a broader bearish market, teetering near a pivotal support-resistance confluence. Immediate resistance is anchored at $29,35, aligning with the 200-day MA, which has historically rejected bullish advances. A sustained close above this barrier could ignite a rally toward $2,991, a psychological threshold aligning with the 50-day MA.

Conversely, failure to hold above $2,935 risks a breakdown toward $2,313, dynamic support below the falling channel. A breach here may accelerate selling pressure toward $2,228, a liquidity pool from September 2024, with a cascade to $2000 plausible in an extended downturn.

Can the Ethereum Price Reclaim the $2,935 Mark Amid Crypto Market Crash?

The Relative Strength Index (RSI) reading, currently at 34.37, indicates oversold conditions in the ETH market. Its position below the 50-mean level suggests intense selling pressure. However, with the altcoin undervalued, the bulls could ignite a buying spree, causing a rebound in the Ethereum price. Moreover, there’s room for potential upside movement before it reaches overbought conditions.

Reclaiming the $2,935 mark could invalidate any downtrend, inviting short-term longs. A breakout above the resistance could lead to further upside, while a breakdown below the support could trigger a decline. Traders should monitor these levels closely for potential trading opportunities.

Meanwhile, Ethereum’s price shows signs of potential strength even as the broader cryptocurrency market experiences a downturn. Its price action hints at possibly retesting its $2,935 resistance mark. While overall market sentiment is cautious, Ethereum’s resilience is attracting attention.

Technical Indicators Hint at a Possible Price Reversal

Technical indicators are hinting at a possible reversal, though confirmation is needed. Traders are watching key support levels, and holding above these could fuel a move towards the $2,991 resistance. The current market dip presents both a challenge and an opportunity for Ethereum.

The MACD indicator upholds a buy signal, which could cause a rebound. Its position above the orange signal line calls for traders to rally behind ETH. Additionally, on-chain data supports a potential reversal in the Ethereum market.

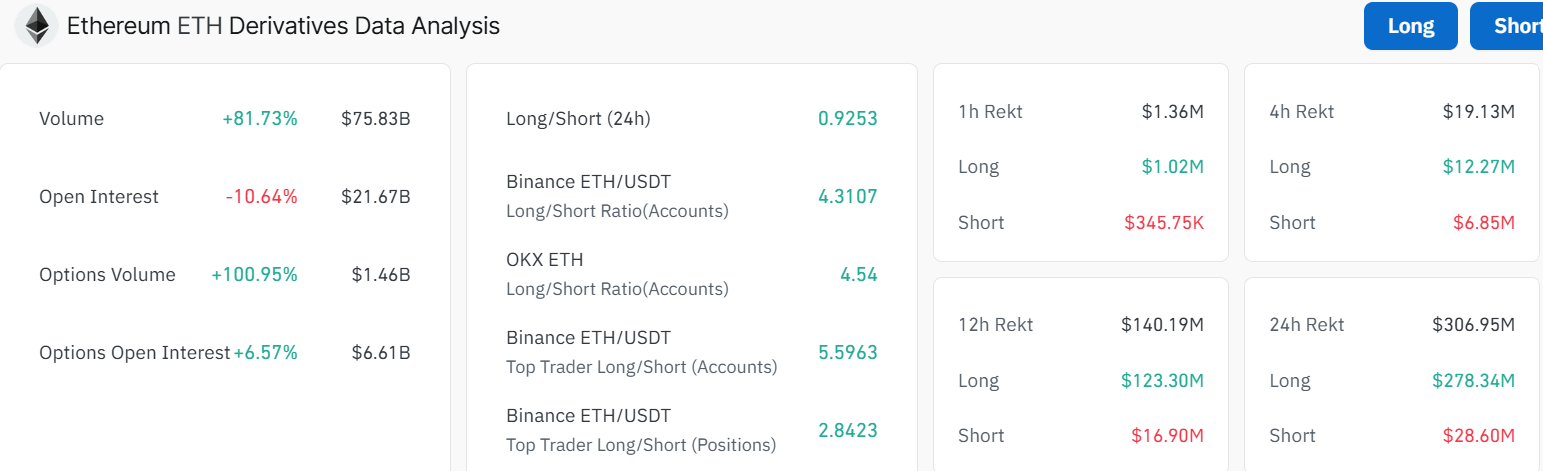

Despite a slight pullback in open interest by 10% to $21.67B, the volume has spiked 81% to $75.83 billion. This suggests increased market activity, with new money flowing into the market, potentially triggering a rebound above the $2,935 resistance zone.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.