Highlights:

- Ethereum Foundation holds $970.2 million in assets, primarily in crypto, as of October 31.

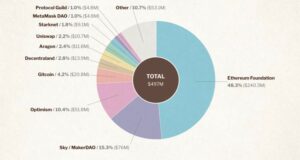

- The foundation allocated $240.3 million to the Ethereum ecosystem in 2022-2023, over 48%.

- Ethereum’s active addresses rose to 13.7 million in October, marking significant network growth.

The non-profit organization Ethereum Foundation revealed its financial 2024 report on November 8, detailing significant financial activities and investments over recent years. In its 27-page report, the foundation disclosed that as of October 31, it held approximately $970.2 million in assets.

Of this amount, it holds $788.7 million in crypto assets, with 99.45% in Ether, making up 0.26% of the total ETH supply. The foundation holds $181.5 million in “non-crypto investments and assets.” The foundation’s choice to hold most of its assets in Ether highlights its strong confidence in Ethereum’s future. “We choose to hold the majority of our treasury in ETH. The EF believes in Ethereum’s potential, and our ETH holdings represent that long-term perspective,” the foundation said.

The EF stated that its treasury is focused on funding important public goods for the Ethereum ecosystem. It also intends to adopt a conservative treasury management policy. This policy aims to ensure there are enough resources, even during a prolonged market downturn.

The foundation supports several projects, including Geodework, L2BEAT, Argot Collective, and 0xPARC. These projects focus on Ethereum’s core infrastructure. They also work on decentralization, Layer 2 scaling solutions, and advancements in programmatic cryptography.

Aya Miyaguchi, executive director of the Ethereum Foundation, highlighted the organization’s focus on long-term growth and sustainability. She said the foundation is dedicated to planting seeds for Ethereum’s future resilience and collaborative progress, even if the results take years to materialize.

2/ EF’s long-term thinking keeps us focused on supporting a sustainable and open ecosystem. We’re more committed than ever to planting seeds that may only mature years down the line, ensuring Ethereum’s resilience and collaborative growth. Learn more about the three core driving…

— Aya Miyaguchi (ayamiya.eth) (@AyaMiyagotchi) November 8, 2024

Ethereum Foundation Allocated Over 48% to Ethereum Ecosystem in 2022–2023

The foundation contributed $240.3 million to the Ethereum ecosystem between 2022 and 2023. This amount represents approximately 48.3% of the total spent by various entities. The remaining funding came from organizations like MakerDAO (now rebranded as Sky), Optimism, Aragon, Uniswap, Starknet, MetaMask DAO, Gitcoin, Decentraland, and Protocol Guild. This highlights the collaborative effort within the Ethereum community.

The report reveals that in 2022, the foundation spent $105.4 million. This increased to $134.9 million in 2023. The main investments were in Layer 1 research (30.4%), community development (18.5%), and internal operations (36.2%). In 2023, the largest investment, 35.2% or $474 million, went to new institutions.

Ethereum Foundation Explains Ether Sales Strategy Amid Criticism

Recently, the foundation faced community criticism over large, unexplained transactions and ether sales. These actions were made without prior notice, leading to calls for more transparency. The foundation explained that it periodically sells ETH to ensure adequate savings for the future.

The report stated:

“This requires periodically selling ETH to ensure sufficient savings for future years, and programmatically increasing our fiat savings in bull markets to fund spending in bear markets.”

Ethereum Sees Strong Growth with Rising Activity and Market Boost

Ethereum has seen positive growth recently, with active addresses rising to 13.7 million in October, up from 12.3 million in September. Additionally, its on-chain volume surged to $108.6 billion in October, compared to $90.9 billion in September. Following Trump’s recent presidential victory, the crypto market saw a significant boost. Bitcoin hit a new all-time high of $76,943, while Ethereum surged to $2,945, reflecting an 18% increase over the past week.